Solana is seeing increased momentum with significant ETF inflows, as the crypto asset prepares to test key resistance levels in the near term.

After a notable spike on December 9, Solana ($SOL) is making headlines with a 4.3% increase in the last 24 hours, pushing its price to $139.1.

With a 24-hour trading range between $132.08 and $144.43, the crypto is clearly experiencing some volatility, with positive ETF flows possibly adding to the momentum. However, Solana has been weak in the past week with a 3.1% decline.

Notably, can Solana sustain this upward trajectory, or will the broader market influence a pullback?

Solana Price Analysis

A SOLUSD chart from TradingView reveals an interesting technical setup, with clear levels of support and resistance. The price is currently testing key Fibonacci retracement levels, with the 0.236 level at $140.96 acting as the first major resistance. This level aligns with the recently failed breakout that pushed the price just below $145.

A breakout above $140.96 could signal a potential move toward the next resistance at $146.9, which is above the 0 Fibonacci level. However, if the price fails to break above these levels, a reversal could push the price toward lower support levels.

On the downside, the 0.786 Fibonacci retracement level at $127.06 is a critical support zone. A break below this liquidity level could open the door for a deeper retracement toward $121.65, the 1.0 level.

Additionally, the MACD indicator shows waning bearish momentum, with the MACD line above the signal line, signaling potential further upside. The histogram is also deep in the green zone, showing that if the momentum continues, Solana may have a chance to break through further resistance.

$SOL Sees Consistent ETF Inflows

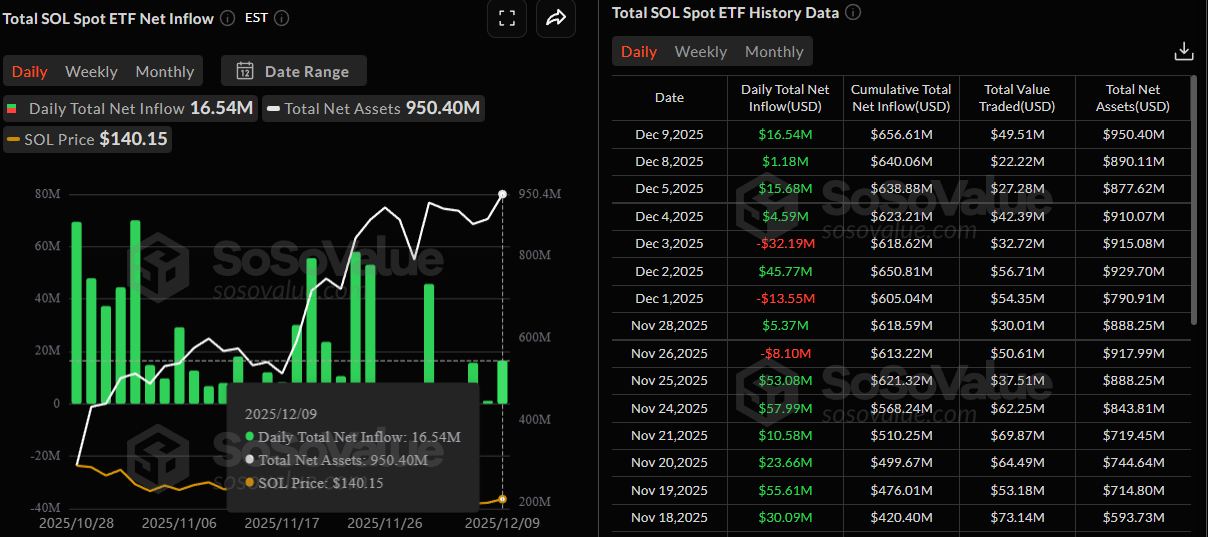

Looking elsewhere, Solana’s Spot ETFs have been experiencing notable positive fluctuations in daily net inflows, suggesting a recovering market sentiment. On December 9, 2025, the ETFs saw an inflow of $16.54 million, pushing their cumulative net inflow to $656.61 million.

The total assets under management (AUM) now stand at $950.40 million. These figures indicate a healthy investor interest, especially in the wake of recent market volatility.

Notably, the asset has seen further positive momentum in the days preceding December 9, recording substantial inflows, including $15.68 million on December 5 and $45.77 million on December 2. The key takeaway here is that, despite fluctuations, the Solana ETF continues to attract institutional capital, signaling strong demand for Solana.

thecryptobasic.com

thecryptobasic.com