Chainlink is attempting to stabilize after several weeks of pressure, with markets tracking a gradual recovery from the late-November swing low. $LINK trades near $14 and continues to build structure on the 4-hour timeframe. The market now faces several technical thresholds that could define direction through December.

Price Action Holds Above Support as Momentum Attempts to Rebuild

$LINK formed a base near $11.59 and has climbed steadily since then. It moved above the 23.6% Fibonacci retracement at $13.33 and tested the 38.2% level near $14.50. Additionally, higher lows continue to develop, which signals early trend reconstruction. The price trades inside the Donchian and Keltner channels, showing attempts to form a tighter range.

Support sits near $14.02 to $14.09 and marks an important zone. Buyers stepped in repeatedly in this area. A decline below that range could send $LINK toward $13.33 and possibly into the $12.80 region.

However, a stable hold above $14 encourages another attempt at $14.50. A break there strengthens the path toward $15.39 and later $16.29.

Momentum readings show moderate strength. The Chande Momentum Oscillator sits near 25. It signals controlled bullish pressure without overbought conditions. Hence, $LINK retains capacity for continuation if bids remain firm.

Open Interest Cools After a Strong Year of Growth

$LINK’s futures open interest expanded sharply this year. It climbed from below $300 million in February to peaks above $1.7 billion by late October. The rise reflected aggressive leverage as $LINK approached its yearly highs.

However, open interest has since dropped to about $592 million. The retreat signals reduced speculative exposure and ongoing profit-taking.

Related: Zcash Price Prediction: Bulls Test Key Fib Level as Spot Inflows Support…

Consequently, markets now rely more on organic spot flows. The decline also removes excess leverage, which improves the odds of healthier trend formation. Moreover, open interest still sits above mid-year levels. This suggests room for renewed participation once conditions stabilize.

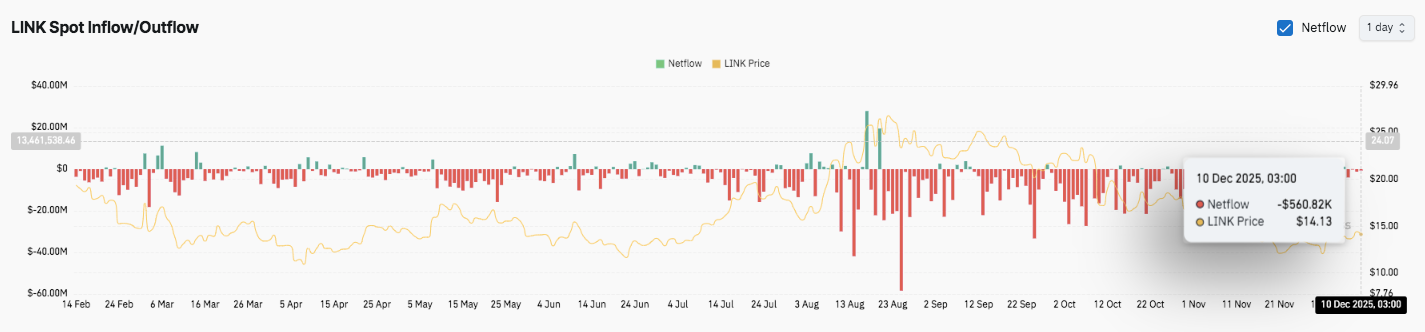

Spot Flows Remain Negative but Show Signs of Relief

Spot flows remain dominated by outflows. Several sessions saw more than $40 million in net selling. The pressure aligned with $LINK’s drop from above $20 to near $14. Significantly, recent sessions show smaller outflow spikes. This hints at reduced fear among holders. Besides, lighter selling often precedes periods of accumulation.

Technical Outlook for Chainlink Price

Key levels remain well-defined heading into December.

- Upside levels: $14.50, $15.39, and $16.29 as immediate hurdles. A clean breakout could extend toward $17.57 and $19.20.

- Downside levels: $14.02–$14.09 as short-term structural support, followed by $13.33 and $12.80.

- Major trend floor: $11.59 remains the critical long-term level safeguarding the broader recovery structure.

The technical picture shows $LINK trading inside a tightening volatility channel, with the market pressing against upper Donchian and Keltner bands. This compression often precedes a decisive expansion phase.

Price continues to print higher lows, yet resistance at $14.50 limits upside follow-through and keeps the token inside a controlled recovery trend. The Chande Momentum Oscillator shows moderate strength, leaving room for sharper swings once a breakout occurs.

Will Chainlink Move Higher?

Chainlink’s price prediction depends on whether buyers can maintain control above the $14.02–$14.10 region. Sustained strength here would allow $LINK to attempt another breakout above $14.50.

A break and hold above that barrier opens a path toward $15.39. Moreover, a stronger momentum phase could extend toward $16.29, where medium-term reversal signals typically form.

However, failure to protect $14.00 exposes the chart to a retreat toward $13.33. Losing that level would weaken the recovery trend and increase the risk of revisiting the deeper $12.80 area. Market flows still lean cautious as outflows dominate, suggesting traders may want clearer conviction signals before committing to new long positions.

For now, $LINK trades in a pivotal zone where compression, waning open interest, and defined levels suggest volatility is building. The next decisive move depends on whether demand strengthens enough to challenge the $14.50 ceiling.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com