$DOGE$0.1470 bumped above multiple resistance levels as an institutional-led volume hinted at a possible trend reversal despite ongoing network outflows.

News Background

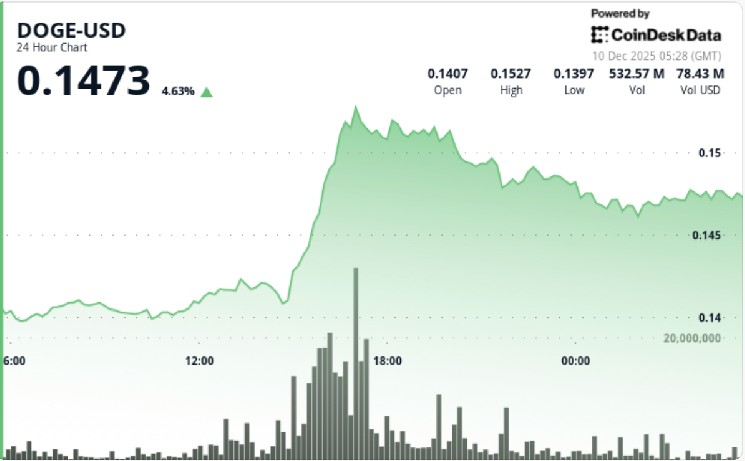

- Dogecoin staged a strong upside push Tuesday, rallying from $0.1406 to an intraday peak of $0.1532 before easing to a $0.147307 close, up 0.81% on the day.

- The breakout came on exceptionally heavy trading, with volume spiking 312% above average during the 15:00–17:00 $GMT window — a signature profile of algorithmic or institutional accumulation rather than retail speculation.

- Fundamental conditions remained mixed: $DOGE saw $4.81 million in net network outflows even as on-chain activity surged, with active addresses hitting 67,511 — the second-highest reading in three months.

- This divergence between capital movement and user engagement suggests accumulation at the network level despite outward liquidity pressures.

Technical Analysis

- $DOGE’s move above $0.1470 marked its cleanest breakout in nearly six weeks, completing a symmetrical-triangle compression that began in mid-October.

- Volume expansion vastly outpaced price movement — a classic precursor to trend expansion — with 1.75 billion tokens traded, roughly 51% above $DOGE’s seven-day average.

- Higher lows at $0.1469, $0.1488 and $0.1512 confirmed a rising-channel structure, and the breakout candle at 15:00 $GMT validated $0.1470 as a new pivot level.

- Despite the explosive move, $DOGE remains below all major EMAs, with the 20-day EMA at $0.1476 repeatedly acting as dynamic resistance.

- The bearish stacking of the 50-day, 100-day and 200-day EMAs (at $0.1649, $0.1836, and $0.1975 respectively) continues to impose structural headwinds.

- Momentum indicators show early signs of life: RSI at 41 suggests recovery room, while MACD approaches a bullish cross on 4-hour charts — often a precursor to multi-session extension moves.

Price Action Summary

- $DOGE printed a clean 6% rally from $0.1406 to $0.1532, breaking through resistance layers with strong confirmation from volume.

- The peak occurred within minutes during a high-intensity breakout phase, with successive hourly candles supported by sustained liquidity.

- After reaching $0.1532, $DOGE retraced modestly and stabilized above the $0.147 breakout level, showing continued bid strength into the close.

- Multiple intraday tests of $0.1470 held firmly, reinforcing that area as a new micro-support. Momentum faded slightly into late trading, but not enough to break the structure — $DOGE continues to consolidate tightly beneath the $0.1520-$0.1530 resistance cluster.

What Traders Should Know

- $DOGE’s high-volume breakout is technically significant, but structural resistance remains heavy.

- Key points: $0.1470 is now the must-hold support — losing it reverses the breakout and reopens $0.138 downside risk.

- Break above $0.1522–$0.1530 is required to unlock the next leg toward $0.1580 and the 50-day EMA at $0.1649.

- Momentum is early, not overextended: MACD nearing a bull cross and RSI at neutral levels offer room for continuation.

- Divergence between strong user activity and mixed network flows suggests underlying accumulation despite broader caution.

- If $DOGE can sustain closes above the 20-day EMA, the setup shifts from relief rally to structural reversal attempt.

coindesk.com

coindesk.com