Cardano tests key resistance levels with significant liquidation data showing pressure on long positions.

Cardano (ADA) is currently trading at $0.4316, reflecting a 3.3% gain over the past 24 hours. The crypto has seen a daily price range from $0.4075 to $0.434, indicating a modest upward movement within a tight price band. Over the last week, ADA has experienced a 12.5% increase, and its 14-day performance shows a 4.6% rise, signaling a steady positive trend.

As Cardano builds on recent gains, the focus is on its price action around the $0.43 mark, which is proving to be a decisive area. The market is closely watching for a possible breakout to the upside as momentum continues to build.

Cardano Testing Key Resistance Levels

The 1-day chart for Cardano reveals a clear downtrend, marked by a retracement from $0.6936 to $0.3713. Using Fibonacci retracement levels, Cardano will test the 0.236 level at $0.44743, which acts as a short-term resistance.

The next key resistance levels are the 0.382 Fibonacci level at $0.4945 and the 0.5 level at $0.53250, where further upward pressure may face more significant challenges. On the downside, the 0 Fibonacci level at $0.3714 might offer potential support if the price falls back below the $0.40 mark.

The Relative Strength Index (RSI) is at 43.84, indicating that Cardano is not yet oversold, but still moving toward the neutral zone. This suggests that while there’s potential for further upside movement, it may face resistance. The market is closely monitoring how the price interacts with the $0.44743 resistance level and the $0.3714 support level.

ADA Liquidation Data

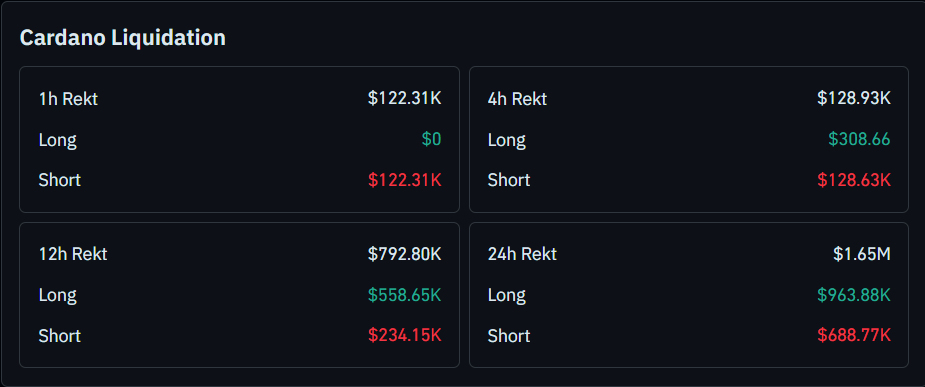

Meanwhile, the liquidation data for ADA over the past 4 to 24 hours shows significant market volatility, with the 4-hour liquidation totaling $128.93K. Short positions are facing higher liquidations, amounting to $128.63K, compared to $308.66 in long liquidations.

This indicates that shorts are under pressure, possibly due to a price surge or squeeze. In the 12 hours, a larger total of $792.80K faced liquidation, with $558.65K in long liquidations and $234.15K in short liquidations, showing that the long side is experiencing more volatility, possibly due to price fluctuations or resistance levels.

Over the 24 hours, the total figure reaches $1.65M, with $963.88K in long liquidations and $688.77K in short liquidations. This suggests that long positions are facing the most pressure, potentially due to price resistance.

thecryptobasic.com

thecryptobasic.com