Recent data from Coinglass reveals that traders are piling into short positions on XRP at a far more aggressive pace than any other major asset.

Despite this pressure, the asset has held surprisingly firm, posting gains over the past day.

Aggressive Shorts on XRP

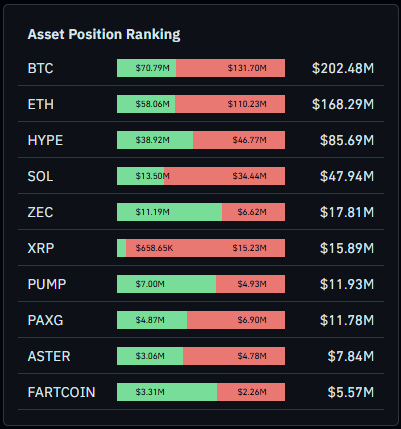

According to figures shared by Coin Bureau, traders are heavily tilted toward shorting top cryptocurrencies, but the imbalance is most extreme for XRP. The breakdown shows that Bitcoin holds $131 million in shorts versus $70 million in longs.

Meanwhile, Ethereum has $110 million shorts, compared to $58 million in longs. SOL registers $34 million in shorts and $13 million in longs.

But XRP stands out with $15 million in shorts compared to just $0.6 million in longs. This translates to a nearly 96% short allocation, with longs making up barely 4% of total positioning. It is one of the most lopsided ratios in the market, with shorts outweighing longs by roughly 25 to 1.

This data highlights how strongly traders are betting against XRP as the coin attempts to recover.

XRP Price Holds Steady Despite the Pressure

Despite being heavily shorted, XRP’s price has not reacted as many had hoped. The token is currently trading at $2.08, up 1.79% over the past 24 hours. Its weekly candle shows a 1.88% gain.

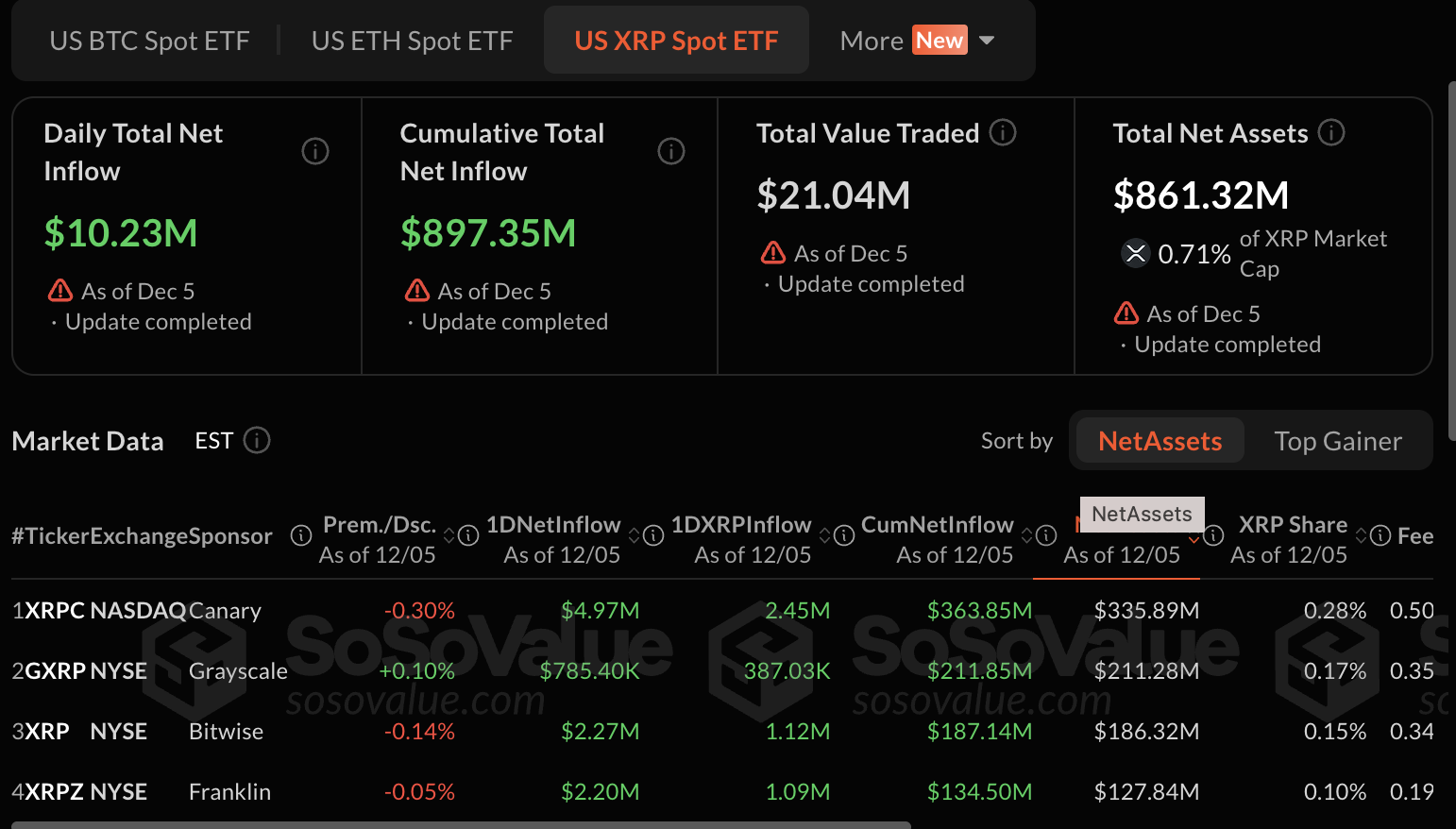

This mild upward movement suggests that underlying spot demand remains resilient, preventing bears from gaining full control. Market observers attribute this strength to inflows from XRP spot ETFs.

As of the close of business last week, XRP ETFs have attracted $897 million in inflows over 15 consecutive trading days. Major contributions came from Canary Capital with $363.89 million and Grayscale’s GXRP with $211.85 million. Others, including Bitwise and Franklin, have also purchased XRP worth $187.14 million and $134.5 million, respectively.

Many XRP analysts continue to project a supply shock as ETFs keep buying XRP, expecting a major uptrend that could catch many by surprise. However, traders appear to be largely betting against this outlook, given the heavy skew toward bearish positions in the futures market.

Crypto AI founder Leo Simpson argued that the crowd is leaning heavily in the wrong direction on XRP. He noted that such one-sided positioning often fuels sharp moves:

“When longs are nearly absent, even a small catalyst can trigger a real squeeze.”

He warned traders to stay alert and avoid letting market consensus push them out of potential upside.

Others commenting on the data echoed this view, noting that such a heavily bearish stance could easily backfire, as the markets often move against the dominant position.

I am sitting here waiting to pounce in case my buy orders are missed.

— Just Val ❣️🌱✨🍄 (@Cryptogal3) December 7, 2025

XRP Liquidation Data

Coinglass liquidation records over the past 24 hours show $9.71 million in total liquidated positions across XRP. Long positions accounted for $7.05 million, while short positions totaled $2.66 million.

This ratio shows that both sides of the market are taking hits, though longs have absorbed more liquidations. Still, the rapid buildup of short exposure remains the standout trend.

All eyes are now on whether the bears will finally force a breakdown, or whether XRP’s quiet strength will trigger a squeeze that catches the market off guard.

thecryptobasic.com

thecryptobasic.com