- $BONK holds strength above its key support zone as trading stays steady across major levels.

- $BONK stalls between key MAs as RSI dips below neutral, signaling market indecision.

- Bonk.fun lifts DAT allocation to 51%, rebalancing fee splits and marking second treasury shift.

$BONK has stabilized around a key support zone as Bonk.fun’s updated fee model reshapes activity within its own platform. The recent rebound followed Bonk.fun’s move to direct most of its platform fees into $BONK accumulation under Bonk Holdings Inc.’s Decentralized Autonomous Treasury.

Support Zone Holds as $BONK Rebounds

This week began with a brief slide toward $0.00000858. The drop did not last long, as $BONK’s price rallied nearly 18% toward the $0.000010 area, confirming the strength of its long-established floor. However, after meeting resistance around this zone, the token eased by roughly 6% to trade near $0.00000957.

At the moment, $BONK sits between its 20-day and 50-day moving averages. This range often signals a pause rather than a clear trend. Similarly, the RSI now rests around 48, showing the market has slipped below the neutral zone.

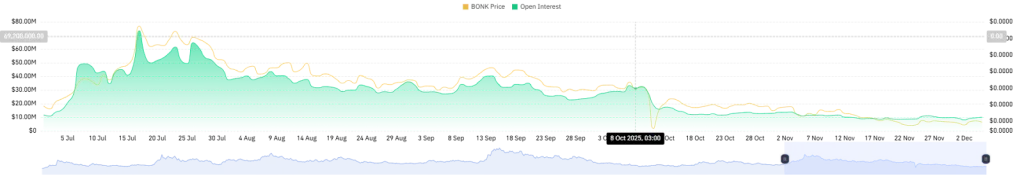

Not to leave out, open interest remains steady at about $10 million, reflecting a market with no major influx of new positions. Without fresh leverage entering the system, price swings tend to remain muted.

Bonk.fun Redirects 51% of Fees Toward DAT Purchases

While price action steadied, Bonk.fun confirmed that 51% of all platform fees will now flow directly into DAT purchases, a sizeable jump from the previous 10% allocation.

To make room for this new route, the project rebalanced its earlier fee splits, including the 35% buy-and-burn share and portions of its SBR and $BONK reward pools, while keeping community-oriented budgets in place. This is the second major shift in $BONK’s treasury structure in 2025.

Related: DOGE Price Strengthens as Bullish Structure and Analyst Signals Converge

Earlier in the year, BNKK executed a $32 million $BONK purchase to launch the DAT program. The group later expanded its role by acquiring a majority revenue stake in Bonk.fun valued at $30 million. BNKK board director Mitchell Rudy said the updated fee system is designed to reinforce $BONK’s long-term supply foundation and help the reserve reach roughly 5% of circulating supply.

Institutional access also expanded with the listing of the $BONK Exchange-Traded Product on the SIX Swiss Exchange, allowing investors to hold exposure backed by custodied $BONK without needing technical expertise. Since launch, the ETP has maintained a stable price structure.

Key Technical Levels Ahead

The next phases of $BONK’s chart will revolve around clear reference points.

Support levels include:

- 50% Fibonacci level around $0.00000944

- 38.20% and 23.60% Fibonacci markers at $0.0000092 and $0.00000891, respectively

- The historical $0.0000086–$0.0000083 range

These levels have already shown their importance in past market swings.

On the upside, $BONK would need to approach the 78.60% Fibonacci area at the $0.000010 zone before retesting resistance between $0.0000105 and $0.0000101.

With a steady support floor, consistent revenue, and a treasury system now geared toward long-term accumulation, $BONK enters a phase defined more by structural reinforcement than volatility.

Disclaimer: The information provided by CryptoTale is for educational and informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making any investment decisions. CryptoTale is not liable for any financial losses resulting from the use of the content.