A prominent market analyst has suggested that XRP is still not looking hot despite the recent recovery push.

Notably, XRP continues to face pressure around the lower end of the $2 range, and broader market sentiment remains uneasy. At press time, XRP trades at $2.08, down over 3% in December. Currently, the bears aim to push the price below the $2 support.

XRP Not Looking Too Hot

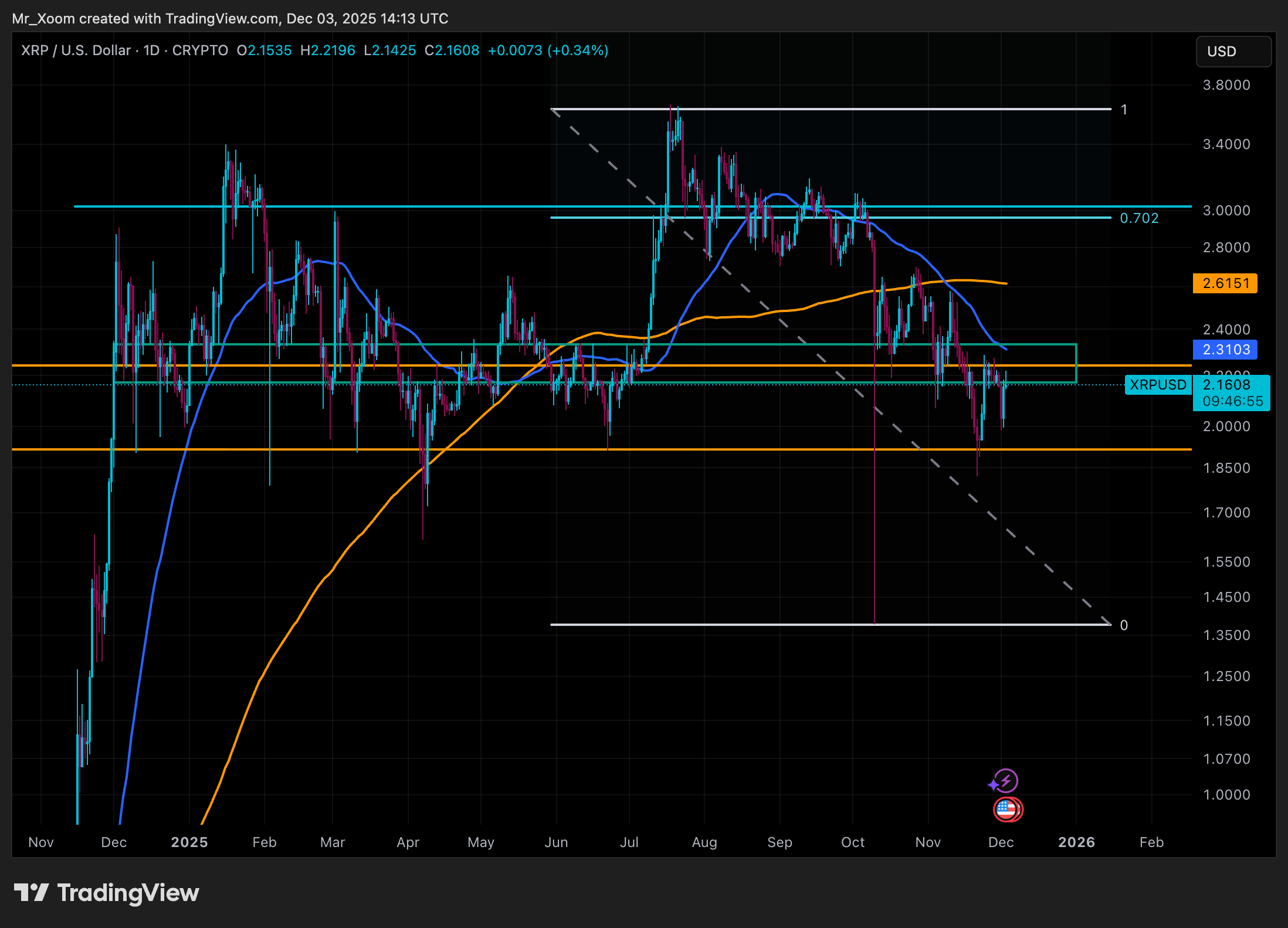

Amid this downtrend, crypto analyst Mr. Xoom recently called for caution. Mr. Xoom explained that XRP’s structure does not look strong despite the relief rally on Dec. 2 and 3, which culminated in an 8% gain. The analyst also noted that most crypto assets sit right under major resistance zones.

According to Mr. Xoom, the stock market, especially the Russell index, has not shown the kind of strength that usually supports a solid crypto rally. Because of this setup, he urged traders to approach every short-term bounce with caution.

Price Holding Below Critical MAs

Data from his chart shows why he holds this sentiment. Currently, XRP trades under the 50-day moving average at about $2.31 and the 200-day moving average near $2.61 at the time of the analysis.

This confirms a downtrend, as the short-term average has already crossed below the long-term one. Moreover, XRP’s price also struggles inside a heavy resistance area between $2.20 and $2.35, which has rejected every recent attempt to recover.

Notably, XRP climbed to the $3.6 peak in July, but it lost momentum and started forming lower highs. Sellers stepped in around the 0.702 Fibonacci level near $3.00, and the trend eventually reversed.

Since then, XRP has created a clear pattern of lower lows. A sharp sell-off recently pushed the price into the $1.8 area in late November before it bounced back toward current levels.

Meanwhile, a descending trendline from the summer peak still guides the market, and it aligns with a projected downside target around $1.35 if the price breaks below the $1.85 to $2.00 support range. For now, the market continues to move inside a broad band between $1.85 and $2.35, and each move toward the top of that range has stalled.

XRP’s Potential Paths

However, while Mr. Xoom remains cautious, other analysts see room for a different outcome. For instance, market watcher Casi pointed to XRP’s bounce from a local 0.618 retracement, which introduced a possible bullish scenario.

🚨XRP Is Heading Towards a Critical Retest at $2.04 Support! 🚨

XRP has shown some bullish momentum after bouncing off a .618 local retracement… This opens up a bullish scenario, but there is STILL a potential of reaching the $1.64 macro .618 support! This next test at $2.04… pic.twitter.com/hnUVsniQty

— CasiTrades 🔥 (@CasiTrades) December 5, 2025

She expects XRP to retest the macro 0.50 Fibonacci level at $2.04, which she called the most important support in this correction. She believes the market will reveal its next major direction at this level.

Casi outlined two possible paths. If XRP holds $2.04, she expects the price to push through $2.41 and climb toward $2.65, which would signal the start of a new upward wave with targets between $7 and $10. If XRP loses $2.04, she expects a deeper move toward $1.64, which lines up with the macro 0.618 retracement and would complete the correction before a larger rally begins.

Another analyst noted that XRP holders have shifted back into accumulation after nearly a month of net outflows. This development usually appears before a trend reversal, and it marks the strongest increase in holder positions since early October.

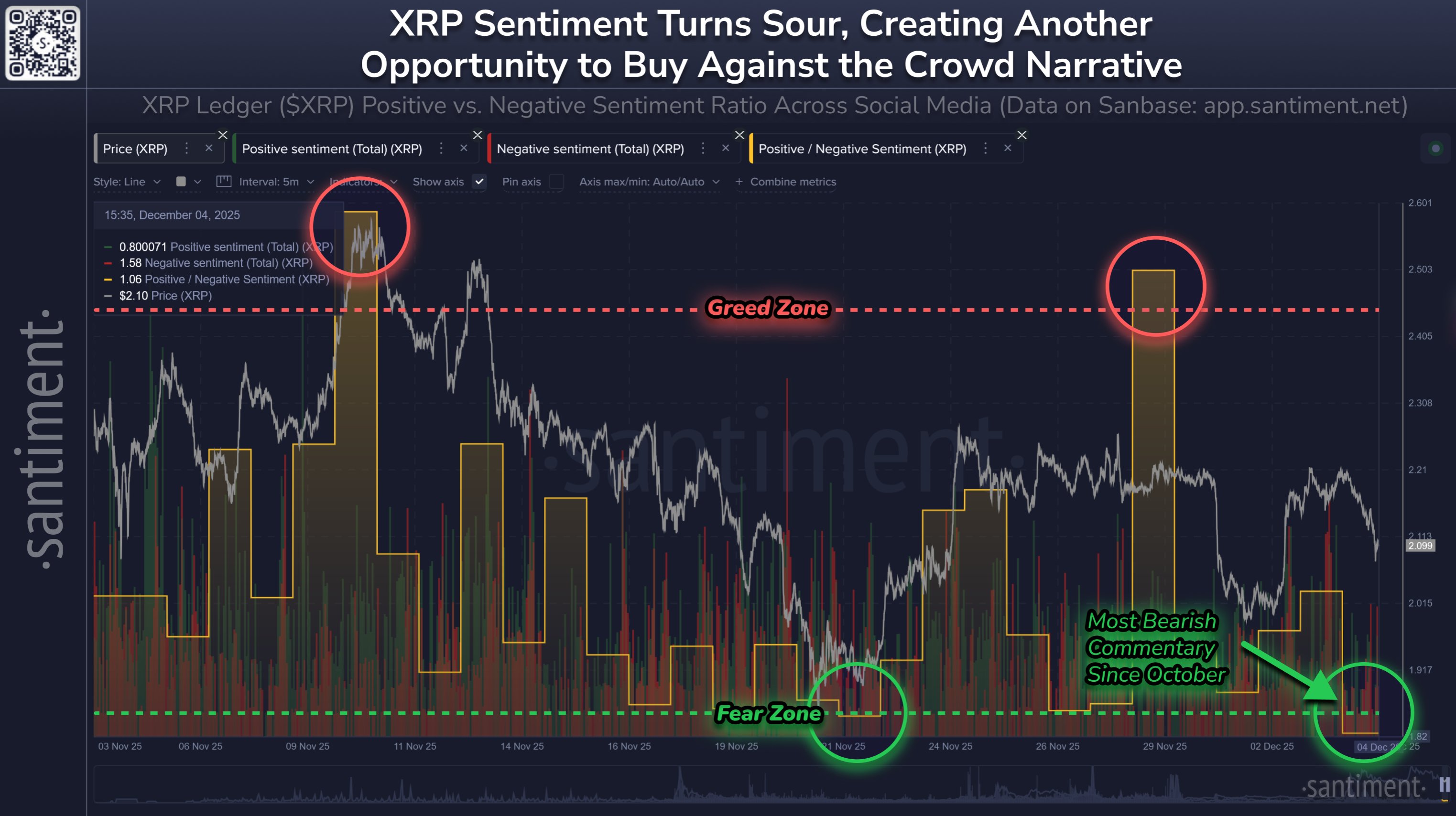

Meanwhile, Santiment also highlighted a surge in fear around XRP. Specifically, XRP dropped 31% in two months, and its social sentiment now shows the highest level of doubt since October.

The last time XRP faced similar fear, the price jumped 22% in three days before greed took over and the rally faded. Santiment believes the current setup looks similar and may offer another opportunity.

thecryptobasic.com

thecryptobasic.com