Ripple's token breaks critical $2.07 floor amid volume surge, signaling deeper correction ahead.

News Background

- XRP continues to face conflicting forces as short-term technical weakness clashes with strengthening institutional adoption.

- Spot XRP ETFs have now attracted nearly $850 million in inflows since launching in mid-November — one of the strongest altcoin ETF starts on record — suggesting long-horizon capital continues to accumulate exposure.

- Despite this, broader market liquidity remains thin, and leverage metrics across major exchanges show declining open interest, indicating a risk-off environment and reduced speculative participation.

- Combined with Bitcoin’s continued volatility below key weekly levels, altcoins like XRP remain highly sensitive to technical breakdowns even as fundamental demand builds in the background.

Technical Analysis

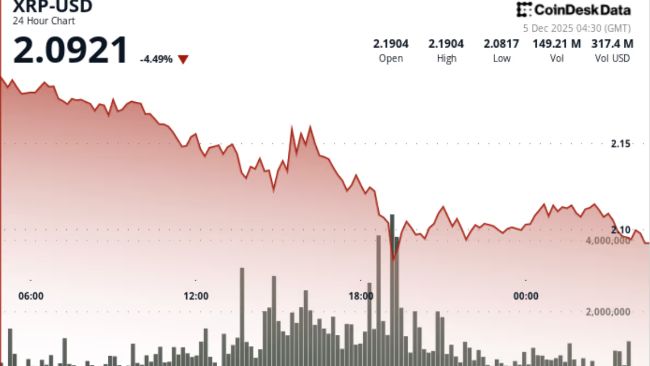

- XRP spent most of the session attempting to stabilize above the $2.07 support zone, but the tape revealed a consistent pattern of lower highs — a classic sign that buyers were losing control of momentum.

- Volume expanded on every rejection near $2.11–$2.13, reinforcing seller dominance at overhead resistance.

- The decisive technical shift came in the session’s final hour: the $2.07 floor gave way as volume surged dramatically. A secondary volume burst at 03:24 GMT pushed XRP briefly toward the $2.00 level, confirming that the initial breakdown was not a false move but the start of a continuation leg lower.

- Momentum indicators now firmly tilt bearish, with RSI trending down from mid-range levels and MACD crossing deeper into negative territory. The breakdown transforms former support at $2.07 into immediate resistance — a key pivot level that must be reclaimed to restore near-term bullish structure.

Price Action Summary

- XRP fell sharply from $2.20 to $2.10, shedding 5.7% across a 24-hour $0.13 range that delivered nearly 6% volatility. Attempts to reclaim $2.11 failed on weakening volume before the breakdown intensified.

- At 19:00 UTC, volume spiked to 94.0M — 68% above normal — marking the rejection at $2.13 and confirming the shift toward bearish continuation.

- Subsequent declines saw XRP test levels near $2.09 and briefly flirt with the $2.00 handle as volume again surged above 1M in a single minute.

- Price now consolidates in the $2.10–$2.12 zone but remains beneath all intraday resistance levels, leaving downside pressure intact.

What Traders Should Know

- XRP now trades at a critical juncture. The failure of $2.07 — a level that held multiple retests earlier in the week — opens a clean technical path toward $2.05 and, if that breaks, the deeper $1.90–$1.97 demand region highlighted by several analysts.

- Despite strong ETF inflows, institutional spot buying did not offset short-term technical deterioration. Until price reclaims $2.07–$2.11 with conviction and rising volume, the structure favors continued downside.

- A clean bounce from $2.05, paired with a reclaim of $2.11, would be the earliest sign that buyers are regaining momentum. Failure would expose the November lows and extend the bearish cycle into December.

coindesk.com

coindesk.com