Chainlink ($LINK) has seen a sharp rise in whale accumulation over the past two days. This increase in whale buying, paired with improving technical conditions and a new ETF listing, has shifted short-term sentiment around the asset.

Large Holders Accumulate as Price Recovers

Over a 48-hour window, wallets holding between 100,000 and 1 million $LINK picked up roughly 4.73 million tokens, according to on-chain data shared by analyst Ali Martinez. The total balance of these wallets rose from about 155 million to 159.47 million $LINK. This accumulation followed several weeks of flat or declining holdings through most of November.

4.73 million Chainlink $LINK bought by whales in 48 hours! pic.twitter.com/5Q5IDivpxh

— Ali (@ali_charts) December 3, 2025

During that same period, $LINK’s price fell from over $16.50 to just above $12. The new round of whale buying appeared to coincide with a price rebound to around $15 at press time, showing a possible shift in short-term momentum.

Last month, large wallets offloaded over 31 million $LINK, as CryptoPotato reported. The recent change in behavior suggests renewed positioning by long-term holders.

Meanwhile, recent exchange data shows $LINK continues to move into self-custody. CryptoQuant reports that fewer than 130 million tokens remain on centralized platforms. This level is near the 44-month low set in early December and suggests lighter near-term selling pressure.

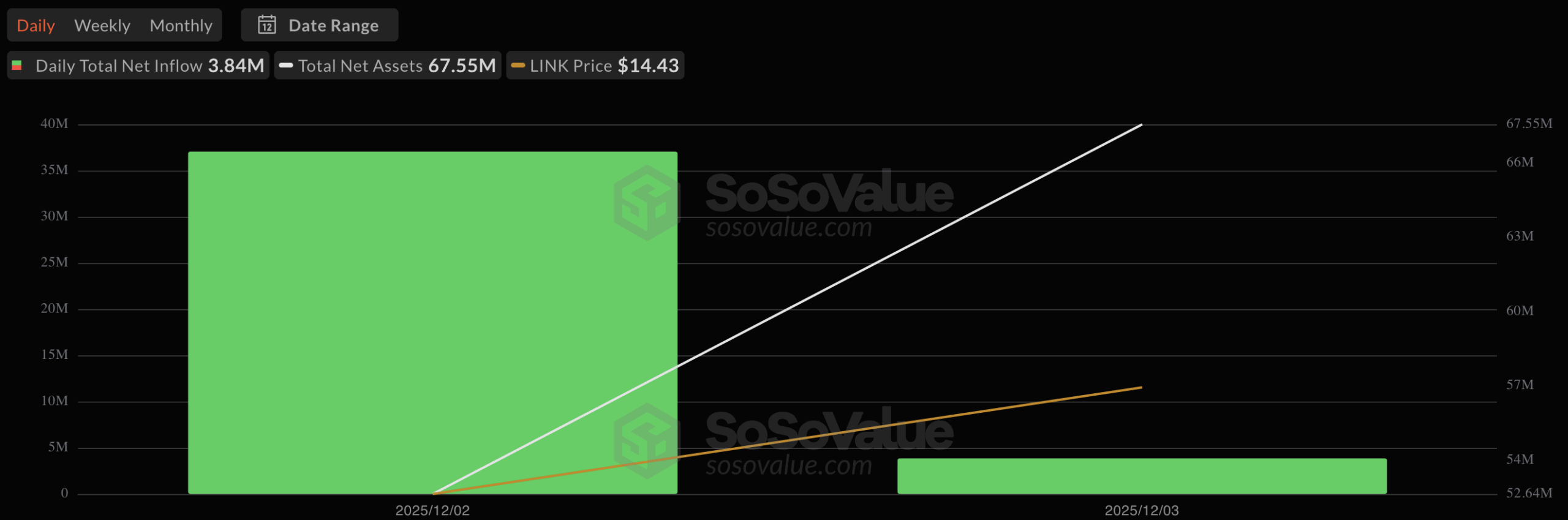

Adding to the recent momentum, the newly launched Grayscale Chainlink Trust (GLNK) began trading on NYSE Arca last week. The ETF, which was converted from a closed-end fund, recorded $37 million in inflows on launch day and an additional $3.84 million (on December 3). Current assets under management stand at approximately $67.55 million, according to SoSoValue.

You may also like:

- Chainlink ($LINK) Down 53% Since August – But Big Buyers Are Loading Up Fast

- Chainalink’s ($LINK) Supply Shock Begins? 15 Million Tokens Vanish From Exchanges in 30 Days

- Selling Pressure Dominates Chainlink ($LINK), But Here’s Why It Might Actually Be a Bullish Signal

Technical Outlook Eyes Higher Levels

Analyst CryptoWZRD noted that $LINK’s daily chart closed strong, with LINKBTC nearing a trendline breakout. Key levels to watch include resistance at $16 and support at $12.

“A breakout of this trendline will trigger very quick upside momentum,” he said.

On the intraday chart, $LINK is trading near $15.20. A breakout could push the price toward $16.90, while rejection at that level may lead to sideways action. The next lower support is around $13.50.

In the broader trend, analyst CW shared a long-range chart showing $LINK within a rising channel that has guided price movement for several years. $LINK is currently sitting near the lower boundary of this channel, which has historically acted as support during previous cycles.

According to CW,

“In this cycle, $LINK will reach the middle of the upper channel.”

That midline aligns with the $100 to $120 zone, based on the long-term trend.

cryptopotato.com

cryptopotato.com