Cardano faces key resistance at the 23.6% Fibonacci level, requiring bullish momentum to break this level for further upside potential.

Cardano (ADA) has experienced a moderate positive movement, currently trading for $0.449, reflecting a 0.9% increase over the past 24 hours. Its daily trading range has been between $0.4296 and $0.4529, showing a steady fluctuation and indicating moderate volatility.

In terms of performance over the last week, Cardano has seen a more notable improvement of 3.2%, which suggests a stronger recovery compared to the broader market. Looking at the past 14 days, ADA has declined 3.8%, reflecting the hardship on the longer timeframes.

This modest uptick in price highlights Cardano’s stability within the market, with its market cap standing at approximately $16.4 billion and a 24-hour trading volume of $975 million. Despite a relatively quiet performance in the larger crypto market, ADA’s recent price action suggests it may be positioning itself for further upside.

Cardano Price Analysis

Specifically, ADA is currently testing key levels of support and resistance, as the daily chart shows with Fibonacci retracement levels. The price sits slightly below the 23.6% Fibonacci retracement level at $0.4597, which acts as an immediate resistance.

Yesterday, December 3, the bulls attempted to break this liquidity zone but faced a roadblock at $0.455. The recent price action shows the bulls struggling to break through this level, which has resulted in a slight pullback.

The next level of resistance is at the 38.2% Fibonacci retracement level around $0.5044, which marks a significant area to breach for any potential continuation to the upside. On the downside, if Cardano fails to hold at the current level and falls below the 0 Fibonacci level at $0.39, the price could test levels like $0.35.

The MACD indicator at the bottom of the chart shows some positive momentum, with a slight increase in green bars, indicating potential bullish sentiment. However, further confirmation from the price action may be necessary before a decisive move occurs.

Cardano Liquidation Overview

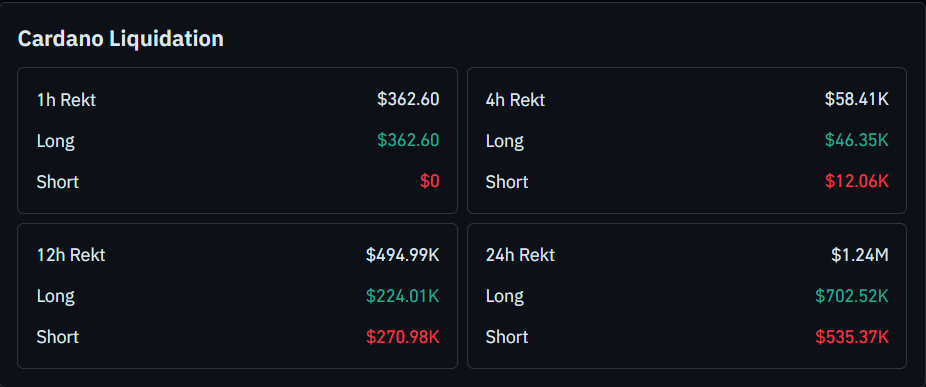

The liquidation data for Cardano provides a snapshot of the current leverage positions and the liquidation pressures in the market. Notably, over the past 24 hours, a total of $1.24 million in Cardano positions faced liquidation, with the majority of the liquidation occurring in long positions ($702.52K).

This indicates that many traders who were betting on an upward price movement are facing significant losses as ADA fails to maintain its momentum. In contrast, short positions accounted for $535.37K of the liquidations, indicating that bearish traders are also witnessing some pressure.

On shorter time frames, the liquidations are also notable. Over the past 12 hours, nearly $495K in total liquidations occurred, with $270.98K from short positions and $224.01K from long positions. The outcome of these competing pressures will likely dictate whether Cardano heads towards a bullish breakout or a deeper retracement.

thecryptobasic.com

thecryptobasic.com