XRP shows bullish momentum, but it must break key resistance on the daily chart to unlock its next upside target.

Notably, XRP is trading around $2.20, extending its latest advance with a strong 24-hour performance. The coin is up roughly 9.2% on the day, as steady buying interest has pushed price firmly higher from intraday lows. According to the 24-hour chart, XRP has moved within a daily range of $2.00 to $2.21, with most of the session spent grinding upward after an initial consolidation near the lower bound.

The move has lifted XRP’s market cap to about $132.5 billion, supported by more than $4.6 billion in trading volume over the same period. With price now holding near the upper end of its range after a sharp intraday spike, traders are watching to see whether bulls can maintain momentum and turn this break into a more sustained push.

Can XRP Close Above Key Resistance?

On the technical end, XRP is attempting to stabilize above the $2.10 to $2.20 zone after a recent correction that saw the coin at a bottom around $1.82. The price is now testing the upper band of the 1-day Fibonacci framework.

The chart shows the key retracement levels derived from the swing low near $1.81 and the recent peak at approximately $2.28. This places XRP just above the 0.236 Fibonacci level at $2.17, which had formed the first strong overhead resistance.

A daily close above this threshold would open the path toward the broader resistance region stretching toward $2.28, where previous selling pressure emerged. Until that breakout is confirmed, the zone overhead remains the primary supply region that bulls must reclaim to resume the broader uptrend.

On the downside, XRP has formed multiple layered support cushions that traders are closely watching. The nearest support sits at the 0.382 level around $2.10, followed by deeper areas at $2.05 (0.50 Fib) and $1.99 (0.618 Fib), which collectively form the strongest demand cluster. Should price lose this structure, the next significant defense comes at $1.91 (0.786 Fib), with a full retracement back toward the $1.81 low if bearish momentum intensifies.

Meanwhile, the MACD offers gradual bullish confirmation, with the MACD line crossing above the signal and the histogram turning green, indicating accumulating buying interest and early upside momentum.

Overall, XRP sits at a sensitive technical point: holding above key mid-Fibonacci supports keeps the recovery bias intact, while reclaiming the $2.17–$2.28 resistance range remains the critical trigger for a stronger bullish continuation to levels like $2.6.

XRP Futures Flows

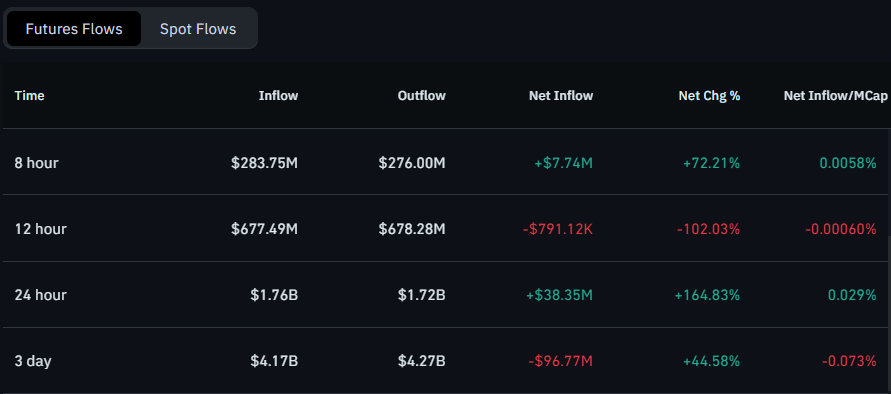

Notably, XRP derivatives data further shows a noticeable shift in futures positioning over the last day. In the past 24 hours, futures venues recorded about $1.76 billion in inflows against $1.72 billion in outflows, leaving a net inflow of roughly $38.35 million and a net change of about +165%.

The 8-hour window also prints a modest positive skew, with a $7.74 million net inflow and a sharp uptick in the net-change percentage. This suggests that, intraday, traders have been adding exposure on the long side or closing short positions as XRP’s spot price stabilizes above the $2 level.

However, the picture over a slightly longer horizon still reflects caution. Specifically, the 12-hour flows show a small net outflow of about $791,000, hinting that some participants used earlier strength to trim risk, and the 3-day reading remains negative with around $96.77 million in net outflows, even though the net-change percentage has improved.

Taken together, the data suggests short-term futures sentiment has turned constructive again. However, the lingering three-day outflows indicate that a portion of the market is still in de-risking mode.

thecryptobasic.com

thecryptobasic.com