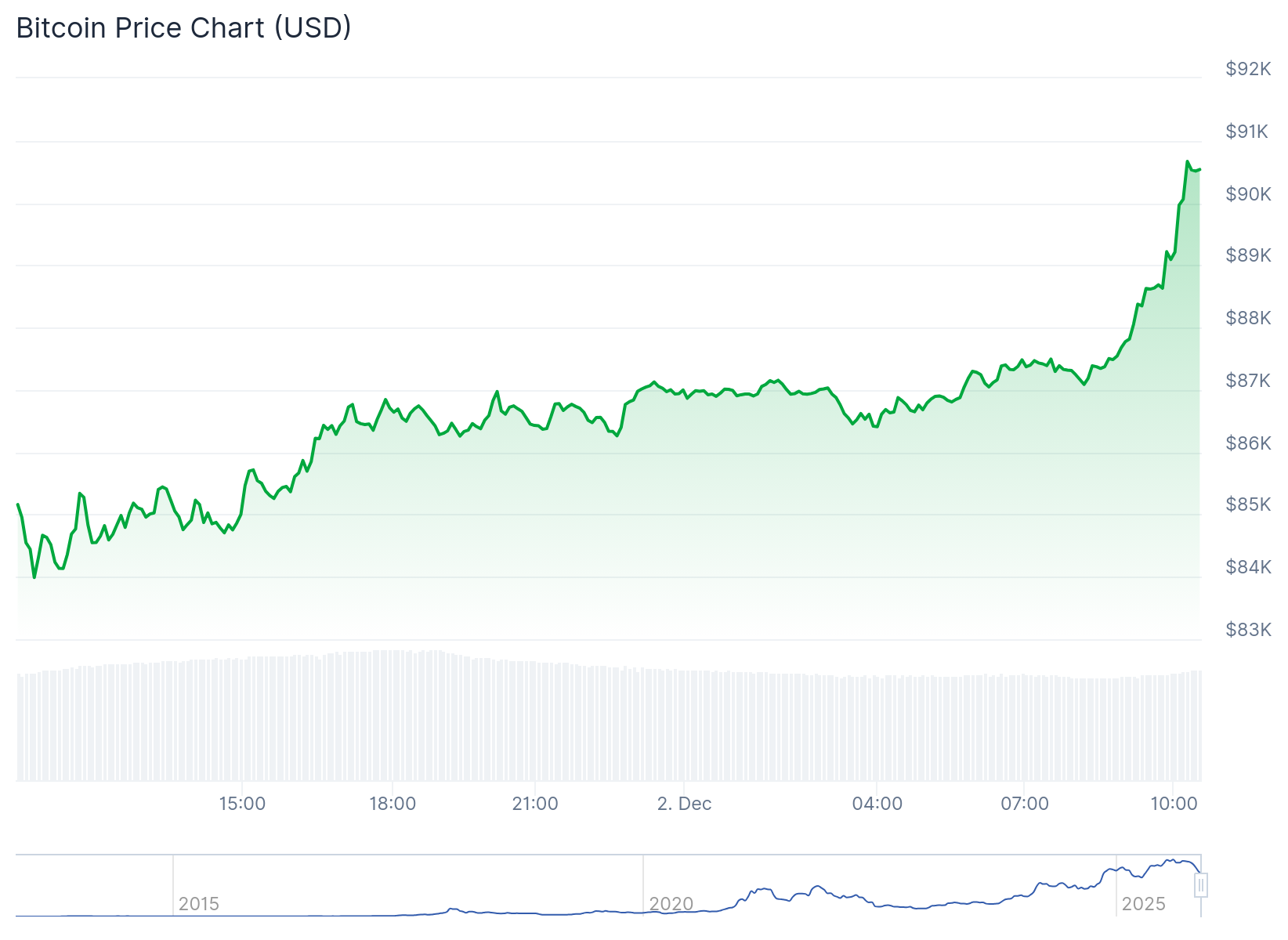

Crypto markets saw an uptick on Tuesday after a sharp but short-lived pullback at the start of the week. Bitcoin is currently trading above $90,000, and broader sentiment is showing early signs of recovery.

As of press time today, Dec. 2, Bitcoin (BTC) is trading around $90,510, up over 6% on the day, and roughly 4% higher over the past week. The move follows Monday’s volatility, which wiped out more than $200 million in leveraged positions.

Total crypto market capitalization has gained 6.2% in the past 24 hours to reach $3.15 trillion.

Ethereum (ETH) is edging back up toward $3,000, changing hands at $2,979, up a sharp 7.5% today. Solana (SOL) leads the large-caps with a 9% gain to above $136, while BNB is up about 7% at $870.60. Dogecoin (DOGE) is also up nearly 8% on the day, but remains slightly in the red on the weekly chart.

On Tuesday, despite the market uptick over the past few hours, the Crypto Fear and Greed Index remained in extreme fear for a second straight day, extending last week’s persistent stretch in the same zone.

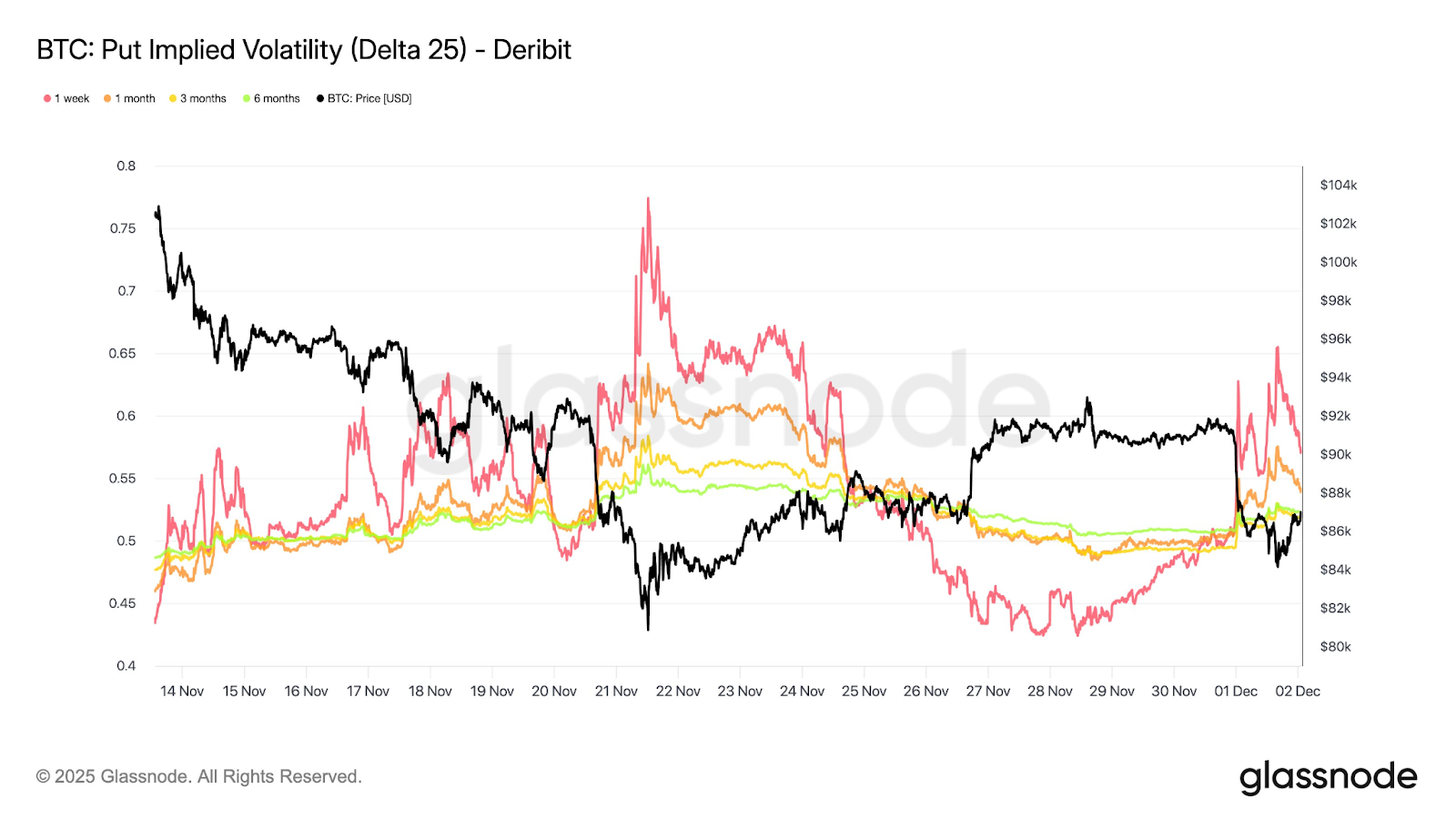

Less Worried Market

In a post on X today, analysts at glassnode said Bitcoin options markets showed a more muted risk premium compared with last week, adding that one-week put implied volatility jumped to 76% on Nov. 21 at similar price levels but only reached ~63% during yesterday’s selloff.

“The market appears less worried, but any further downside could trigger a far sharper repricing,” the crypto analytics firm warned.

In a separate weekly update published yesterday, Dec. 1, the analysts described Bitcoin as “transitioning out of deleveraging into a fragile equilibrium.” They added that even though oversold conditions have eased, liquidity remains thin and a sustained recovery “will likely require much stronger spot demand, renewed inflows, and broader participation.”

Big Movers and Liquidations

Among the Top 100 assets on CoinGecko, Sky (SKY), formerly Maker DAO, tops the leaderboard today, up 17.6%, followed by pumpfun’s PUMP, up 15% just a day after it was among the biggest daily losers, and SUI, up 11.5% today.

On the downside, Leo Token (LEO), launched by the parent company of Tether and Bitfinex, is leading with 6.1% daily losses, followed by Canton (CC), down 4% today.

Data from Coinglass shows that over the past 24 hours, the market liquidated over $466 million in leveraged positions. Longs accounted for $196 million, while shorts made up $270 million as prices pushed higher. BTC led with $206.85 million in liquidations, followed by ETH at $126 million, and other altcoins at over $22 million.

ETFs and Macro Conditions

Spot Bitcoin ETFs recorded $8.48 million in net inflows on Dec. 1, marking the fourth day of consecutive net inflows, and bringing cumulative inflows to $57.71 billion, per SoSoValue. Meanwhile, spot Ethereum ETFs saw nearly $80 million in outflows over the same period.

On the macro side, U.S. Treasury yields held steady Tuesday morning as investors waited for clearer signs on whether the Federal Reserve is leaning toward a rate cut at its meeting this month, CNBC reported.

Commenting on the macroeconomic developments, Iliya Kalchev, market analyst at Nexo, said in commentary shared with The Defiant that global macro sentiment is “cautiously constructive.”

Kalchev added that institutional adoption “remains steady” as large asset managers “are expanding tokenisation pilots focused on efficiency and settlement speed, and U.S. regulators are preparing new stablecoin rules under the GENIUS Act, including frameworks for tokenised deposits.”