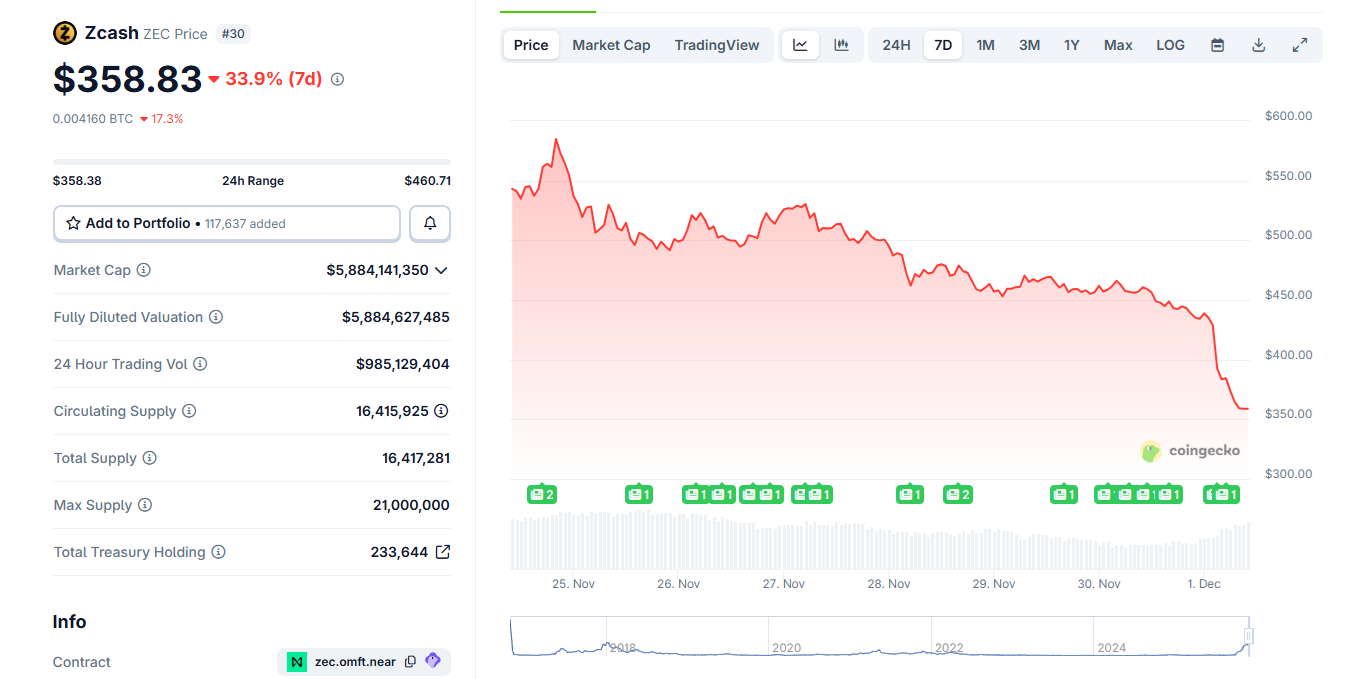

$ZEC was unable to go against the market on Monday, as most assets lost value. The privacy coin crashed by over 21% within hours, tracking the losses of $BTC.

Zcash sank to $360.35, unraveling rapidly during Asian trading hours and early European trading hours. The coin broke down its support above $440, setting expectations for a slide as low as $340, and possibly below $300.

The recent $ZEC slide also showed the rally above $700 was not entirely sustainable, despite going against the market direction. $ZEC trading volumes also tapered off in the past week, only accelerating during the latest selling event.

The Zcash price crash followed a statement by Vitalik Buterin, urging the community to stay away from token-based governance to avoid future problems.

$ZEC has long liquidity

Open interest for $ZEC also slid below $500M, while short positions shot up again. Over 45% of Zcash positions are attempting to short at this price level, increasing from a previous low of around 30%.

$ZEC short sellers almost gave up in the past month, as each attempt to short the token caused a short squeeze. This time around, short positions may allow a retrace to around $440.

During the latest downturn, Zcash liquidated most available long positions, down to the $360 range. At this point, $ZEC may attempt a reversal, if market conditions do not cause further crashes.

$ZEC is getting more aggressively shorted on Hyperliquid, with 13 out of 20 whales taking short positions at various price levels. Some are paying negative fees for a chance to bet on a $ZEC price slide. Whales with long positions are also feeling more pressure. One of the top whales still carries $4.4M in unrealized loss, recently adding collateral to retain the position, making a bet on a $ZEC reversal.

On Polymarket, the chances of Zcash rallying to $1,000 by the end of the year have collapsed, down from 42% in November to 8% after the latest crash.

$ZEC sinks as altcoin season unravels

Zcash fell against Bitcoin, sliding below 0.005 $BTC. The current altcoin climate also worsened, as the altcoin season index fell back to 26 points.

The $ZEC rally was one of the few engines for a higher altcoin index. The recent price drop also increased the concerns that Zcash was an exit pump for whales, and was artificially boosted, based on a mix of whale buying and short liquidations.

Privacy coins as a whole erased more of their value, with total market cap falling below $17B. Zcash lost its top position as the biggest privacy coin, as Monero ($XMR) regained the top spot.

$XMR rose by over 9% net in the past week, to trade above $418. $XMR was also the only privacy coin in the green, potentially replacing $ZEC as the asset that pumps counter to the market. While other privacy coins failed, $XMR raised a new hope for a rally after years of sideways trading, repeating the performance of Zcash. However, the lesson of $ZEC may also increase skepticism on the potential for a sustainable price expansion.

Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.

cryptopolitan.com

cryptopolitan.com