At 03:00 GMT on November 28, 2025, a cooling system failure halted 90% of global derivatives trading after machines at a CyrusOne data center in Illinois overheated. This caused the CME Group’s systems to shut down.

This technical outage revealed a critical vulnerability in financial infrastructure. Physical cooling capacity, not computation or cyber threats, suddenly became the weak link for global market operations.

Cooling System Failure Halts Global Trading

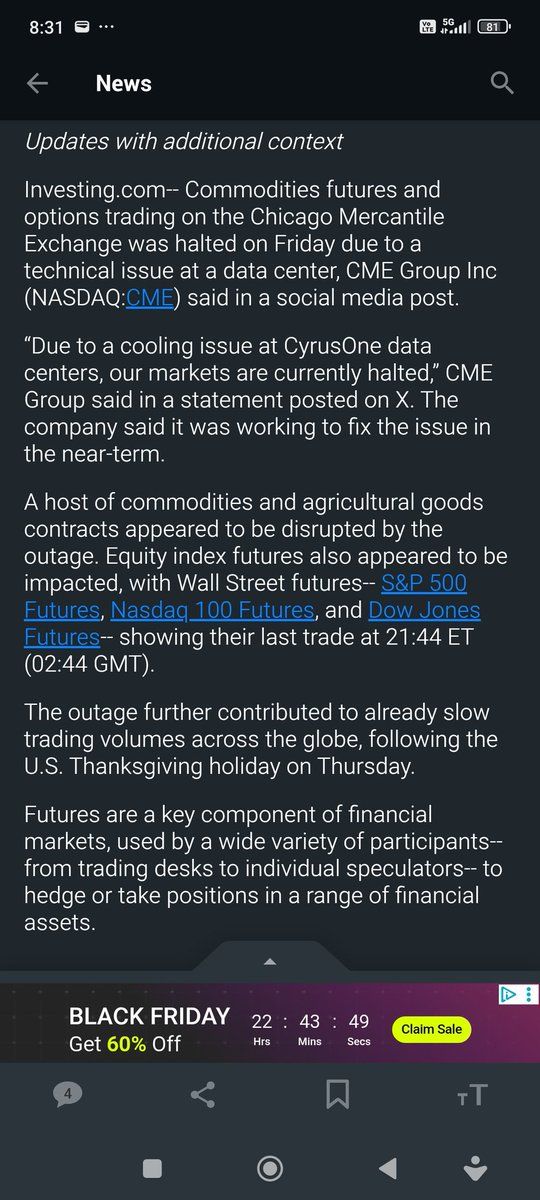

CME Group confirmed that all markets were halted due to a cooling failure at a CyrusOne data center. The exchange, handling approximately 30 million contracts daily, ceased operations across its entire Globex platform. Treasury futures, energy, and agricultural markets froze from Chicago to Kuala Lumpur.

Due to a cooling issue at CyrusOne data centers, our markets are currently halted. Support is working to resolve the issue in the near term and will advise clients of Pre-Open details as soon as they are available.

— CME Group (@CMEGroup) November 28, 2025

This outage was not the result of a cyberattack or market intervention. The cooling system failed to remove the heat from the hardware. As servers overheated, safeguards shut down the infrastructure to prevent serious damage.

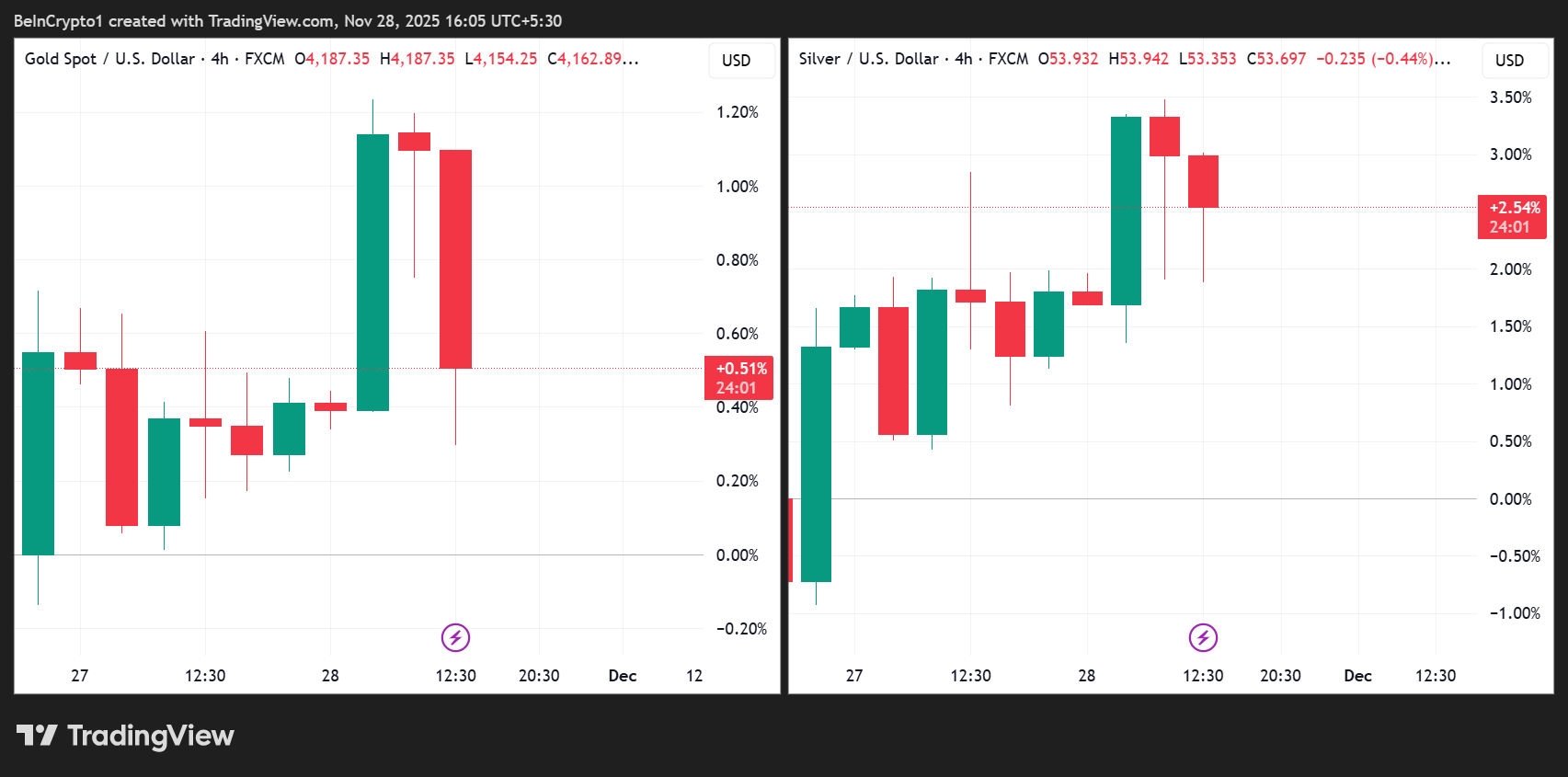

For traders, the sudden disruption was alarming. Gold experienced two sharp $40 liquidation drops before recovering, while silver fell about $1 within minutes of the halt.

These movements appeared disconnected from typical market selling, raising speculation about systemic issues or market intervention.

Market observers noted that the halt coincided with gold and silver nearing potential breakouts.

JUST IN 🚨: CME Futures Halted

— Barchart (@Barchart) November 28, 2025

Incredibly just as Silver and Gold were about ready to launch 🚀 pic.twitter.com/zgqxcuQZ3C

The synchronized plunge in precious metals added to doubts over whether the outage was purely technical.

Thermodynamic Limits Challenge Financial Systems

This event highlighted a pressing challenge for global finance. In 2024, US data centers consumed 183 terawatt-hours of electricity, over 4% of national usage, matching Pakistan’s annual electricity demand. Projections suggest this will more than double to 426 terawatt-hours by 2030.

AI workloads are driving annual energy demand by nearly 30%. Physical heat generated by computation must be expelled efficiently.

The CME’s infrastructure, built for 2015 usage, now faces 2025’s exponentially higher computational demands.

“The CME Group, which prices everything from Treasury bonds to crude oil to the S&P 500, went dark because the machines that run global finance exceeded their thermal limits. The heat generated by computation overwhelmed the capacity to reject it. This is not a glitch. This is a structural warning,” wrote Shanaka Anslem in a post.

Notably, CME Group sold the affected data center in 2016 and leased it back from CyrusOne. When cooling failed, the exchange owned and controlled nothing, waiting like clients for the third-party provider to restore capacity.

This centralization created a major single point of failure. It brings to mind the recent Cloudflare outage, which also exposed Web3’s centralization problem.

Some critics believe today’s market infrastructure is not suitable for modern demands. Global price discovery relies on centralized servers that can be physically constrained.

First CME “glitches” when Silver was about to break out.

— Macro Liquidity by Sunil Reddy (@Macrobysunil) November 28, 2025

Later #Gold prints a $40 liquidation wick twice and instantly recovers both times.

That’s not real selling.

That’s market plumbing under maximum stress. https://t.co/3vyRiRSMTM pic.twitter.com/VnJUJvCDo5

Now, heat rejection capability sets the true limits for market transactions, not just hardware or software efficiency.

What Really Happened? Competing Narratives and Market Implications

Two main explanations emerged. The official story cites a cooling malfunction at the CyrusOne facility.

According to CME Group’s Global Command Center, teams quickly worked to fix the thermal problem and restore trading.

Yet many traders remain skeptical. Critics point out that only the CME’s matching engine was affected, despite many clients using the same CyrusOne data center.

If the cooling failure was facility-wide, more systems should have halted. The targeted disruption fueled doubts about a purely accidental outage.

Some analysts suggested the timing and selectiveness pointed to a controlled halt rather than a random malfunction.

The official story gets stranger by the hour.

— Honza Černý (@honzacern1) November 28, 2025

If the outage was truly a “cooling issue”, we’d see it across multiple CyrusOne clients — not only on CME’s matching engine during a vertical move.

When media starts adding vague “context” instead of facts, you know the narrative is… pic.twitter.com/2Ks5zaxgx0

The sharp moves in precious metals before and during the outage fostered speculation about intervention or crisis management.

Regardless of the underlying cause, this event demonstrated systemic risk.

CME Group clears record volumes across asset classes, including cryptocurrency derivatives. In October 2025, the average daily volume of crypto surged 226%, with Micro Ether futures up 583% to 222,000 contracts. Increasing scale magnifies infrastructure vulnerabilities.

While this outage occurred during quiet holiday trading, a similar failure during market stress could escalate systemic risk.

Even a brief shutdown in global price discovery can cause uncertainty and volatility and could trigger cascading effects across related markets.

Financial infrastructure is now constrained by thermodynamic realities. Improved distribution, redundancy, and architectural redesign may be required to prevent future incidents.Thermodynamic realities now constrain financial infrastructure

The key question is whether the industry will adapt proactively or be forced to react after further disruptions.

The post 90% of Derivatives Freeze As Cooling Failure Stops Global Finance appeared first on BeInCrypto.

beincrypto.com

beincrypto.com