Jake Claver, CEO of Digital Ascension Group, has said a major XRP supply crunch may be closer than most expect, sending the price to the moon.

He shared this view as XRP ETFs continue to see consistent daily inflows, which all go into XRP acquisition.

XRP OTC and Dark Pool Liquidity Is Almost Gone

In a widely shared video on X, Claver explains that XRP spot ETFs have already begun “eating through” OTC and dark-pool supply at an unexpected pace.

He estimates that between 1 billion and 2 billion XRP were available across these private liquidity venues. But in just the first week of ETF activity, about 800 million XRP have already been absorbed.

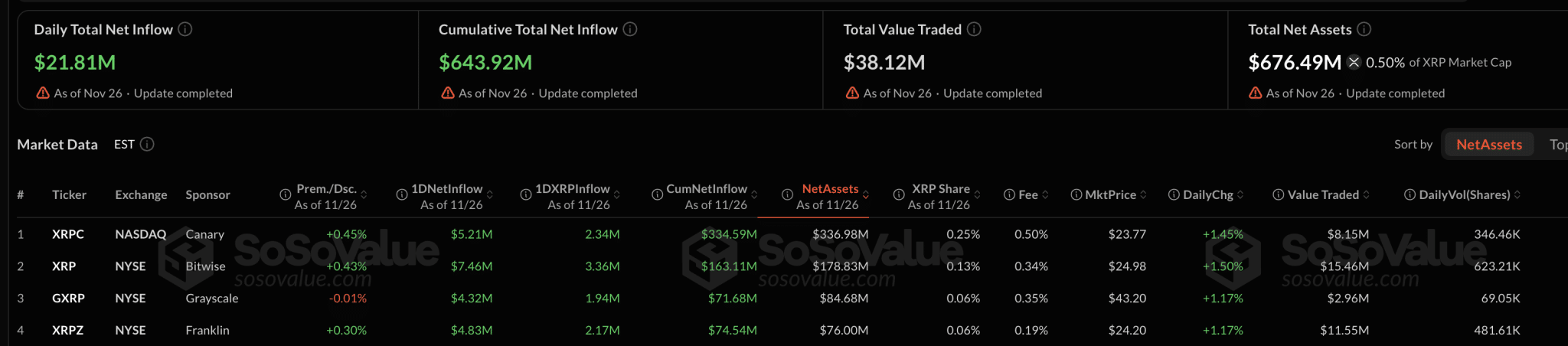

That means half or nearly all of the accessible OTC supply may already be gone. It’s worth noting that XRP ETFs have accumulated just over 300 million XRP, with total assets of $676 million as of today.

Meanwhile, Claver adds that this dynamic will intensify as more spot XRP ETFs launch. Importantly, the largest issuers haven’t even stepped in yet: BlackRock, Vanguard, and Fidelity are still on the sidelines.

If all three enter the market, the number of XRP spot ETFs could surpass Bitcoin’s, in his view.

When OTC Supply Ends, Price Discovery Moves to Exchanges

Furthermore, Claver noted that XRP price movement has been muted so far because the ETFs are still sourcing XRP privately, rather than through retail exchanges. Accordingly, the real volatility begins when those channels run dry.

As he puts it, “You’re going to see some crazy price movement when there’s no more available supply through the OTC desk and the dark pools, and they have to go to the exchanges.”

He points to Kraken’s recent anomaly, where XRP briefly registered a candle at $91. Interestingly, the figure did appear on the exchange’s official charting data. While other historical spikes on platforms like Bitrue and Bitstamp have vanished upon review, this one remained visible.

Glimpse of What Happens When Liquidity Gets Thin

For Claver, Kraken’s case was a preview of what happens when institutions are forced into public markets. Thin liquidity, combined with sudden demand, creates violent upward moves.

With ETF inflows accelerating, major issuers preparing to join the market, and OTC supply drying up, he believes the broader XRP community is not prepared for what comes next.

“Strap in,” Claver says. “It’s not going to last much longer.”

ETF Demand Is the Fastest Path to a Higher XRP Price

Notably, Claver’s perspective aligns with that of other XRP commentators, such as Chad Steingraber, who says ETFs are now the strongest near-term driver of XRP’s price.

Steingraber argues that the speed of institutional accumulation outpaces all other catalysts. Bitwise has boosted its XRP holdings to 80.5 million XRP (~$178.8M) after a $7.46M inflow on Wednesday.

Other ETFs show similar momentum: Canary Capital added $5.21M (AUM $336.98M), while Grayscale and Franklin Templeton recorded inflows of $4.32M and $4.83M. In just nine trading days, total XRP ETF assets have reached $676.49M.

Steingraber expects demand to accelerate as three more ETFs go live, potentially lifting daily ETF trading volume to $75–$80M. At that pace, ETFs may need 20–30M XRP per day, totaling up to 400M per month and 4.8B annually— a drain he believes could trigger a supply shock within months, not years. Accordingly, he expects XRP’s price to go higher.

thecryptobasic.com

thecryptobasic.com