Shiba Inu has rebounded from a weekly downtrend, as the leading meme coin prepares to test Fibonacci resistance levels.

Looking at the price charts, it is notable that Shiba Inu is quietly clawing its way back after a choppy week. Currently, $SHIB trades around $0.00000857, only about 1% lower on the 24-hour chart despite sharp swings.

Price spent the early part of the week grinding lower before finding a floor near the bottom of its recent $0.00000833–$0.00000869 range. From there, the token staged a strong rebound into late November, printing a new local high at $0.00000892 before easing back into a tight consolidation zone.

Beneath the surface, liquidity remains deep. Specifically, $SHIB’s market cap hovers near $5 billion, down 1.04% in the past day. Zooming out the view, the 7-day chart shows a modest 1.3% decline. Elsewhere, the 14-day performance reveals a much steeper 12.3% drop.

Amid this longer-term decline, market watchers are assessing the extent to which bulls can continue defending the current support zone and whether the latest bounce signals early accumulation.

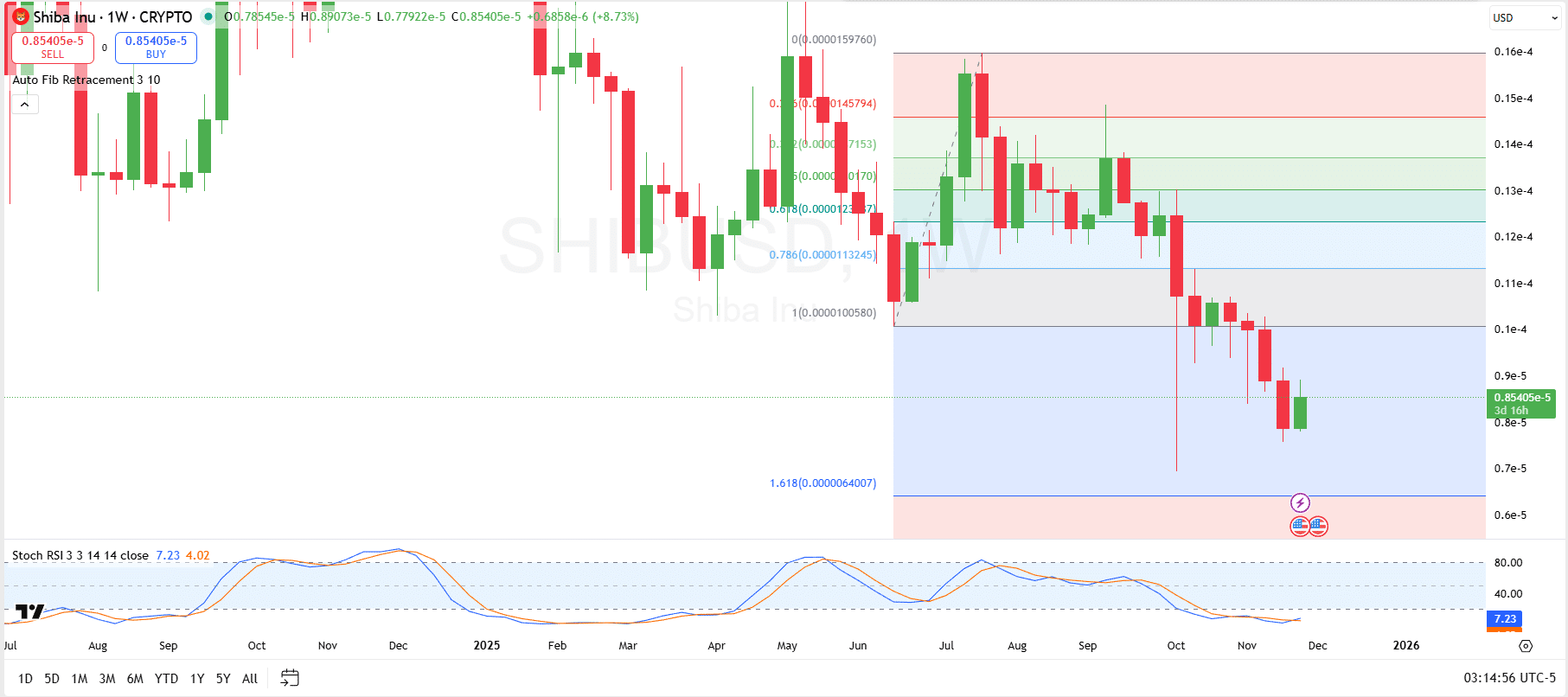

Shiba Inu Price Analysis

On the weekly chart, Shiba Inu remains locked in a clear downside structure. A series of successive red candles seen in the last few weeks show that the prior rally has been largely unwound.

The price is now trading below the key Fibonacci retracement bands drawn from the last major upswing. $SHIB is sitting in the lower extension zone between the earlier swing low around $0.000007 and the 1.0 Fibonacci extension at $0.000010.

Notably, the next key battleground now sits overhead. The first hurdle for buyers is a recovery of the prior swing low and 1.0 Fibonacci level. A weekly close back above this band would mark the first sign that downside momentum is easing and could open the way toward the 0.786 retracement around $0.0000113, followed by the 0.618 level near $0.0000124.

If bulls fail to push $SHIB back above the 1.0 Fib and price rejects from below that level, the focus shifts back to the downside scenario. In that case, the chart leaves room for another leg lower toward the 1.618 extension at roughly $0.0000064.

The Stochastic RSI reinforces this picture of exhaustion rather than confirmed reversal. Both lines are pressed into oversold territory, with readings near 7 and 4, showing that downside momentum has stretched but not yet produced a strong bullish crossover. Any short-term bounce would still sit within a broader weekly downtrend unless $SHIB can reclaim the broken Fibonacci levels above, particularly the 0.786 zone.

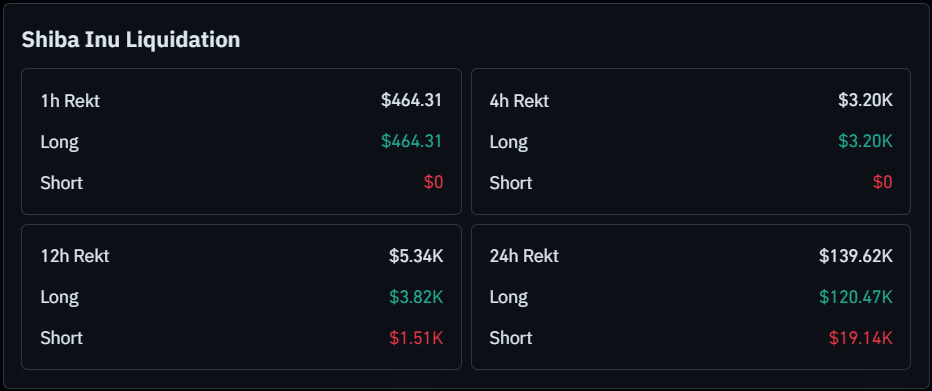

Shiba Inu Liquidation Data

Liquidation data for Shiba Inu shows that the bulk of recent pain has fallen on over-leveraged longs. Over the past 24 hours, roughly $139.6K in positions were liquidated, with about $120.5K of that coming from long traders and only $19.1K from shorts.

Earlier windows tell a similar but fading story: the 12-hour tally is just $5.34K (about $3.82K long vs. $1.51K short), while the 4-hour and 1-hour figures are minimal and entirely long-side.

When liquidation spikes subside after a long-heavy flush, markets often shift from sharp trending moves into a period of consolidation or a relief bounce. With most recent liquidations hitting longs and very few shorts exposed, the next direction for $SHIB is likely sideways to mildly higher.

thecryptobasic.com

thecryptobasic.com