Shiba Inu shows a mild rebound but remains vulnerable as key resistance levels cap the recent recovery push.

Shiba Inu ($SHIB) is showing a modest rebound in the latest 24 hours. Specifically, $SHIB has posted a 1.7% gain as it attempts to stabilize after a period of broader market weakness that even took Bitcoin below $83,000.

The meme coin is trading within a 24-hour range of $0.000007895 to $0.000008415. Despite a short-term uptick, $SHIB remains under pressure on higher timeframes, with the token still down 7.2% in the past week and 17.4% over the last 14 days.

Trading volume reached $132.8 million in the past day. With $SHIB trading near the midrange of its recent price action at $0.000008148, technical charts signal that the memecoin is attempting to carve out a local floor. Will the bulls escape to test stronger resistance?

Where is Shiba Inu Headed?

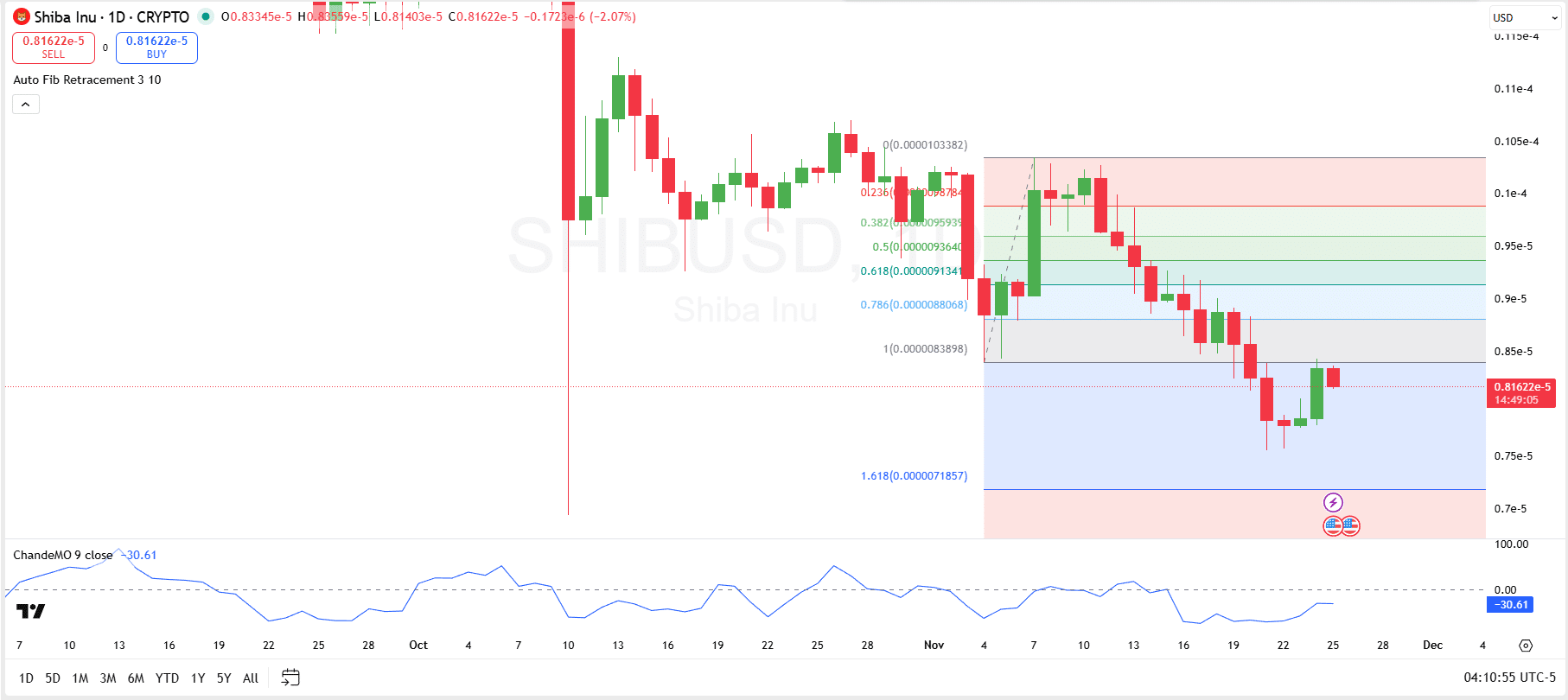

The latest Shiba Inu daily chart from TradingView shows the token attempting to establish a short-term base after a steep multi-week decline. Price recently bounced while heading to the 1.618 Fibonacci extension around $0.00000719, a level that acted as an exhaustion point during the selloff on October 10.

This rebound pushed $SHIB back to test the 1 Fib level at $0.0000084, but the recovery remains shallow so far, indicating that buyers are still hesitant. For $SHIB to regain bullish momentum, it must first surpass the 1.0 level, reclaim the 0.786 retracement level at $0.0000088, and then break above the stronger Fibonacci zones at 0.618 and 0.5. Until these levels flip into support, $SHIB remains vulnerable to further downside retests.

Complementing this reading, the Chande Momentum Oscillator (CMO) sits near -30, a region typically associated with oversold conditions. While this suggests that sellers may be losing strength and a short-term bounce is possible, the oscillator has yet to break back into neutral territory.

This means momentum has not fully shifted in favor of buyers. Overall, the technical setup shows early signs of stabilization, but $SHIB must clear key Fibonacci resistance levels before any meaningful recovery can take shape.

Shiba Inu Liquidation Data

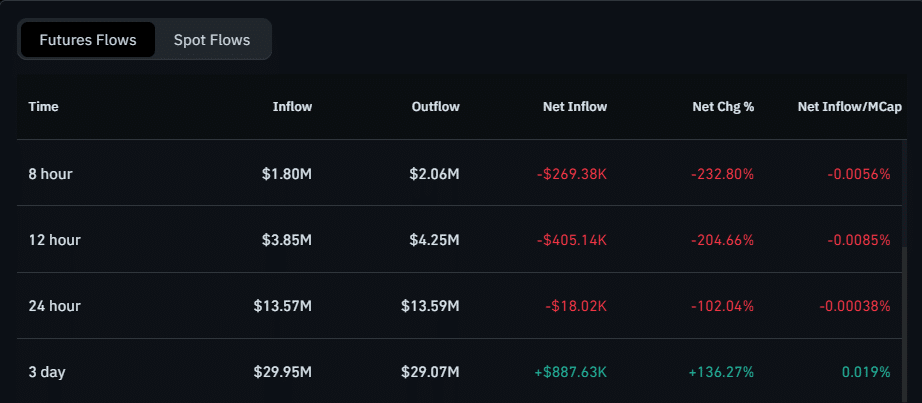

The Shiba Inu futures flow data reflects a noticeable imbalance between inflows and outflows across multiple timeframes, signaling continued caution among derivatives traders. Over the 8-hour, 12-hour, and 24-hour windows, $SHIB recorded consistent net outflows, with outflows exceeding inflows by $269.38K, $405.14K, and $18.02K respectively.

These negative readings, paired with steep net-change percentages such as –102% in the 24-hour timeframe and –232% in the 8-hour timeframe, highlight sustained selling pressure and a reduction in leveraged long exposure. This suggests that traders remain defensive, likely responding to $SHIB’s recent price weakness and overall bearish technical structure.

thecryptobasic.com

thecryptobasic.com