This weekend, after a week-long crypto rout that felt like a marathon with no water stations, the digital asset economy is limping in well under the $3 trillion mark at $2.87 trillion. At the same time, crypto fear and greed indexes are flashing “extreme fear,” a bright neon warning that investors are currently a bit too panicked for their own good.

Bollinger Bands Blow Out as Crypto Fear Index Screams ‘Extreme’ in Neon Letters

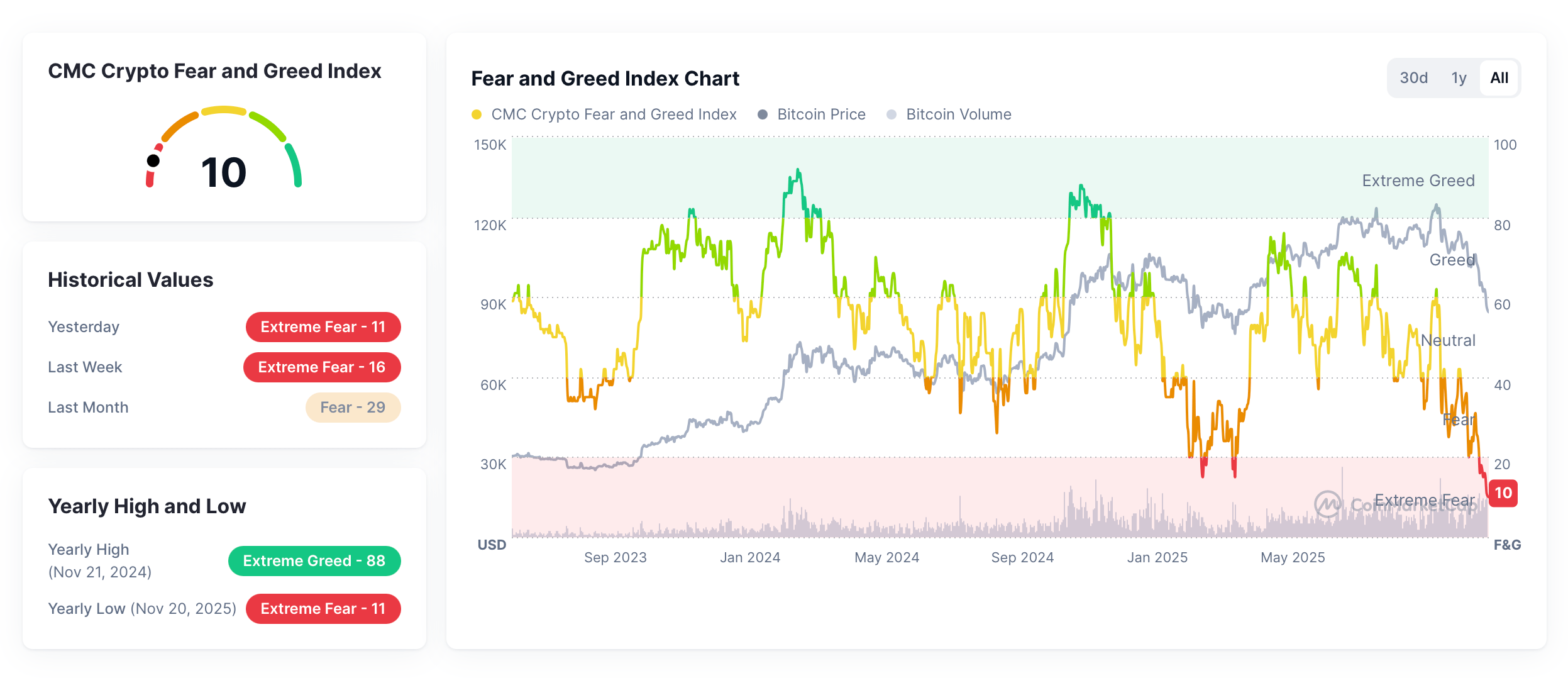

According to the CMC Crypto Fear and Greed Index (CMC CFGI) hosted on coinmarketcap.com, this marks the lowest reading the gauge has ever logged since June 2023. As of press time, the metric sits at a shaky 10 out of 100—squarely in “extreme fear”—with CMC’s ruleset noting that the market “may be undervalued.”

The CMC CFGI shows the market spent yesterday in “extreme fear,” matched by the mood last week, while last month managed a milder state of “fear.” Over on alternative.me, however, the Crypto Fear and Greed Index (CFGI) paints a slightly different picture with a current reading of 11 out of 100. Yesterday it clocked in at 14, last week hit a 10, and last month landed at 27 out of 100.

Alternative.me’s CFGI shows that “extreme fear” has cropped up before, with readings dipping to those levels in February 2025, June 2022, March 2020, and August 2019. Similarly, the fear and greed index for the stock market this week is at 11, indicating “extreme fear” among equity investors. In more recent times, bitcoin (BTC) and the broader crypto economy have been tightly aligned with stock market moves.

Read more: Why the Crypto Market Is Crashing: The Theories Fueling Today’s Fear

The “extreme fear” zone arrives as bitcoin has notched a 30% drawdown — a familiar drop seen during the 2011 cycle, the 2013 cycle, the 2017 cycle, the 2021 cycle, and now the ongoing 2024–2025 cycle as of November 2025. To many observers, but not all, this drop looks and feels like a healthy, fear-driven correction in an ongoing bull market — exactly the kind of setup that precedes the most explosive legs higher.

Additionally, Bollinger Bands show the price has wandered far beyond the bands, signaling a statistical outlier (either overbought or oversold), and prices typically drift back toward the mean. Historically, that reversion happens roughly 60–80% of the time when no outside factors interfere. CFGI readings tend to follow a similar rhythm after these extremes, often snapping back once the panic cools. In most cases, the index eventually steadies as prices and sentiment drift back toward their usual range.

FAQ ❓

-

What is causing crypto sentiment to hit “extreme fear”?

A sharp market decline and bitcoin’s 30% drawdown have pushed sentiment gauges across major regions into deep fear territory. -

How low did the fear and greed indices fall?

The CMC reading hit 10 out of 100 while alternative.me’s gauge reached 11, marking some of the lowest global sentiment levels since 2023. -

Does extreme fear mean the market is undervalued?

Both CMC and alternative.me note that extreme readings often appear when global crypto prices may be trading below fair value. -

How do past cycles help explain today’s drop?

Similar extreme fear prints have emerged in prior bitcoin cycles worldwide, often preceding market recoveries once sentiment normalizes.

news.bitcoin.com

news.bitcoin.com