Shiba Inu continues its bearish trend with heavy long liquidations, but key support at the 1.618 Fibonacci level could signal a potential reversal.

Shiba Inu ($SHIB) has faced notable fluctuations in the past 24 hours, seeing a decrease of 9.8%, as it currently trades for $0.00000786. Over the past week, $SHIB has experienced a decline of 13.7%, and in the last 14 days, it has dropped by 13.2%. The coin’s performance continues to show a bearish trend, with a 30-day decline of 20.7%.

Meanwhile, $SHIB’s price range in the last 24 hours has been between $0.00000761 and $0.00000880, reflecting the current volatility in the market. Investors and traders continue to monitor $SHIB’s movements closely, questioning if it can hold on to support reverse.

Shiba Inu Price Analysis

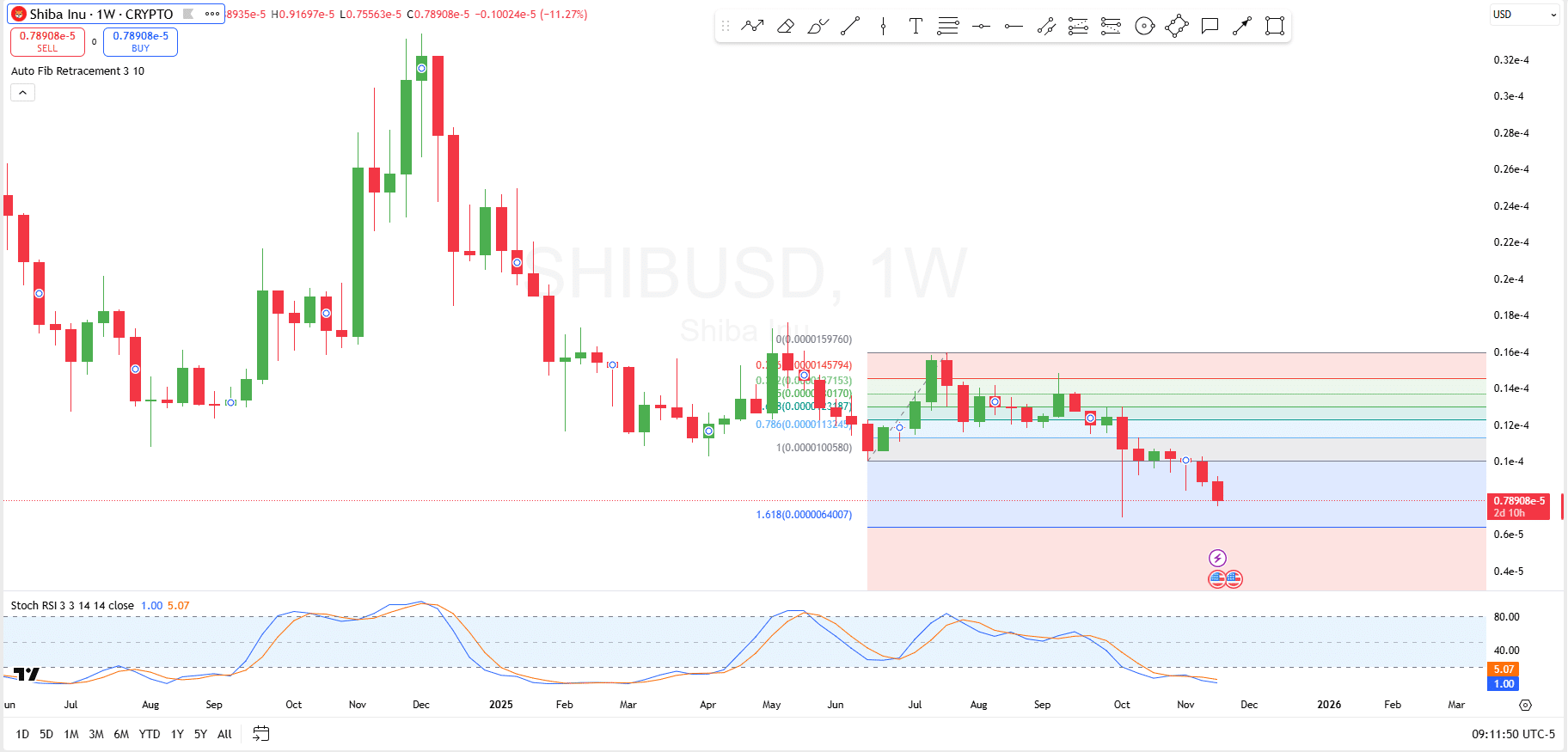

Notably, the weekly Shiba Inu chart shows the current price action as the asset struggles with significant downward movement. The key support level rests at the 1.618 Fibonacci extension level, currently around 0.0000064.

This level is crucial for the price to hold for reversal, as further downside could push the price lower, potentially reaching the next support zone near the 0.00000048 region.

On the upside, the next major resistance lies at the 1 Fibonacci level, around $0.0000106. A breakout above this resistance would suggest a possible rally toward higher levels, but the price would need to overcome the resistance zone first.

Stochastic RSI on the chart indicates an oversold condition, suggesting a potential bounce if the price reaches key support levels. However, unless there is a strong reversal from this support, the price may continue its downtrend.

$SHIB Liquidation Data

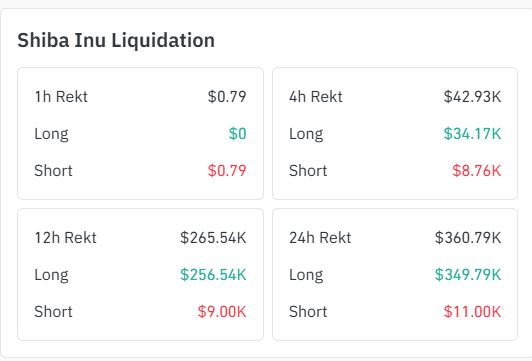

Meanwhile, the liquidation data for $SHIB shows significant bearish pressure, with long positions facing heavy liquidations across multiple time frames. Over the past 12 hours, long liquidations have totaled over $265.54K, suggesting widespread selling as traders react to downward price movement. This reinforces the sentiment of caution among traders, indicating a potential continuation of the downtrend.

On the other hand, short liquidations remain relatively small, with only $9K and $11K in the 12-hour and 24-hour periods, respectively. This shows that shorts are not under significant pressure, suggesting a more cautious approach from bearish traders. Overall, the heavy liquidation of long positions points to a dominant bearish trend in the market.

thecryptobasic.com

thecryptobasic.com