Shiba Inu breached a key Bollinger Band support level but recently rebounced, showing potential for short-term recovery as burn activity surges.

As of the latest data, Shiba Inu is trading at $0.00000863, reflecting a 0.8% decline over the past day. The coin has also experienced a notable downturn in the past week, plummeting by over 11.5% during this timeframe. Despite this recent dip, $SHIB holds a market cap of approximately $5.08 billion, also down 0.9%.

Looking at the price chart, $SHIB’s value has fluctuated within a 24-hour range of $0.00000824 to $0.00000872, proving volatility is still present in the market. While the broader market is expecting a recovery in the upcoming sessions, will $SHIB continue falling or attempt a reversal?

Shiba Inu Price Analysis

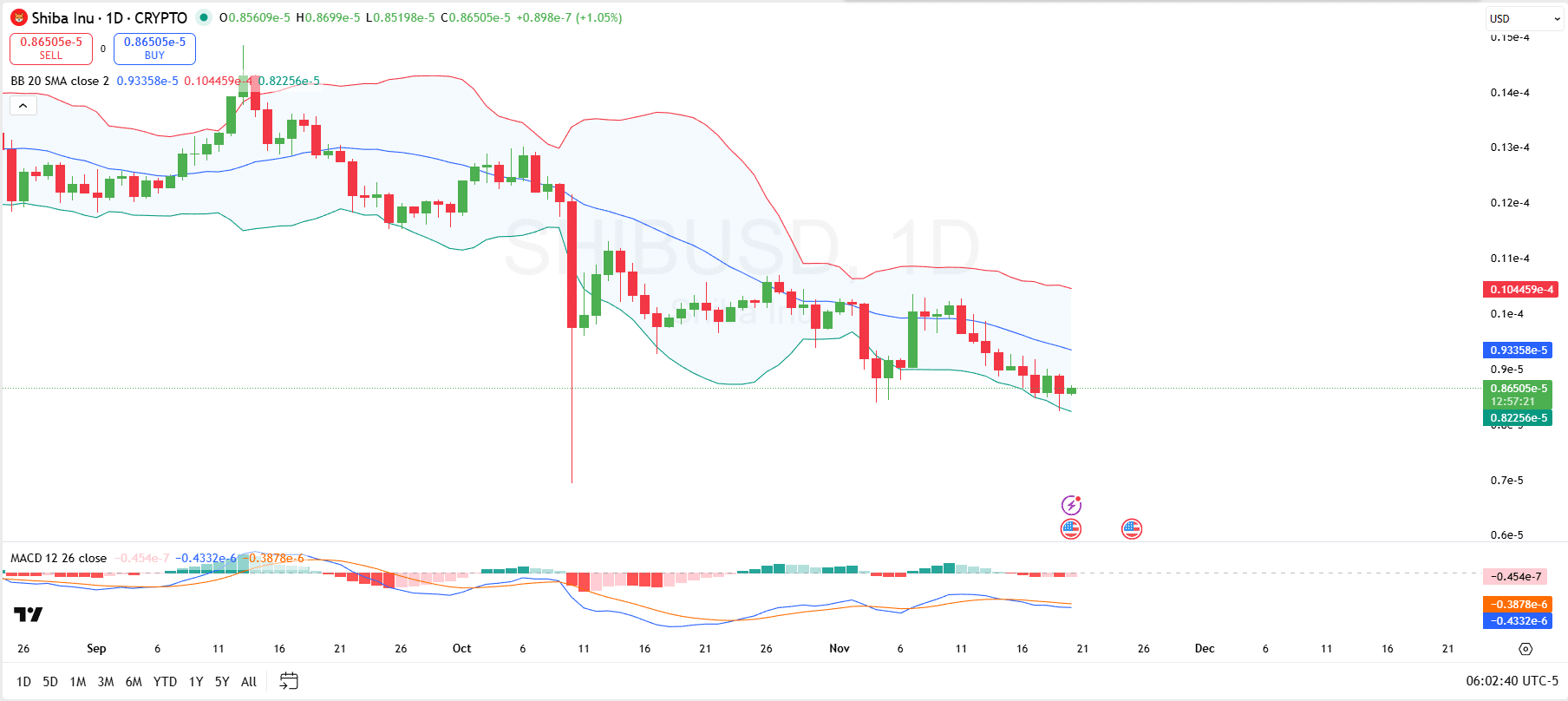

Looking at technical charts on TradingView, the Bollinger Bands indicator for the Shiba Inu on the daily chart show key levels of support and resistance. Currently, the price is above the lower Bollinger Band (0.00000823), which often signals an oversold condition or a period of low volatility.

Notably, $SHIB breached the lower band support yesterday but the bear pressure was not enough to sustain the move.

Historically, when the price touches or comes close to the lower band, it tends to revert toward the middle band (the 20-period simple moving average), suggesting a potential short-term upward move.

The middle band, sitting at 0.00000834, serves as a key level to watch, with price potentially moving toward this area before encountering further resistance at the upper Bollinger Band, currently at 0.000010. To invalidate this setup, the bears must pull $SHIB through the lower Bollinger Band with volume.

Meanwhile, the MACD indicator on the chart shows a relatively neutral stance, with the short-term moving average (blue line) still slightly below the long-term moving average (orange line), indicating minimal bearish momentum.

However, the MACD histogram is shrinking, suggesting that bearish momentum is weakening. As the price moves toward the middle Bollinger Band, the MACD could align with this shift, confirming a reversal or consolidation.

$SHIB Burn Activity Surges 23,864%

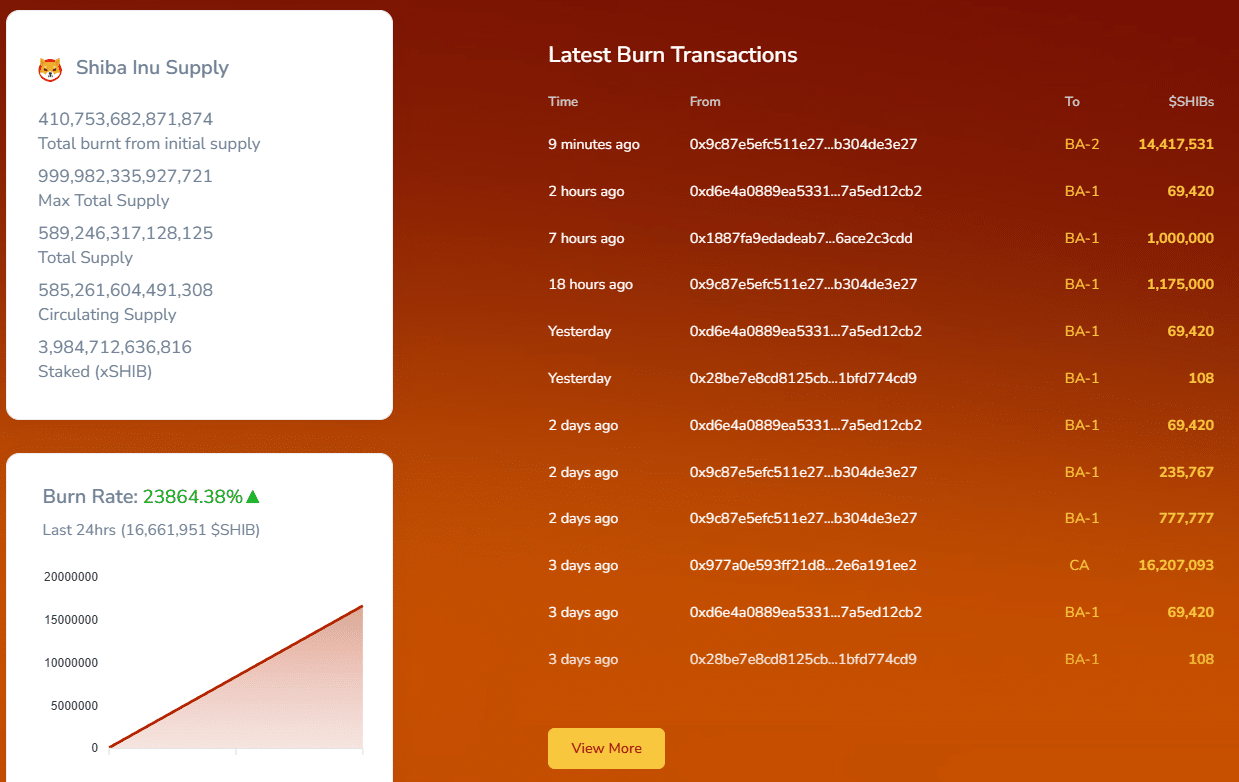

Elsewhere, burn data for $SHIB indicates a significant increase in burn activity, with a burn rate of 23,864.38%. Over the last 24 hours, a total of 16,661,951 $SHIB tokens have been burned.

This surge is likely a result of increased efforts by the Shiba Inu community and ecosystem to reduce the overall supply, potentially boosting scarcity and supporting price action in the long term.

Notably, a large portion of the recent burns comes from regular, smaller transactions, such as those transferring around 69,420 $SHIB, but there have also been larger burns like 14,417,531 $SHIB. The rate of burn activity can help manage inflation and may have a positive impact on $SHIB’s price over time by decreasing the circulating supply.

thecryptobasic.com

thecryptobasic.com