The cryptocurrency market has experienced significant volatility this week, driven by macroeconomic pressures and concerns about the bursting of the AI bubble. Despite this, the market intelligence platform Santiment argued that the onchain market value to realized value ratio indicates a prime buying opportunity.

Macro Headwinds Batter Altcoins

The volatility of the cryptocurrency market has been evident since the start of the week, with bitcoin ( BTC) and other high‑cap altcoins experiencing sharp price swings. BTC fell below $90,000 twice before quickly reversing losses. However, since early November, when it traded above $110,000, BTC has dropped 16%, with its market capitalization sliding from nearly $2.2 trillion to $1.84 trillion.

Analysts attribute bitcoin’s downturn to the collapse of macro factors that previously supported its rally, along with growing concerns that the artificial intelligence (AI) bubble may be nearing a burst. The same pressures have weighed heavily on the altcoin market, where some assets have posted even steeper declines.

Read more: The BTC Narrative Collapse: Why Bitcoin’s Price Drop Was ‘Inevitable’ Despite ETF Hype

Ethereum ( ETH), which traded above $3,800 on Nov. 1, slipped below $3,000 twice this week, hitting a low of $2,870 on Nov. 19 — its weakest level since July 11. Although ETH recovered to just above $3,000, it remains nearly 40% below its all‑time high of $4,946 and far from Bitmine Immersion Technologies Chairman Tom Lee’s year‑end target of $12,000.

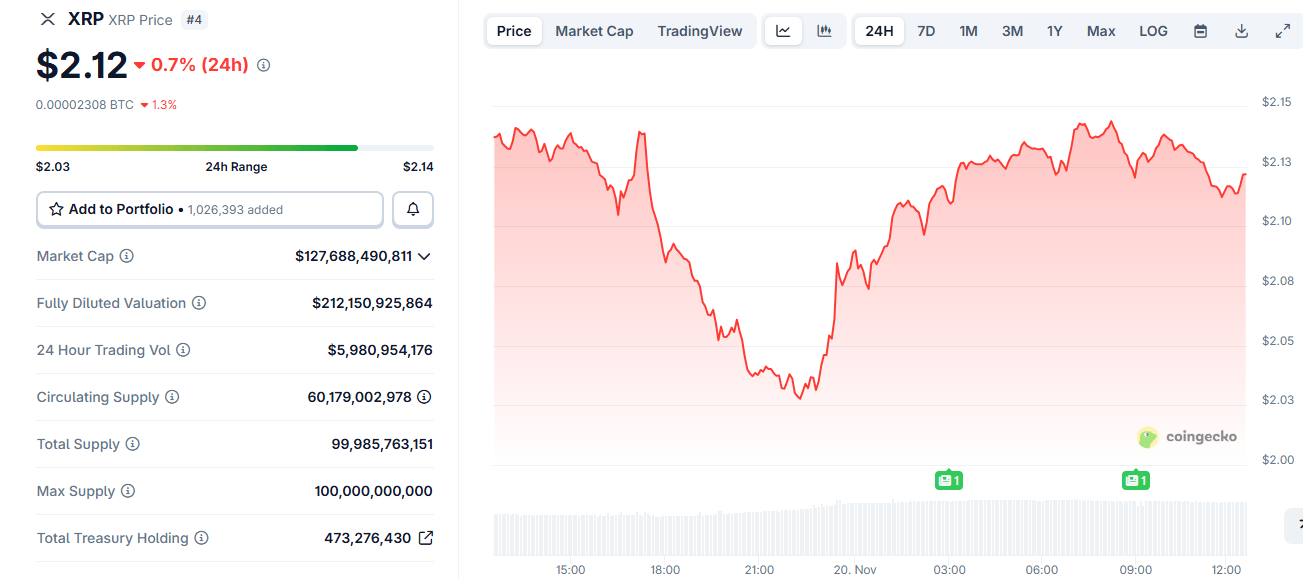

XRP mirrored the trend, dropping from just under $2.30 to $2.08 late on Nov. 17. It rebounded to $2.24 within 24 hours before another sell‑off pushed it down to $2.02, its lowest since June 23. On Nov. 20 at 4:30 a.m. EST, XRP had climbed back above $2.10. Meanwhile, similar declines were seen across most high‑cap altcoins, many of which posted double‑digit losses over a seven-day period.

Despite the bearish sentiment, market intelligence platform Santiment said the market value to realized value (MVRV) ratio indicates buying opportunities. In a Nov. 17 post on X, Santiment noted that most cryptocurrencies “are now flashing extreme pain for average trading returns.”

BTC and XRP, down 11.5% and 10.2% respectively over 30 days, were described as being in a “good buy zone.” Cardano ( ADA), down nearly 20%, was in the “extreme buy zone,” along with Chainlink (LINK) and ETH.

The market intelligence platform, meanwhile, argues that MVRV is a stronger metric for predicting recovery after sharp declines:

“Use MVRV to find out what a ‘buy low’ zone actually is, as opposed to simply looking at trendlines and support. In a zero‑sum game, buy assets when average trade returns of your peers are in extreme negatives. The lower MVRV goes, the higher the probability of a rapid recovery,” Santiment explained in the post.

FAQ 💡

- How has bitcoin performed globally? BTC fell below $90K twice this week and is down 16% since early November.

- What’s driving the downturn? Analysts cite collapsing macro factors and fears of an AI bubble bursting.

- How are altcoins reacting worldwide? ETH slipped under $3K, XRP hit $2.02, and many high‑caps saw double‑digit losses.

- Are there buying opportunities now? Santiment says BTC, XRP, ADA, LINK, and ETH are in strong “buy zones” based on MVRV data.

news.bitcoin.com

news.bitcoin.com