Avalanche could test and bounce from key support as technical indicators show oversold conditions, and a potential for volatility breakout.

The Avalanche ($AVAX) price has seen a 6.6% drop over the past 24 hours, currently changing hands at the $14.57 level. Over the past 7 days, $AVAX has seen a 16.9% drop, and in the 14-day period, it is down 10.6%, indicating a sustained period of bearish price action.

Looking at the 24-hour chart, it shows a downward move in $AVAX’s price, with a notable dip around the $15.70 range and recovery attempts that have brought the price back towards the $14.50-$14.60 region. Despite the slight recovery towards the end of the day, the overall trend remains bearish.

Avalanche Price Analysis

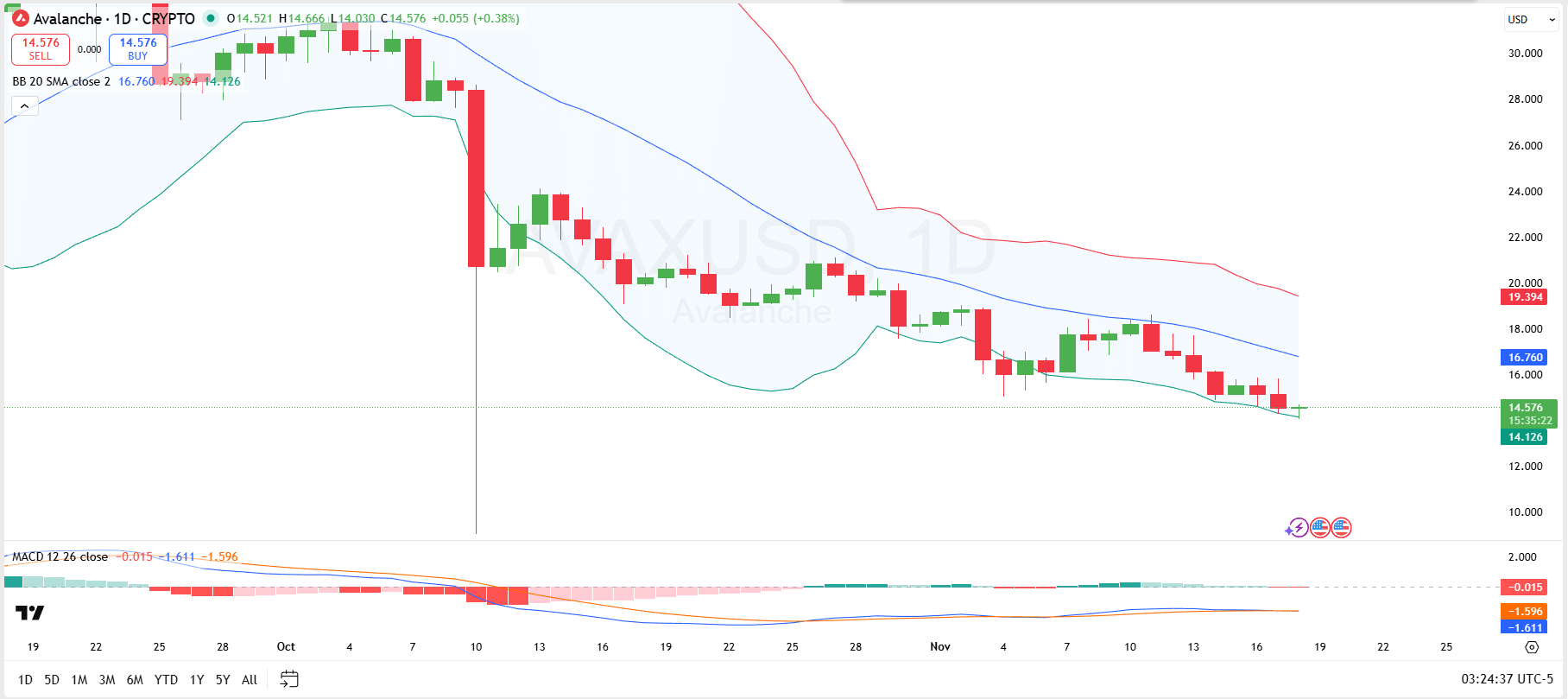

On the daily $AVAX chart, the technical indicators suggest a continuation of the bearish trend with some signs of potential short-term consolidation. The price is currently trading just above the lower Bollinger Band, indicating that Avalanche is in an oversold condition. This is a positive sign in the long term.

Notably, the contraction of the bands suggests that the market is in a period of consolidation with lower volatility. Typically, after this kind of narrowing, we can expect a volatility breakout, where the price makes a sharp move in one direction.

Further, the MACD is showing a bearish crossover, with the MACD line below the signal line. This suggests that momentum is still to the downside, and there is no immediate sign of reversal. The histogram is negative and shrinking, indicating that the selling pressure is easing, but it’s not yet turning bullish.

If the price breaks upward above the $16.76, representing the middle band resistance, it may indicate a reversal or recovery. Conversely, if the price breaks downward below the $14.18 support, placed at the lower band, this could signify a continuation of the bearish trend.

$AVAX Liquidation Data

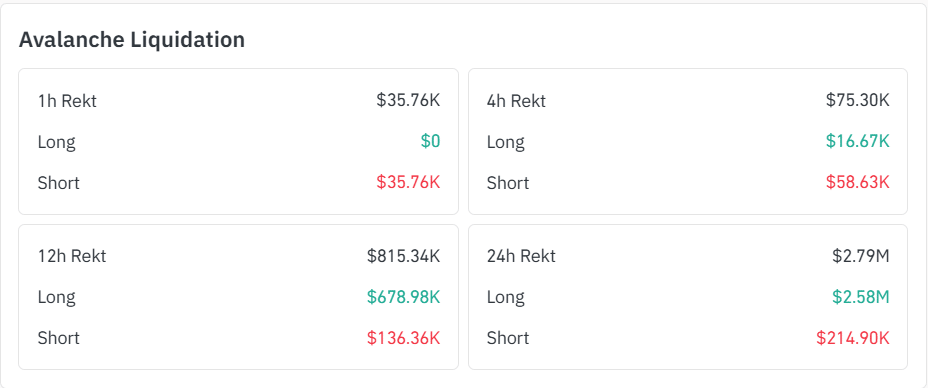

Meanwhile, the recent Avalanche liquidation data indicates significant selling pressure in the market, particularly affecting long positions. Over the 12-hour and 24-hour timeframes, the majority of liquidations were from long positions, with $678.98K and $2.58M being liquidated, respectively.

This suggests that $AVAX has been in a strong downtrend, forcing many traders who were holding long positions to close their trades at a loss. In contrast, short liquidations during these periods were relatively smaller, indicating that bearish sentiment has prevailed, but not to the same extent as the pressure on longs.

Interestingly, in the 1-hour and 4-hour timeframes, the data shows more short liquidations, with $35.76K and $58.63K liquidated, respectively. This could indicate brief price rallies or squeezes, causing more short sellers to be caught off guard.

Ultimately, if the price falls below the support and the liquidation trend continues, further downside movement could ensue. However, if there is a significant shift in market sentiment or a potential short squeeze, there may be a chance for a rebound.

thecryptobasic.com

thecryptobasic.com