The market has moved past the halfway point of November, and the total altcoin market cap has fallen below $1 trillion. The ability of altcoins to rebound while sentiment hits rock bottom may trigger volatility and large-scale liquidations in several assets.

Which altcoins face this risk, and what special factors deserve close attention? Details follow below.

1. Ethereum ($ETH)

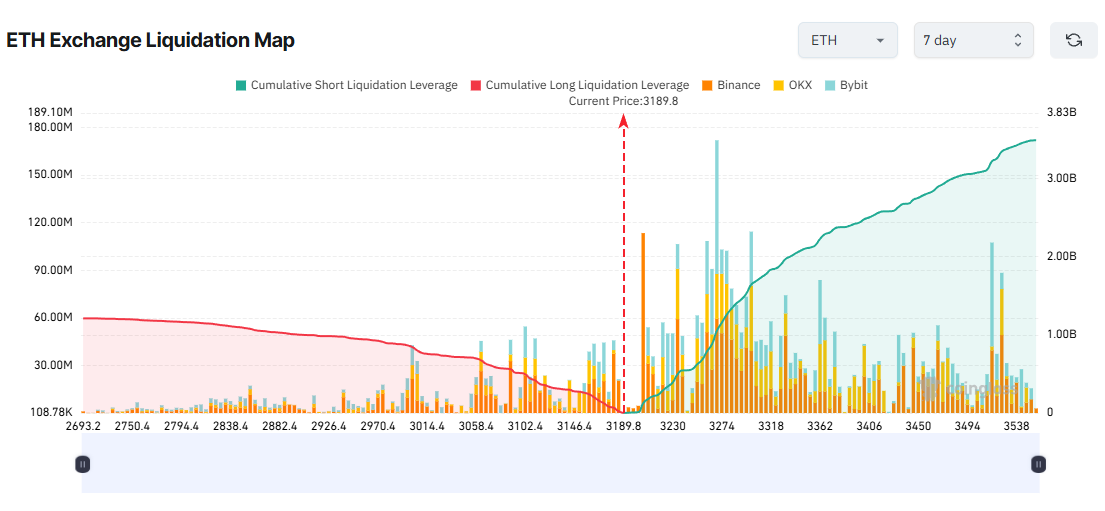

Ethereum’s liquidation map shows a clear imbalance between potential liquidation volumes on the Long and Short sides.

Traders are allocating more capital and leverage to Short positions. As a result, they would suffer heavier losses if $ETH rebounds this week.

$ETH Exchange Liquidation Map. Source: Coinglass">

$ETH Exchange Liquidation Map. Source: Coinglass">

If $ETH rises above $3,500, more than $3 billion worth of Short positions could be liquidated. In contrast, if $ETH drops below $2,700, Long liquidations would total only about $1.2 billion.

Short sellers have reasons to maintain their positions. $ETH ETFs recorded $728.3 million in outflows last week. Additionally, crypto billionaire Arthur Hayes has recently sold $ETH.

However, on the technical side, $ETH remains at a major support zone around $3,100. This level has the potential to trigger a strong recovery.

$ETH: BUY signal just flashed

— Wimar.X (@DefiWimar) November 16, 2025

Ethereum just hit max fear levels.

Historically, we bounced EVERY SINGLE TIME from here.

I buy fear now – I sell greed in early 2026. pic.twitter.com/ewXc3GEXaD

The sentiment indicator for $ETH has also fallen into extreme fear. Historically, $ETH has often rebounded sharply from similar conditions.

Because of this, an $ETH recovery has a solid basis and could trigger significant losses for Short traders.

2. Solana ($SOL)

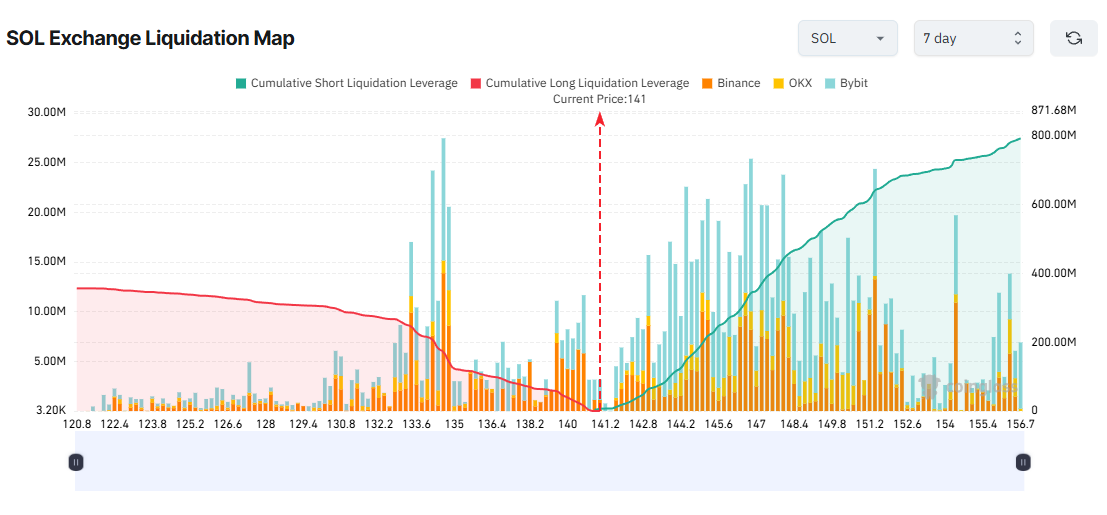

Similar to $ETH, Solana’s liquidation map also shows a strong imbalance, with Short liquidation volume dominating.

$SOL’s drop below $150 in November has led many short-term traders to expect a further decline toward $100. Not only retail traders, but whales have also shown short-selling behavior this month.

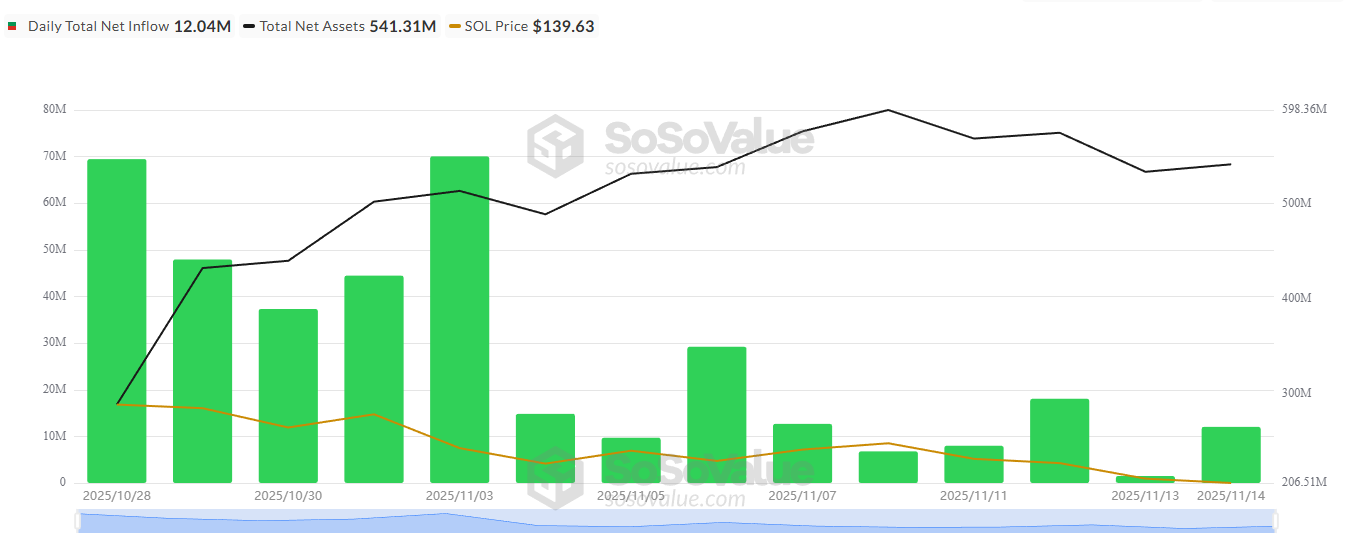

However, $SOL ETF data paints a more positive picture. According to SoSoValue, U.S. $SOL ETFs recorded a net inflow of more than $12 million on November 14 and over $46 million for the past week. Meanwhile, both BTC ETFs and $ETH ETFs saw negative net flows.

$SOL ETF Daily Total Net Inflow. Source: SoSoValue">

$SOL ETF Daily Total Net Inflow. Source: SoSoValue">

This gives $SOL a reason to rebound, as investors still see strong ETF demand. The liquidation map shows that if $SOL climbs to $156, Short liquidations may reach nearly $800 million.

$SOL Exchange Liquidation Map. Source: Coinglass">

$SOL Exchange Liquidation Map. Source: Coinglass">

Conversely, if $SOL falls to $120 this week, Long liquidations could reach around $350 million.

3. Zcash ($ZEC)

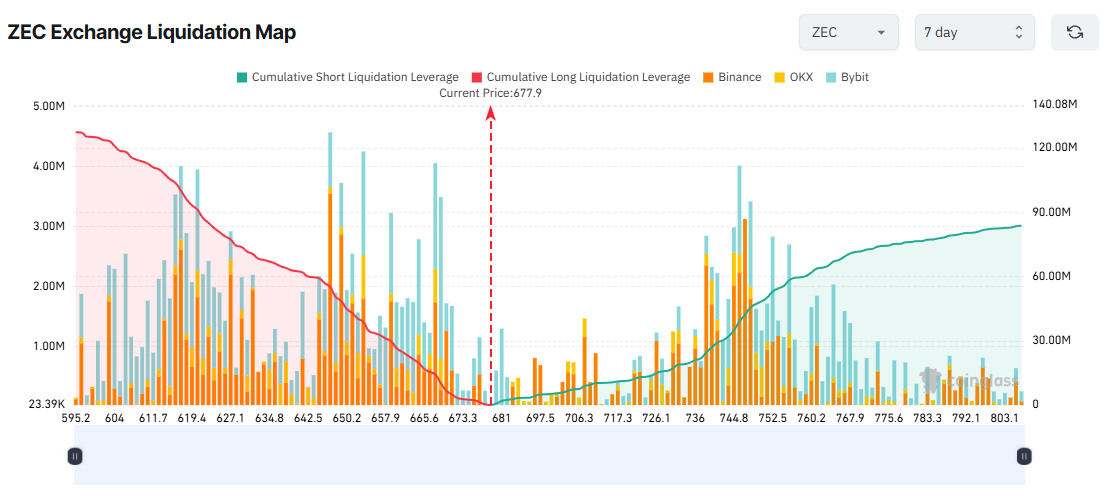

In contrast to $ETH and $SOL, $ZEC’s liquidation map shows that Long traders face the bulk of potential liquidation risk.

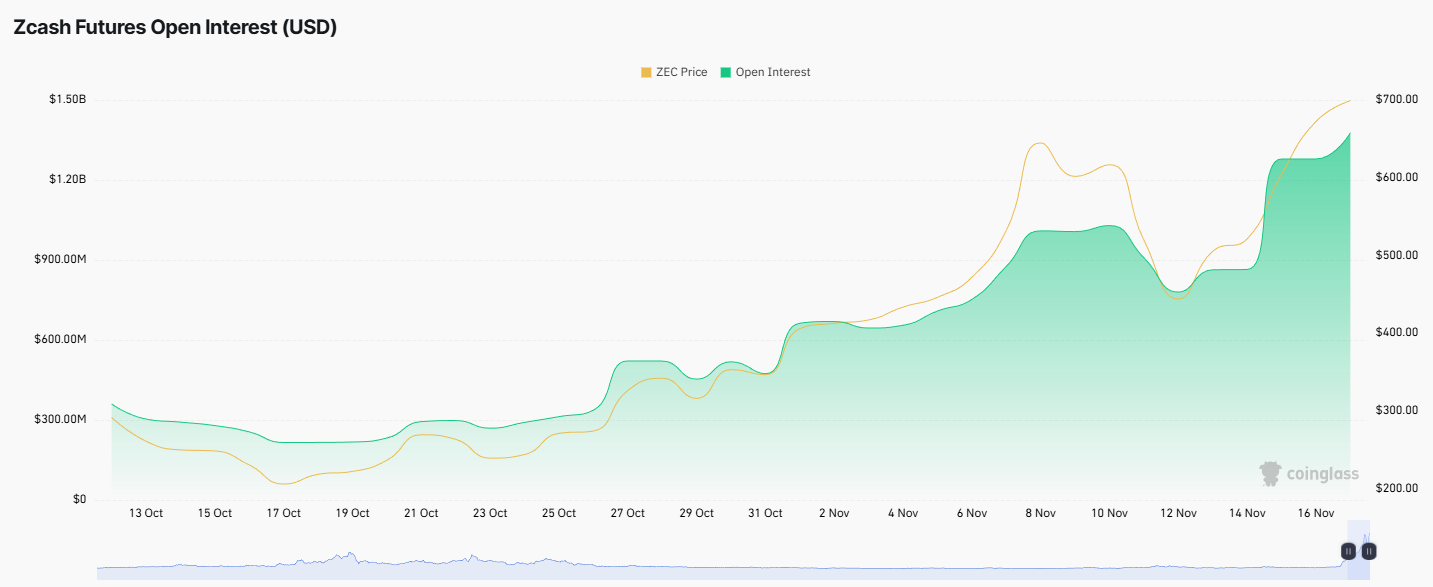

Short-term traders appear confident that $ZEC will continue forming higher highs in November. They have reasons for this outlook. $ZEC locked in the Zcash Shielded Pool has increased sharply this month, and several experts still expect $ZEC to reach as high as $10,000 potentially.

$ZEC Exchange Liquidation Map. Source: Coinglass">

$ZEC Exchange Liquidation Map. Source: Coinglass">

However, $ZEC has faced repeated rejections near the $700 level. Many analysts, therefore, worry about a correction this week.

If a correction occurs and $ZEC drops below $600, Long liquidations could exceed $123 million.

Moreover, Coinglass data shows that $ZEC’s total open interest reached an all-time high of $1.38 billion in November. This reflects a high level of leveraged exposure, which increases the risk of volatile moves and large-scale liquidations.

Because of this, holding Long positions in $ZEC could offer short-term gains. But without clear take-profit or stop-loss plans, these positions could quickly face liquidation pressure.

The post 3 Altcoins Facing Major Liquidation Risk in the Third Week of November appeared first on BeInCrypto.

beincrypto.com

beincrypto.com