-

Cathie Wood suggests stablecoins are gradually replacing Bitcoin in emerging markets due to their stability, while Bitcoin's role as a store of value remains strong.

-

Cameron Winklevoss slams legacy media for dismissing Bitcoin's potential, citing its rise from $138 in 2013 to above $100,000.

-

Despite being a Bitcoin critic, Peter Schiff indirectly acknowledges Bitcoin’s importance as a hedge against inflation amid economic uncertainty.

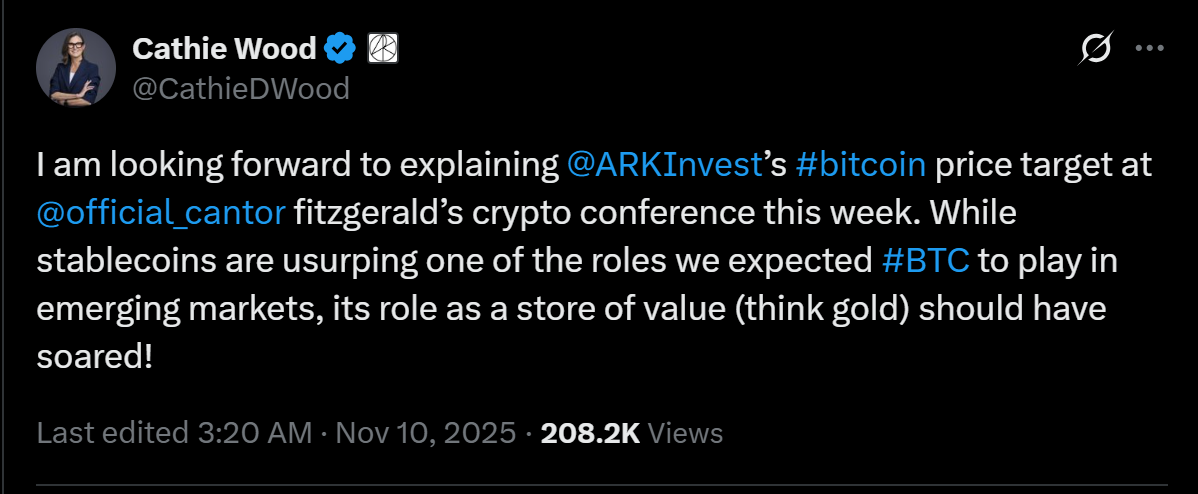

Cathie Wood, founder and chief executive officer of ARK Invest, has cast some doubts on the changing role of Bitcoin in new markets. Wood also pointed to the increasing role of stablecoins, which she says are gradually supplanting one of the key roles that Bitcoin was supposed to accomplish.

Her remarks, expressed in a conversation at the Crypto Conference held by Cantor Fitzgerald, emphasize how she continues to defend the future of Bitcoin and its purpose as a store of value in particular.

Source: X

The remarks made by Wood help in eliminating the gradual transformation of Bitcoin in the financial ecosystem. She acknowledged that while stablecoins have taken on some of Bitcoin’s roles, Bitcoin remains a key store of value similar to gold.

This is an especially interesting statement when weighed against the macroeconomic landscape in general, where investors are increasingly being drawn towards hard assets due to inflationary concerns.

The store of value feature of Bitcoin, which is likened to gold, has been at the core of optimistic Bitcoin speculations by Wood regarding the future value of Bitcoin. She once again reiterated the fact that although Bitcoin adoption keeps on increasing, stablecoins are gradually being regarded as a more dependable medium of day-to-day transactions, particularly in markets where the local currency is volatile.

Cameron Winklevoss Slams Legacy Media Over Bitcoin’s Journey

Gemini co-founder Cameron Winklevoss added to the Bitcoin discussion by criticizing legacy media for downplaying the cryptocurrency. Winklevoss cited a story in the Financial Times (FT) published on April 3, 2013, which stated that Bitcoin was a speculative asset in the process of going bust and suggested that it would be compared with historic financial bubbles such as the tulip mania, the South Sea Company, and the dotcom bubble.

During the publication date of the FT article, Bitcoin was worth somewhere around $138.60 per coin, and the media was extremely doubtful about its future. In the present day, Bitcoin is currently traded at approximately $102,000 as of press time, which is a remarkable growth in the last 12 years. Winklevoss employed this historical view in attacking the traditional media, such as the FT, which he alleges has not acknowledged the historical success of Bitcoin.

Winklevoss was angry about the constant negativity of the media towards Bitcoin, saying that they had failed to notice one of the best investments of the decade. His request to the FT to publish a retraction underlines that the gap between old financial institutions and the new crypto industry is expanding. The unwillingness of the media to recognize the success of Bitcoin, as claimed by Winklevoss, is a sign of an even bigger issue of the mainstream press failing to understand the opportunities that are being realized in the digital asset sector.

Peter Schiff’s Acknowledgment of Bitcoin’s Resilience

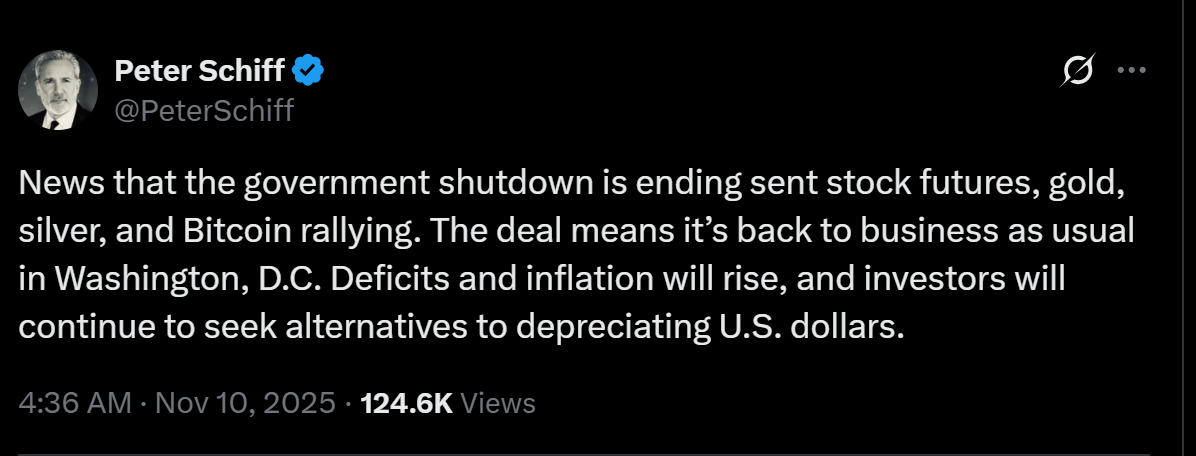

Even the most vocal and well-known economist and Bitcoin critic, Peter Schiff, has been responding to the recent market trends with a change of narrative, though indirectly. Schiff, who holds a very firm position against cryptocurrencies, especially Bitcoin, recently tweeted that he recognized the recoverability of Bitcoin. Regarding the government shutdown ending in a tweet on April 3, 2023, he said that a rebound in stock futures, gold, silver, and Bitcoin indicated that it was time to get back to business in Washington, D.C.

The tweet by Schiff points to the fact that he acknowledges the importance of Bitcoin as part of the financial ecosystem. Though he still dismisses it as a stable store of value. Schiff referred to the increasing deficits and inflation after the agreement to stop the government shutdown. This indicates that these macroeconomic indicators would prompt investors to consider other assets such as Bitcoin, to ensure themselves against having their fiat currencies devalued.

This is a sign that Bitcoin is gaining acceptance in the economic uncertainty, even though he is still indirectly admitting it, since Schiff now starts to acknowledge the growing acceptance of Bitcoin as an alternative asset in the face of increasing inflation.

Analyzing Bitcoin’s Recent Price Action

The Bitcoin price movement has been significantly connected to the economic factors of the world, especially the inflationary fears, governmental policies, and institutionalization. Bitcoin price has tended to shoot up when there is economic uncertainty, with investors rushing to the cryptocurrency as their hedge against inflation and devaluation of the fiat currency.

This impressive upsurge has attracted the interest of both institutional investors and retail traders, which again justifies its worth as a store of value in the contemporary financial establishment. Nevertheless, the volatility of Bitcoin still remains an issue, and numerous researchers warn that the cryptocurrency market is speculative.

The constant rhetoric by personalities such as Cathie Wood, Cameron Winklevoss, and Peter Schiff of the divisive nature of Bitcoin is indicative of its changing and transformative nature to the current financial structure. Bitcoin is still in its ascending phase as a store of value, and still, its role in the international markets is yet to be developed to its full extent.

cryptonews.net

cryptonews.net