Cardano whales and sharks have continued to increase their ADA holdings, taking advantage of the altcoin’s prolonged price dip.

Amid a largely cautious market, ADA has seen its price on a significant downtrend, mirroring moves in other major cryptocurrencies like Bitcoin (BTC). Currently trading below $0.6 at press time, ADA has dropped over 35% in the past 60 days and 7.8% in the past month.

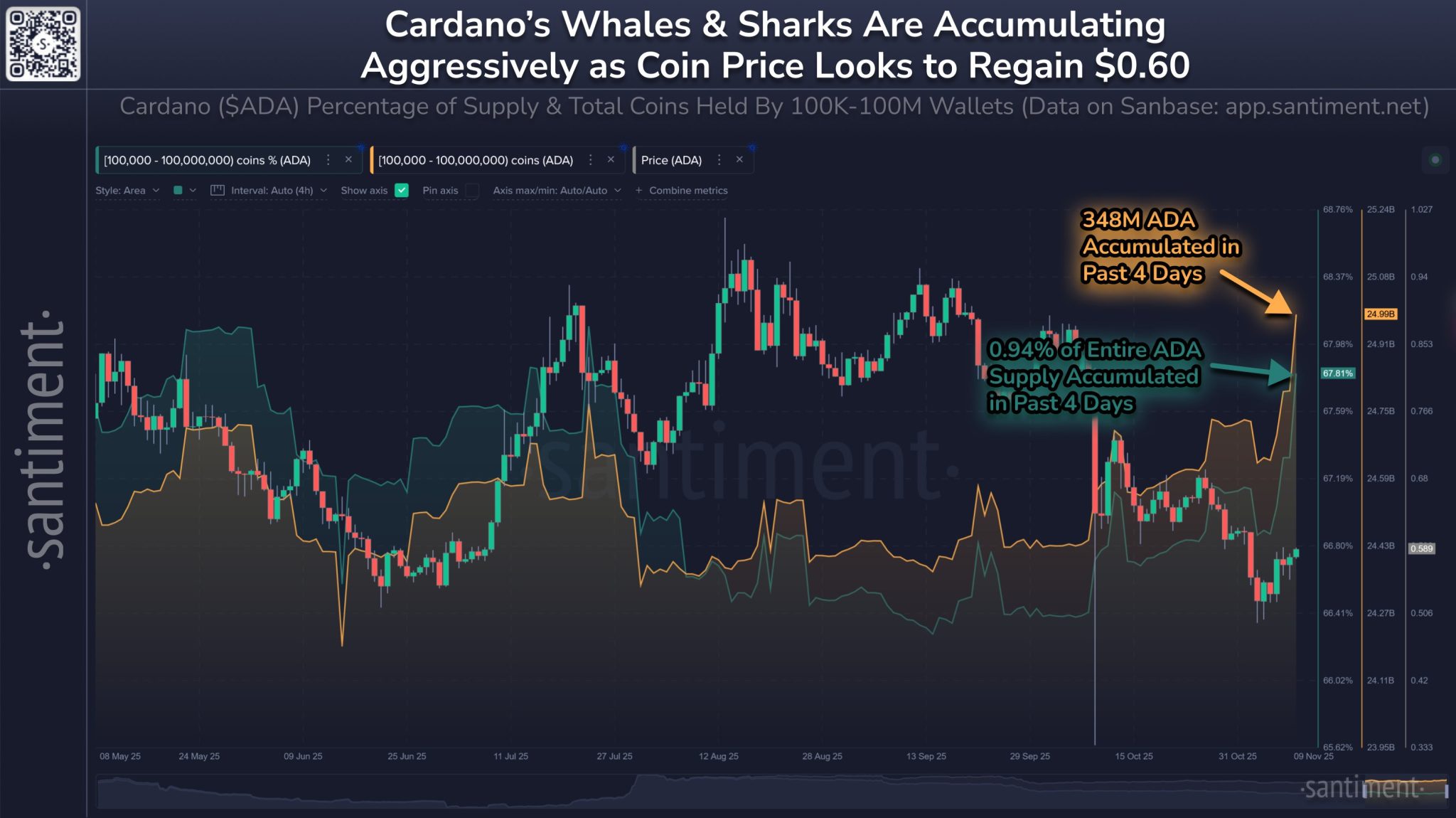

However, on-chain data shows that deep-pocketed Cardano investors are taking advantage of the token’s dip.

Between November 7-10, Santiment data shows that these key Cardano stakeholders bagged a whopping 348 million ADA tokens. Worth over $204 million at the time, this number of tokens amounts to 0.94% of the total supply of ADA.

Interestingly, this heavy accumulation coincides with the Cardano Foundation’s reported steady progress on the roadmap to global Cardano adoption.

ADA has a total supply of 45 billion tokens. According to data on CoinGecko, the Cardano native currency has a circulating supply of 36.6 billion tokens as of November 2025.

ADA Looks to Regain $0.6

Since touching $0.853 in late September, ADA has been on a steady decline to date, fueled by the market-wide correction that took BTC to four-month lows below $100,000.

ADA rebounded in early November after hitting a long-standing support level of around $0.5, where buyers had repeatedly shown strength. At the time of writing, ADA is trading at $0.582 and is down 1.1% in the past 24 hours.

With whales and sharks accumulating aggressively, ADA looks poised to break the $0.6 price level.

A recent TradingView analysis predicts an even higher rally for ADA to $3, citing a Power of Three (PO3) price pattern.

thecryptobasic.com

thecryptobasic.com