Chainlink price movements have been shaped by both macro-level market trends and strategic partnerships, signalling that the next phase of the altcoin’s trajectory may be crucial for medium and long-term holders.

With the recent uptick, analysts are closely monitoring whether Chainlink can leverage its institutional collaborations and technical support to sustain momentum or if the recent rally is merely a temporary reprieve.

Technical rebound faces resistance

Copy link to section

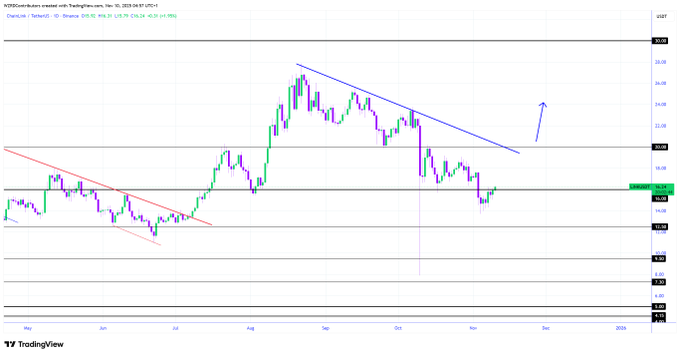

Chainlink price recently bounced off key support levels around $15.50, reflecting short-term technical recovery after several weeks of decline.

This rebound aligns with a recovery from oversold conditions, as the RSI and MACD indicators are slowly recovering from historically weak points.

However, while daily price action shows indecision and moderate volume, the 30-day simple moving average around $17.22 poses a clear obstacle for further upward momentum.

Crypto Analyst CryptoWZRD highlights that a breakout above $16.9 could act as a trigger for a move toward $20, whereas failure to hold support levels between $14.5 and $15.0 may delay the next meaningful impulse.

Despite this uncertainty, the bounce from the Fibonacci retracement zone suggests that buyers are re-entering the market in preparation for a potential recovery.

However, the formation of a weekly head and shoulders pattern adds a layer of caution for traders.

The neckline support around $10 represents a critical threshold, and breaking this level would confirm the bearish structure.

Chainlink price chart | Source: CoinMarketCap

Unless Chainlink price can decisively breach resistance between $17.50 and $18.00, the current upswing appears more like a relief rally rather than a genuine trend reversal.

But while some analysts are bearish on Chainlink, others like Ali Martinez and James Easton see the possibility of the cryptocurrency soaring.

Ali identifies the $14 launchpad support zone as a critical retracement level capable of spurring medium-term rallies toward $50 if buying pressure increases.

Easton, on November 9, highlighted a symmetrical triangle forming over the past two years, highlighting the compression between rising support and falling resistance, which often precedes explosive upward moves.

Institutional adoption drives interest

Copy link to section

Beyond technicals, $LINK price has benefited from significant institutional engagement, which strengthens its medium- to long-term outlook.

The recent partnership with Japan’s SBI Digital Markets marks a pivotal step in the adoption of Chainlink’s CCIP as exclusive cross-chain infrastructure for tokenised finance solutions in Asia.

Similarly, UBS conducted a successful pilot using Chainlink’s oracle infrastructure to enable on-chain subscription and redemption of a tokenised money market fund, demonstrating the practical integration of $LINK into established financial systems.

Dinari has also joined forces with Chainlink and S&P Dow Jones Indices to bring the S&P Digital Markets 50 Index on-chain later this year, further reinforcing Chainlink’s presence in high-profile institutional projects.

Short-term Chainlink price outlook and possible targets

Copy link to section

On the daily charts, $LINK price continues to show sideways consolidation under a descending trendline.

Moderate volume, coupled with early upticks during rebounds, indicates gradual accumulation, as noted by CryptoWZRD.

Elliott Wave analysis, highlighted by Man of Bitcoin, shows a completed corrective phase with three advancing waves now forming from recent lows.

A break above $17.65 would validate the start of a new impulsive cycle, while higher lows above the 0.786 Fibonacci retracement near $13.3 keep upside prospects intact.

Support and resistance levels provide additional context for traders, with some analysts suggesting that maintaining above $15.75 could push $LINK toward $17.25, with further resistance at $18.29 and $19.69.

Conversely, breaking below $15.75 may lead to a retest of $14.46, which could challenge the short-term bullish narrative.

Combining this technical outlook with ongoing institutional developments and historical accumulation patterns, it is evident that the market is at a potential inflection point that could define Chainlink’s price direction for the coming months.

invezz.com

invezz.com