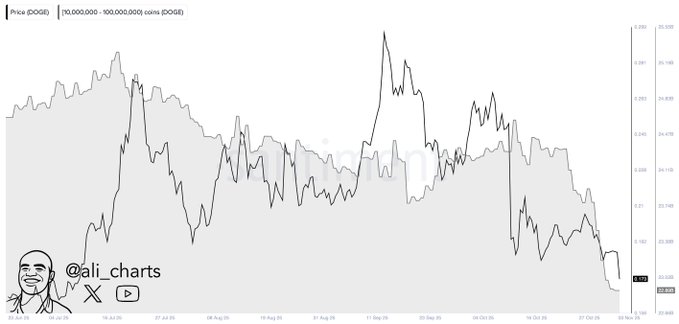

It finally happened: the biggest Dogecoin holders just dumped over one billion $DOGE coins in a single week, and the chart doesn't not need much explanation. Between late October and early November, wallets holding between 10 million and 100 million $DOGE hit the market with some serious sell pressure.

The supply they control has dropped to about 22.9 billion $DOGE, the lowest it has been since the middle of summer.

$DOGE/USDT hit a roadblock at the $0.17 price point, dropping to $0.162 by Nov. 4. It is similar to what happened in March, with lots of bounces, failed attempts to retake $0.20 and then a decisive flush.

There is no outside trigger here — no Elon Musk tweet, no new exchange listing, no catalyst for memes. It is just a bunch of whales leaving the field while retail buyers keep trying to figure out where the bottom is.

Risks for Dogecoin ($DOGE)

You can see this sell-off in every data layer. Santiment shows a drop in whale wallets, Binance order books show imbalances and volume spikes show these were not minor portfolio adjustments. It is full-scale off-loading. The last time we saw this kind of behavior was before $DOGE went from $0.26 to $0.12.

Traders who have ve been keeping an eye on this range know what it means: once these wallets start to clear out, the market usually takes a break for a few weeks before bouncing back. For now, $DOGE is at risk, with support around $0.15 the last recognizable structure before the psychological $0.10 zone.

u.today

u.today