ZCash ($ZEC) looks like the sole survivor of the crypto market. The coin expanded close to $480, as its climb is not affected by the overall market fear.

ZCash ($ZEC) once again moves against all market logic, returning to the $480 range. The coin rallied despite the dip of BTC to $105,000, moving on its own market logic.

$ZEC relies on active derivative trading, with open interest rising to over $582M. However, spot buying and accumulation is also happening, with a few hundred coins each day added to shielded pools. ZCash mining is also at an all-time high, with the hashrate reaching a record.

At the current stage, the ZCash community is showing true belief, but there are still skeptics who see the $ZEC rally as an attempt at finding exit liquidity.

$ZEC rises on Solana-based activity

The two main sources of $ZEC activity are derivative trades, and DEX trading on Solana. $ZEC has become a DeFi token, though at much smaller volumes. However, this is also one of the main sources for making whale-sized orders and swaying the price.

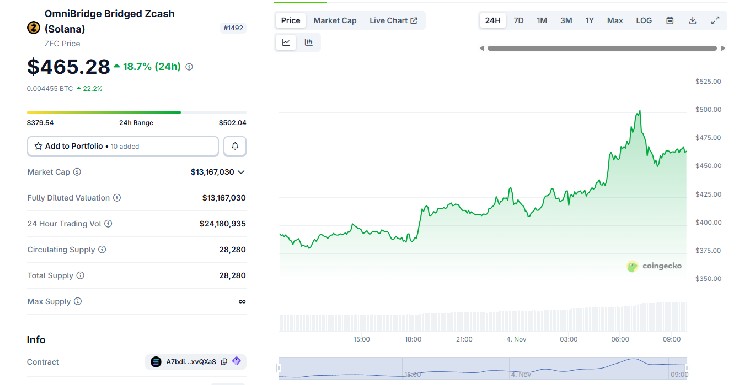

$ZEC on Omni Bridge has a supply of 28,280 coins, with a total valuation above $13M.

Recently, a whale made a $300K order, buying $ZEC at $600, breaking above all other platforms. Previously, whale buyers have also boosted $ZEC.

Solana has now become the main decentralized venue for trading $ZEC, with volumes recently posting a record. However, the DEX market remains much smaller compared to other listings for $ZEC.

On Solana, the $ZEC narrative has replaced the meme token hype, after the trenches slowed down. Now, $ZEC is seen as a potential source of liquidity and interest in DEX trading. The coin has returned to levels not seen since 2017, but has also received additional attention after years of inactivity. $ZEC mindshare is up by another 574% since October 5, rising to 0.7%.

The coin sees a mix of retail hype and whale activity. Recently, a whale opened a 5X long position on Solana, after depositing $7.9M USDC.

$ZEC still gets aggressively shorted

The current rally comes with over 62% in short positions on most major exchanges. On Hyperliquid, more whales are going long, with just 43% in short positions, betting on continued $ZEC expansion.

Based on short liquidity positions, $ZEC may try to liquidate traders up to $495. However, there is liquidity on the downside, and $ZEC has also shown it can dip to a lower range.

$ZEC is now the top privacy coin by market capitalization, even after taking a step back to $462. The token flipped Litecoin (LTC), and moved faster compared to other legacy private coins.

Monero (XMR) remains active, though its expansion stalled at $344. Decred (DCR) and DASH also achieved near-vertical rallies, but are still incapable of catching up with $ZEC. The privacy narrative is also not the main driver of the $ZEC rally, which is getting a boost from influencers and whale traders.

cryptopolitan.com

cryptopolitan.com