After establishing itself as a leading name in the on-chain perpetual DEX space, Hyperliquid ($HYPE) is entering one of its biggest stress tests since launch.

This November, Hyperliquid will unlock a massive amount of $HYPE tokens, raising a critical question: Will the release fuel liquidity and adoption or trigger a sharp price correction?

Supply–Demand Pressure and Short-Term Price Scenarios

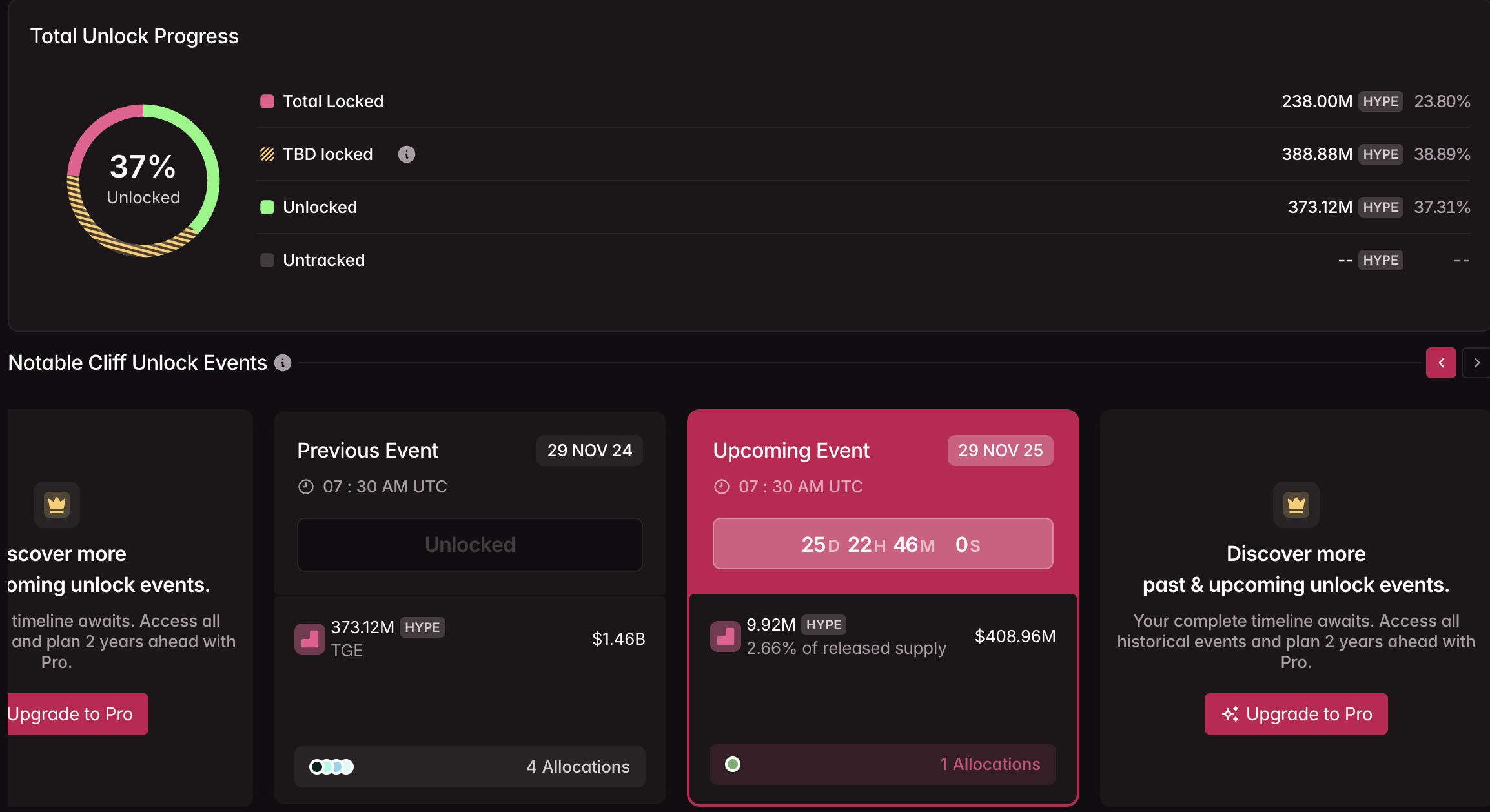

Tokenomist’s data shows that millions of Hyperliquid ($HYPE) tokens will be unlocked in November, representing approximately 2.66% of the circulating supply. When a project releases many tokens at once, it inevitably faces the risks of dilution and sell pressure.

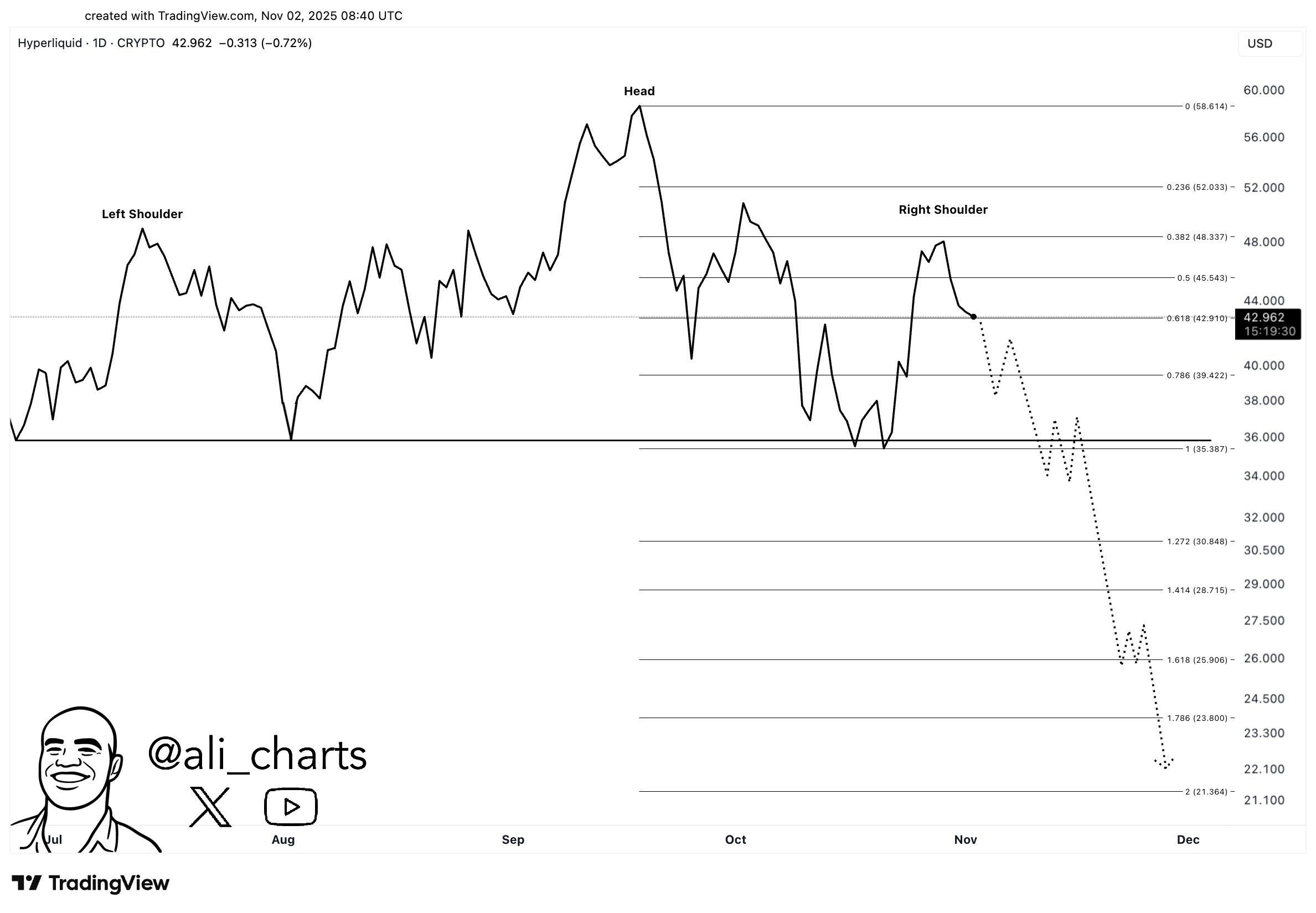

From a technical perspective, several analysts suggest that $HYPE may be forming a head-and-shoulders pattern on the daily chart. This setup could project a potential decline toward $20, signaling a short-term correction phase if confirmed.

$HYPE technical analysis. Source: Ali">

$HYPE technical analysis. Source: Ali">

Meanwhile, another trader noted that recent price action indicates “some TWAP out, slow efficient selling,” suggesting controlled offloading by large holders. The trader added:

“Not sure what’s going on but going to just wait for more clarity.” he said.

On the other hand, some traders see opportunity in the volatility. According to Route2FI, “$HYPE closing a 1-minute candle around $40 in November could turn into a temporary yield farm.”

The analyst referred to the potential opportunity to profit from short-term price fluctuations. However, this strategy is better suited for seasoned traders, as the $HYPE unlock period may bring intense volatility.

Strong On-chain Revenue and Long-term Balance Sheet Factors

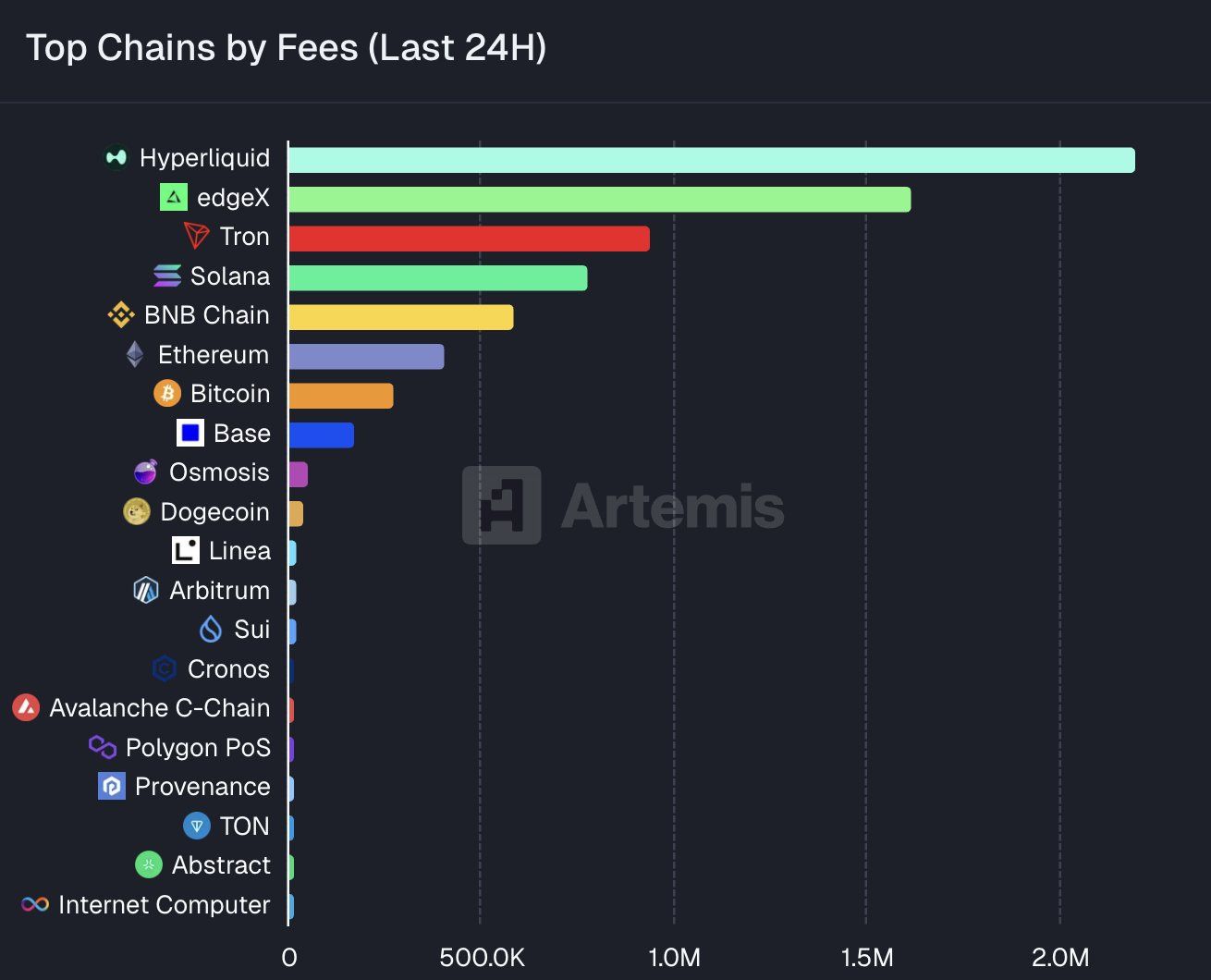

While short-term supply pressure seems unavoidable, Hyperliquid’s core strength lies in its on-chain revenue generation. Data from Artemis shared on X shows that in the past 24 hours, Hyperliquid has generated over $2.2 million in trading fees, surpassing all other blockchains.

Earlier this month, reports showed that Hyperliquid captured up to 33% of blockchain revenue. This made it the top fee earner in the crypto economy, effectively a “transaction fee goldmine” within DeFi. If the project uses some of these fees for token buybacks or burn mechanisms, it can partially absorb the selling pressure from the $HYPE unlock and help stabilize the market.

In summary, the upcoming $HYPE unlock this November will be a major test for the project and its investors. In the short term, dilution risks and market caution may weigh on price action. However, Hyperliquid’s substantial on-chain revenue could help offset the upcoming supply shock. This would depend on how effectively the revenue is used through buybacks, staking, or liquidity programs.

In the long run, $HYPE’s value will depend on how well the team converts real revenue into tangible returns for holders, rather than relying on short-term hype surrounding the unlock. The November unlock won’t signal the end if Hyperliquid proves its model is sustainably profitable on-chain perpetual DEX. Instead, it could become a revaluation milestone for one of DeFi 2025’s most promising projects.

beincrypto.com

beincrypto.com