The competition between Ethereum ($ETH) and $BNB Coin ($BNB) is intensifying as the latter shows remarkable resilience amid a cooling crypto market.

While $ETH continues to dominate, multiple signals have sparked the debate over whether $BNB could challenge the second-largest cryptocurrency’s position in the market.

$BNB vs. Ethereum: Could Network Growth and Market Strength Tip the Balance?

The crypto market has seen many ups and downs over the past years, with the recent crash pulling it below $4 trillion. Despite this volatility, Ethereum has maintained its position as the second-largest crypto asset after Bitcoin (BTC).

However, could this dominance be challenged? Three key signals represent early warnings of a potential shift.

From a technical perspective, the $BNB/$ETH chart shows a long-term bullish structure shaped by cycles of expansion and correction. While volatility remains, the broader picture still points to $BNB holding a structural advantage.

$BNB/$ETH Chart">

$BNB/$ETH Chart">

Altcoin Vector also noted in a post on X (formerly Twitter) that $BNB has outperformed $ETH so far this year.

“It’s not just price: $BNB maintained a consistent impulse phase, strong enough to forge its own $BNB Season. While $ETH’s impulse faded, $BNB’s stayed alive, sustaining structure even after the deleveraging event,” the post read.

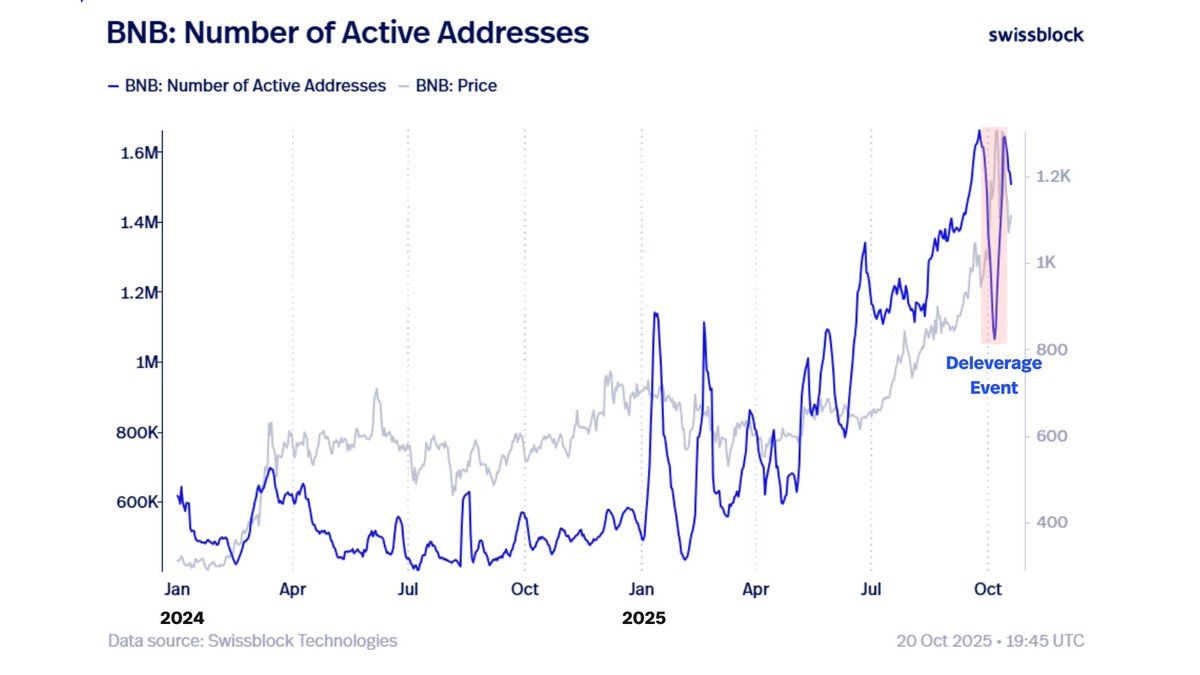

Another signal of $BNB’s momentum is the jump in daily active addresses. Altcoin Vector emphasized that $BNB’s value goes beyond short-term price moves — it’s backed by strong real-world usage.

The large number of active addresses means many users are transacting on the network, showing steady demand and adoption.

“$BNB’s active addresses show sustained user engagement, a sign of network health and adoption.Even after the shock, participation remains structurally strong,” Altcoin Vector wrote.

$BNB's Active Addresses">

$BNB's Active Addresses">

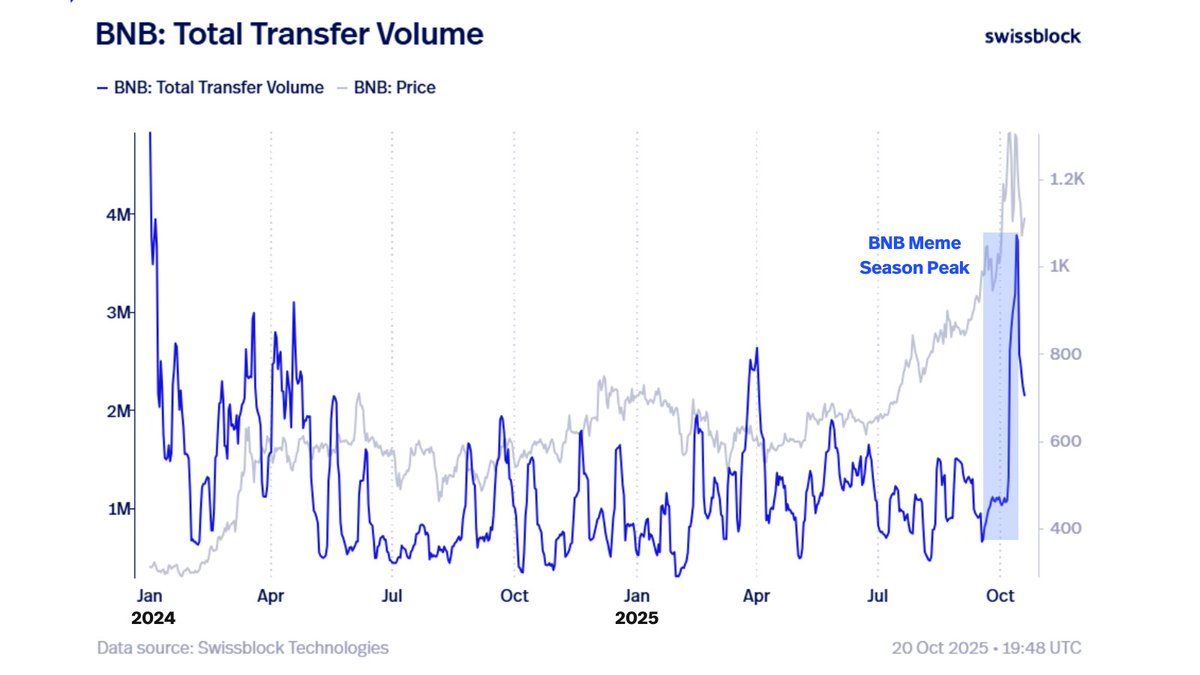

Lastly, $BNB has also seen a record surge in on-chain volume, reflecting heightened liquidity and significant ecosystem activity. Altcoin Vector pointed out that,

“$BNB’s on-chain volume spiked with daily peaks of coins transferred proving liquidity surges, large transactions, and ecosystem activity. $BNB Meme Season? Finished even before it get started. However, on-chain volume is still alive. It’s not only about price action, but fundamentals: liquidity and active participants.”

$BNB: Total Volume ">

$BNB: Total Volume ">

Still, despite $BNB’s strong signals, Ethereum’s established lead in smart contract infrastructure, DeFi, and market capitalization remains significant. According to BeInCrypto Markets data, $ETH controls a market share roughly three times greater than $BNB. Moreover, development and innovation on Ethereum persist.

Thus, challenging Ethereum’s dominance is no easy task. Its deep-rooted ecosystem, developer community, and network effects have kept it firmly in second place for years, making any potential shift a gradual and hard-fought process.

The next few years may further test both sides of this debate. Whether $BNB’s ongoing surge can lead to a shift in market capitalization or if Ethereum’s dominance will withstand this latest challenge remains to be seen as crypto markets evolve.

The post Can $BNB Overtake Ethereum? 3 Key Signals Fuel the Debate appeared first on BeInCrypto.

beincrypto.com

beincrypto.com