$BNB has remained one of the few major cryptocurrencies to form a new all-time high (ATH) even as the broader market struggled.

However, after a strong rally, the Binance ecosystem token may face turbulence. A growing number of short-term holders appear poised to take profits, signaling potential volatility ahead.

$BNB Holders Susceptible To Selling

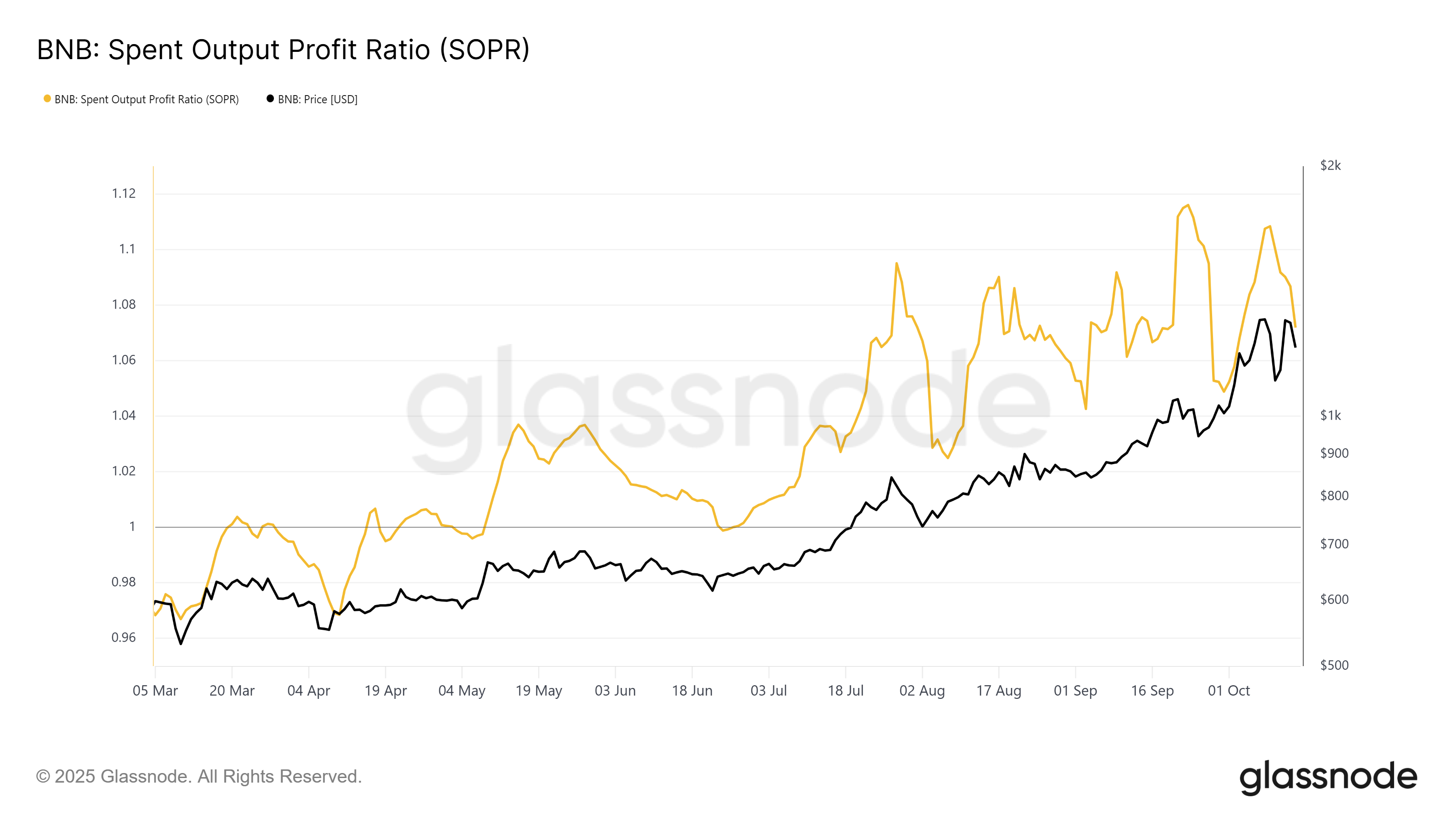

The Spent Output Profit Ratio (SOPR) is reflecting early signs of waning profitability among $BNB investors. The most recent readings are hovering near the neutral 1.0 level, indicating that holders are realizing minimal profits. While this does not yet imply losses, it highglights that $BNB’s profit margins are tightening.

If the SOPR dips below 1.0, it would signal that investors are selling at a loss. Historically, this tends to trigger selling fatigue, often allowing prices to stabilize and recover. However, $BNB’s current position above this mark suggests that profit-taking remains active, leaving the altcoin vulnerable to continued downward pressure.

$BNB SOPR">

$BNB SOPR">

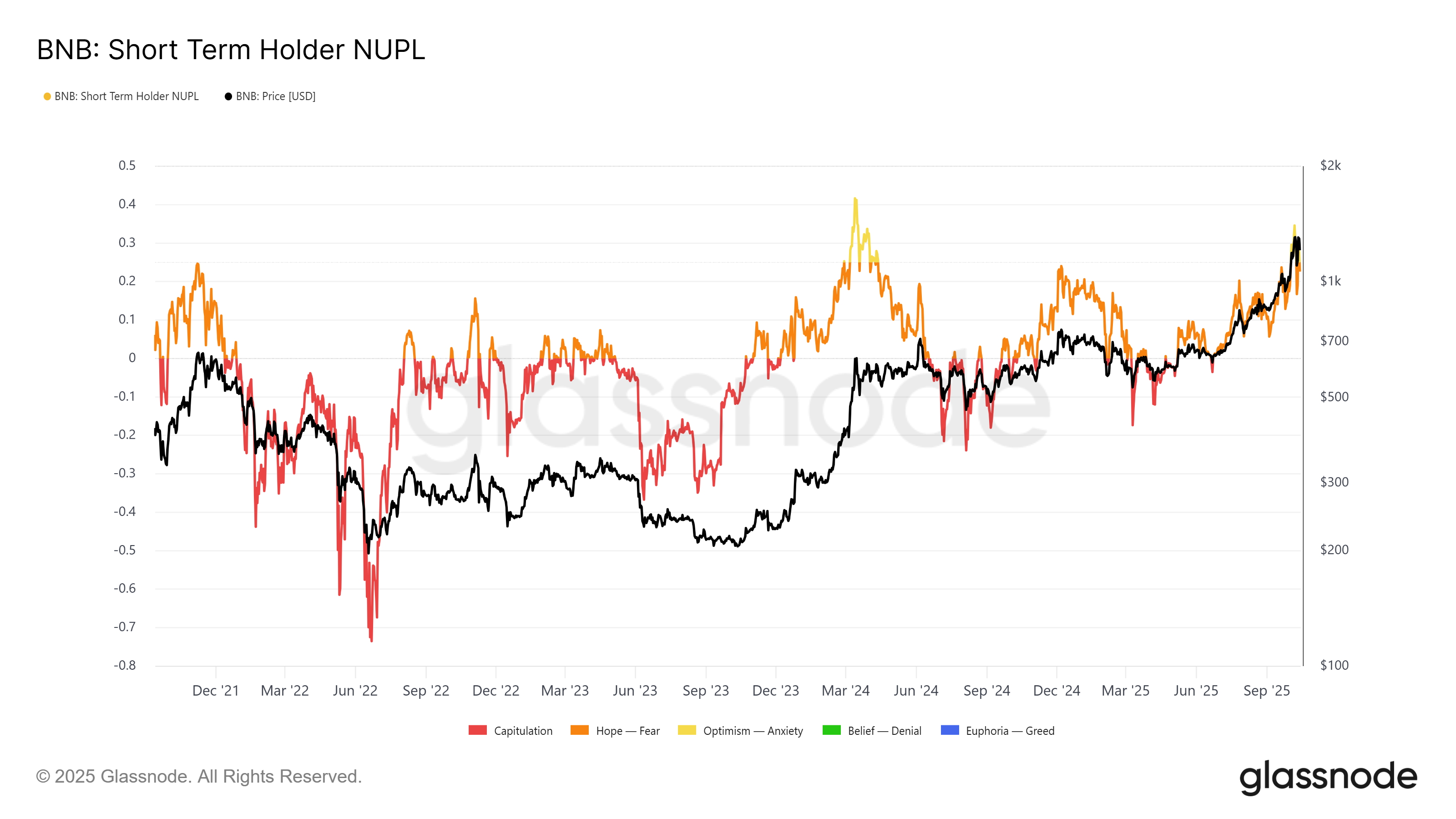

$BNB’s short-term holder Net Unrealized Profit/Loss (STH NUPL) has recently spiked above the 0.25 threshold, historically a warning signal. Breaching this level has often preceded a saturation of profits among short-term investors, leading to waves of selling and subsequent price reversals.

The current NUPL data suggests that many short-term holders are sitting on sizable gains, increasing the likelihood of sell-offs in the near term. With no clear bullish indicators emerging on the macro front, $BNB could be entering a cooling phase, where consolidation or correction becomes increasingly probable.

$BNB STH NUPL">

$BNB STH NUPL">

$BNB Price Could See Further Decline

At the time of writing, $BNB is trading at $1,181, maintaining a fragile position above its key $1,136 support level. Given the weakening sentiment and increased selling pressure from short-term holders, this support could soon be tested.

If bearish momentum intensifies, $BNB may fall toward $1,046. Losing this critical level could open the door to a deeper correction, potentially driving the price down to the psychological support zone at $1,000. Such a decline could erase much of the token’s recent gains.

$BNB Price Analysis">

$BNB Price Analysis">

Conversely, if $BNB manages to hold above $1,136 and attract renewed buying interest, a rebound toward $1,308 is possible. A decisive break above this resistance could reignite bullish momentum and bring the token closer to retesting its $1,375 all-time high.

The post $BNB’s Big Rally Looks Shaky: Are Quick Sellers Lining Up? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com