- Aster faces wash trading concerns after being delisted from DeFiLlama, yet continues showing strong market momentum and community support.

- Despite delays in its airdrop and scrutiny over trading data, Aster remains resilient with rising trader optimism and open interest growth.

The crypto market was briefly rocked by the negative news surrounding Aster. The project became a hot topic after analytics platform DeFiLlama officially removed its perpetual trading volume data.

The reason? The volume movement pattern was said to be too similar to Binance data, raising strong suspicions of wash trading activity. However, instead of being depressed, the ASTER token price continued to rise, indicating that market sentiment had not been completely shaken.

Market Defies Fear as Aster Rebounds Amid Volume Crash

After being removed from DeFiLlama on October 13, 2025, Aster’s trading volume plummeted from around $50 billion to just $2.16 billion in 24 hours.

This extreme drop should have caused market panic, but the reality was different. The ASTER token actually rose by around 6.06% in the past 24 hours and is now trading at about $1.4797, making it one of the five highest-rising cryptocurrencies today.

Technical analyst Lingrid explained that Aster is in a consolidation phase after forming several triangle patterns—a sign of pressure before new volatility emerges.

According to Lingrid, the token briefly touched the imbalance block area in the $1.25–$1.32 range, right at the long-term support line. This area is usually a natural price rebound point.

If buying momentum is strong again, the price could move to the $1.50–$1.60 range. However, Lingrid also warned that if the daily close falls below $1.28, the chances of a rebound will weaken.

Furthermore, not yet finished with the suspicious trading issue, the Aster team also announced the postponement of the second phase of the airdrop until October 20, 2025.

The postponement was made after several users reported discrepancies in the allocation data from the snapshot. To maintain transparency, the team gave users who wanted to submit USDT refund claims 48 hours after the update was completed.

While slightly disappointing for some in the community, this step was considered reasonable for the project’s credibility.

Furthermore, CNF previously reported that last September, Trust Wallet integrated the Aster DEX to offer perpetual trading with up to 100x leverage across over 100 markets.

Aster DEX now also supports multi-chain trading, hidden orders, and a variety of advanced trading tools, expanding opportunities for users worldwide. This integration is one reason why interest in Aster remains strong, despite the turmoil surrounding its reputation.

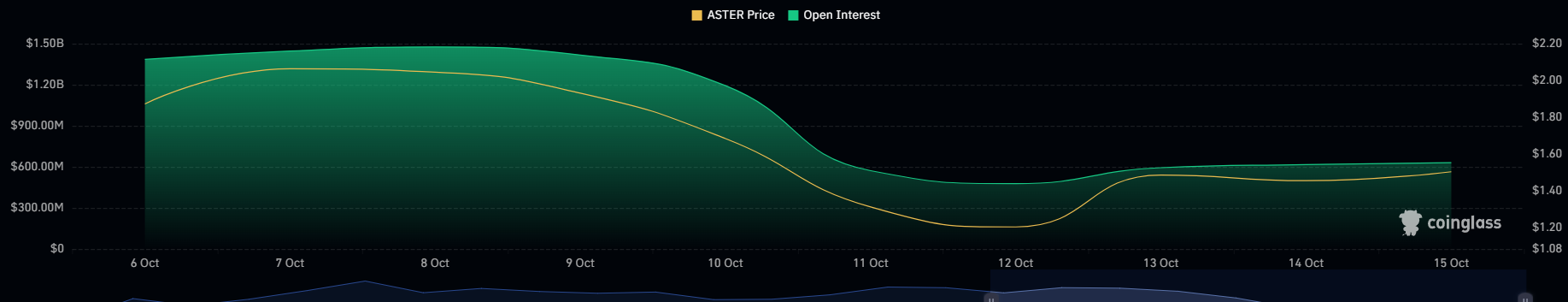

Confidence Persists as Open Interest Rises Across Exchanges

Meanwhile, data from CoinGlass also provides an interesting picture. Aster’s derivatives volume fell 8.58% to $3.29 billion, but open interest rose 4.73% to US$614.97 million.

On Binance, the long/short ratio reached 2.2873, indicating that the majority of traders still hold long positions. This signal indicates that the market still believes in the potential for further upside, despite the negative sentiment.

Furthermore, Aster’s market cap now stands at $2.99 billion, with a daily spot trading volume of around $416 million. This is a significant figure for a project currently facing significant challenges.