The crypto market has just witnessed a record-breaking liquidation event exceeding $19 billion, with most liquidated positions being longs. After this shock, derivatives traders have turned more cautious. However, a few altcoins appear to be defying that trend.

Some altcoins, such as $BNB and $ZEC, are still heavily FOMO’d by investors, while many traders remain uncertain about Ethereum’s ($ETH) next direction.

1. Ethereum ($ETH)

The total open interest in $ETH dropped from $63 billion to $48 billion last week, showing that traders have reduced short-term leveraged positions in the market’s leading altcoin.

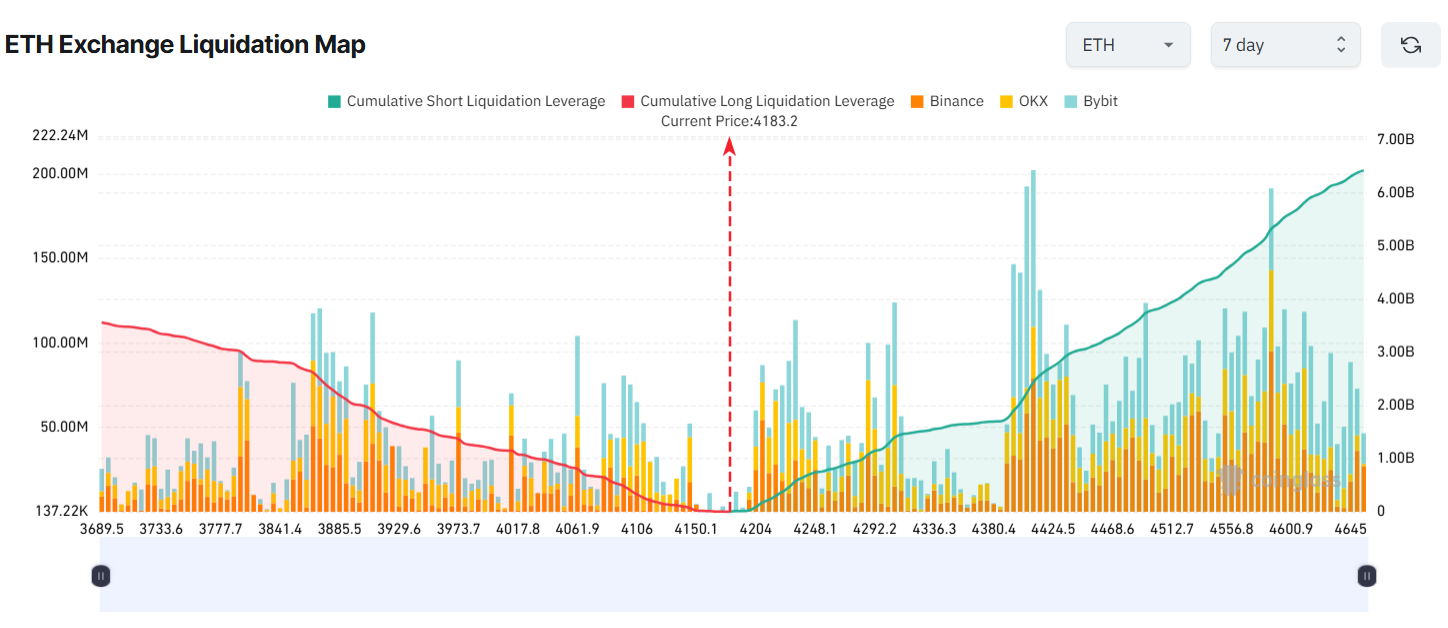

However, short-term bearish sentiment still dominates $ETH traders. This imbalance is visible on the liquidation map, where short liquidations (on the right side) slightly exceed long liquidations.

$ETH Exchange Liquidation Map. Source: Coinglass.">

$ETH Exchange Liquidation Map. Source: Coinglass.">

Analysts recently outlined several reasons supporting a V-shaped recovery scenario for $ETH. Large investors have been accumulating $ETH as its price dips near $3,500, and Trump’s latest statements have calmed market sentiment.

“I wouldn’t be surprised if we see a V-shape recovery in the next 1–2 weeks,” investor Mnpunk.eth, said.

If $ETH continues to recover and rallies toward $4,600 this week, potential short liquidations could reach $5.6 billion. Conversely, if $ETH corrects below $3,700, an estimated $3.5 billion worth of longs could be wiped out.

2. Binance Coin ($BNB)

$BNB has stood out in the recent downturn. While many altcoins struggled to regain their previous highs, $BNB surged to a new all-time high (ATH).

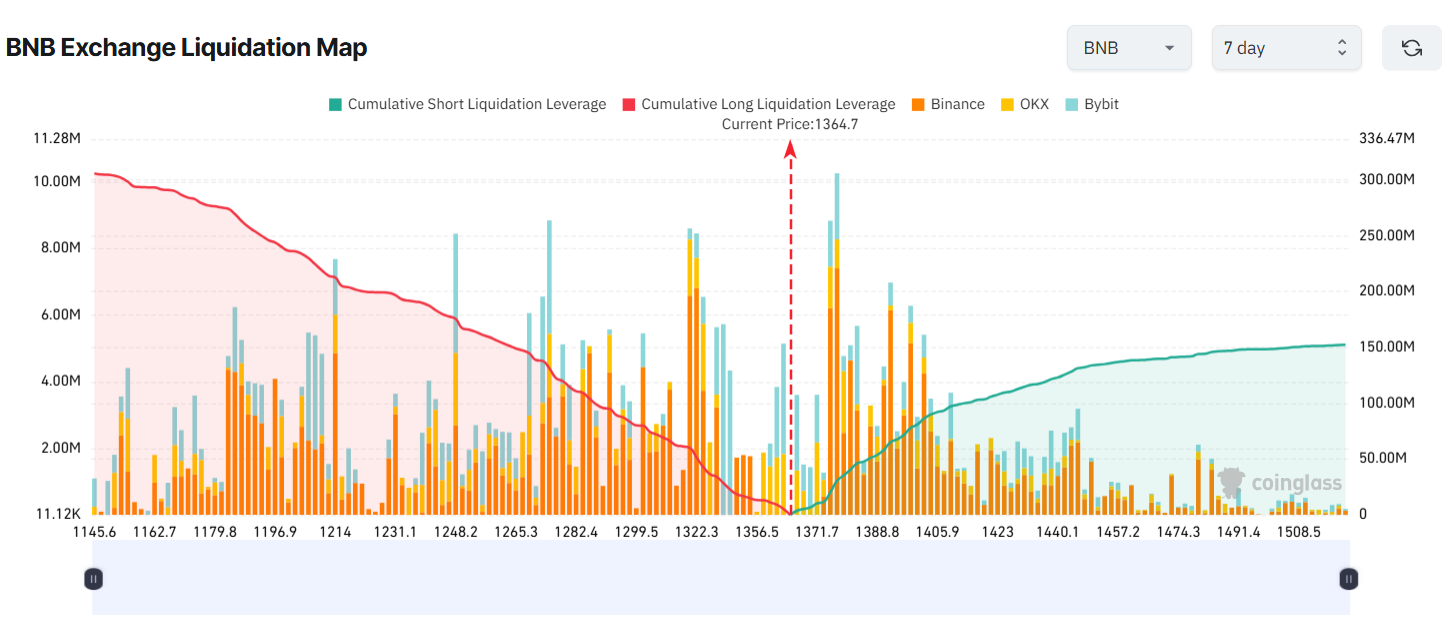

However, this price behavior has created a major imbalance in its liquidation map. The long liquidation volume significantly exceeds shorts, reflecting FOMO-driven leverage among short-term traders.

These long traders continue to bet aggressively with high leverage on $BNB’s price increase, exposing them to greater losses if the market moves against them.

Recent analysis from BeInCrypto highlighted potential risks. The group of investors holding $BNB for 6–12 months has sharply reduced their holdings from 63.89% to 18.15%, suggesting profit-taking and declining short-term confidence.

If $BNB corrects to $1,150 this week, long traders could face over $300 million in liquidations. On the other hand, if $BNB climbs above $1,500 and sets a new high, around $150 million in short positions would be liquidated.

3. Zcash ($ZEC)

In October, several KOLs supported the idea that the privacy culture in blockchain is reawakening.

This argument gained more credibility after $ZEC showed remarkable resilience during last Friday’s sell-off. The privacy coin avoided major losses and moved against the panic trend, setting a new all-time high.

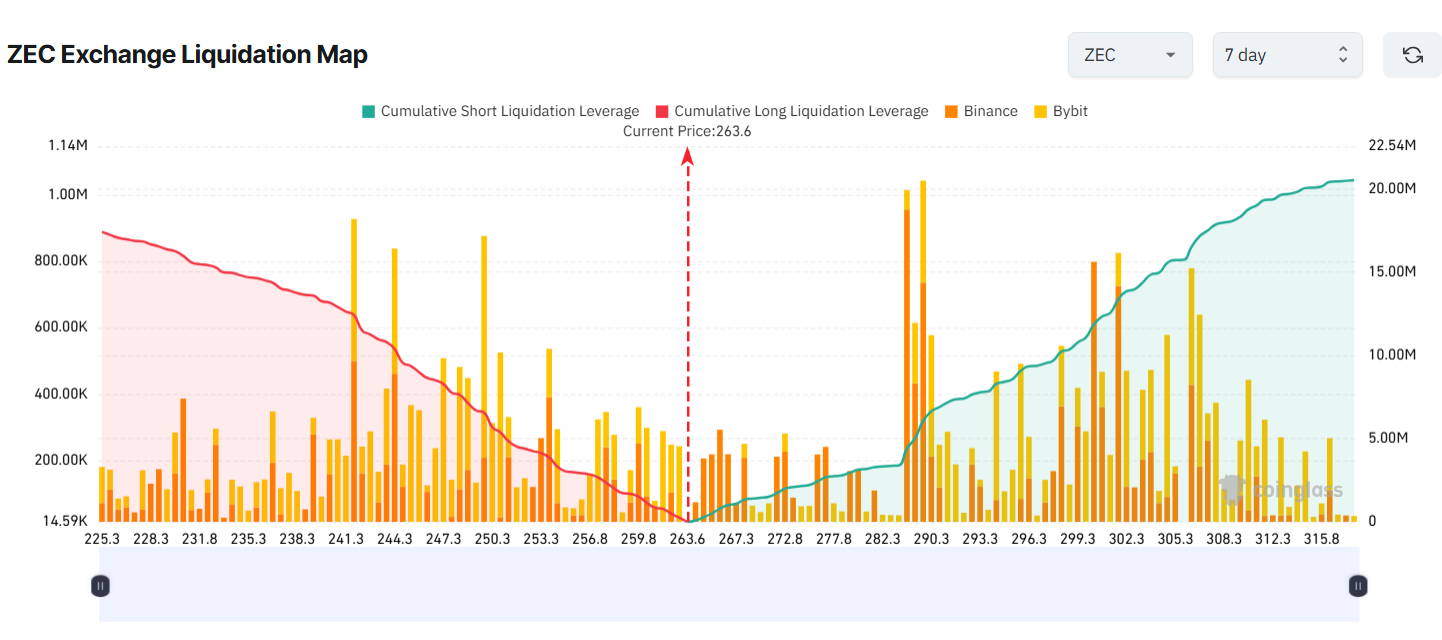

Entering the third week of October, long and short traders on $ZEC appear evenly matched, as reflected in the balanced liquidation map.

If $ZEC continues its upward momentum and breaks above $315, over $20 million in short positions could be liquidated. Conversely, if it drops toward $227, around $17 million in long positions could face liquidation.

Regardless of direction, liquidation risks remain elevated. CoinGlass data shows $ZEC’s total open interest has surpassed $300 million, marking its highest level since 2020.

These three altcoins represent different shades of sentiment regarding short-term derivatives.

- $ETH traders are leaning bearish and betting on short positions.

- $BNB traders remain optimistic and expect further gains.

- $ZEC traders are balanced but increasing exposure on both sides.

This divergence highlights the growing complexity of market volatility as October unfolds.

The post 3 Altcoins at Risk of Major Liquidation in the Third Week of October appeared first on BeInCrypto.

beincrypto.com

beincrypto.com