As the altcoin market capitalization (TOTAL2) recently hit a new all-time high of $1.19 trillion, veteran trader Peter Brandt, who has over 40 years of experience, shared his latest prediction for $XRP, one of the most closely watched altcoins among investors.

Various on-chain and sentiment data support his analysis, helping investors assess both risks and opportunities in October.

$XRP’s Price Structure Suggests a Possible Sharp Correction

In a recent analysis on X (formerly Twitter), Brandt identified a classic descending triangle pattern on the $XRP chart. The formation, referenced from Edwards and Magee’s technical analysis textbook, typically signals a downtrend continuation.

$XRP Price Prediction. Source: Peter Brandt.">

$XRP Price Prediction. Source: Peter Brandt.">

Although the pattern is bearish, Brandt maintained a cautious tone. He avoided making absolute statements but pointed out a specific condition that could confirm a deeper decline.

“On the right is a developing descending triangle. ONLY IF it closes below 2.68743 (then I’ll be a hater), then it should drop to 2.22163,” Brandt stated.

At press time, $XRP is trading around $2.85. This means a 6% drop from its current level could trigger a potential decline of more than 20%.

Brandt’s prediction comes as $XRP faces several negative signals from the broader market. According to data from Santiment, negative sentiment toward $XRP has reached its highest level in six months.

However, using contrarian reasoning, Santiment argued that such strong negative sentiment might indicate a potential rebound, based on $XRP’s historical price recoveries.

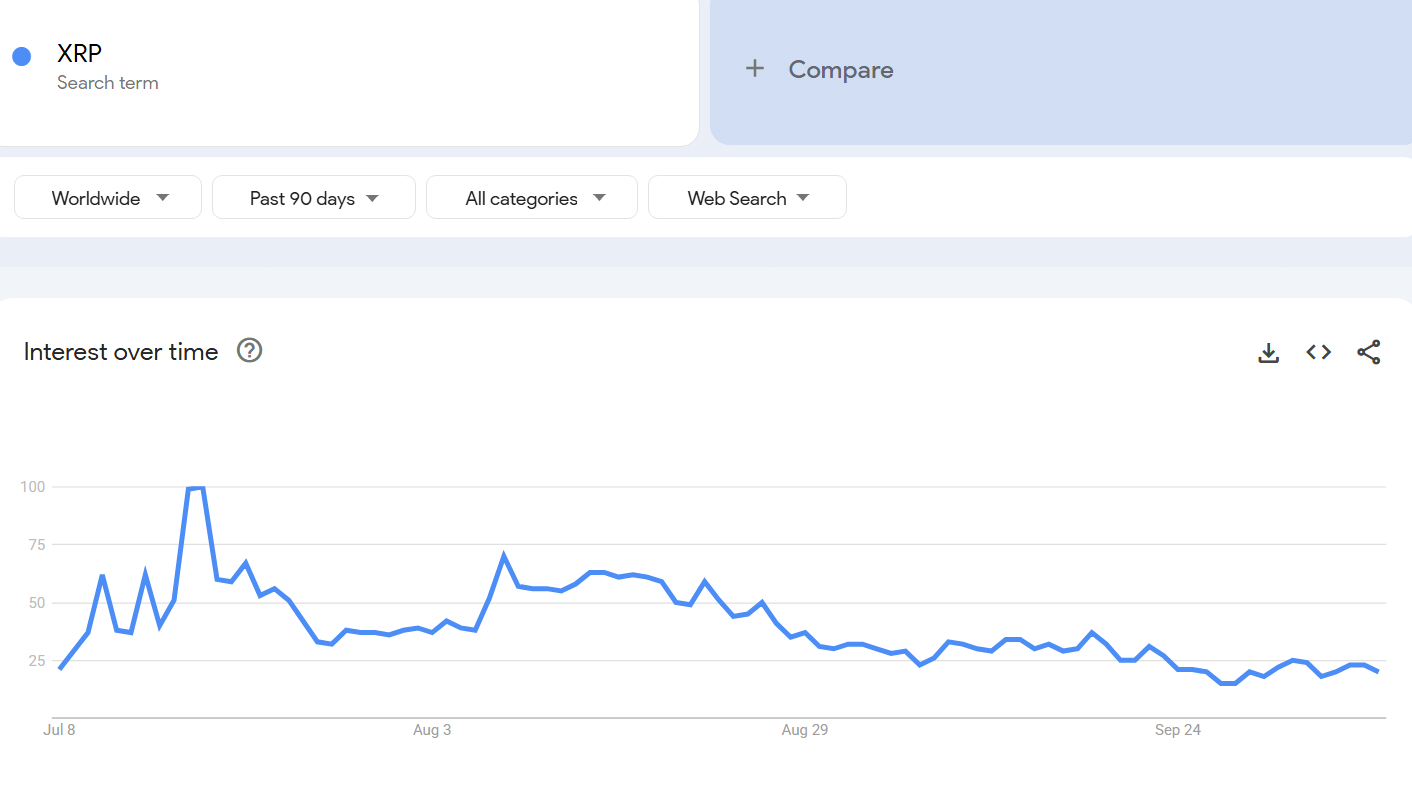

Still, another overlooked factor is the decline in Google search interest for $XRP. Data from Google Trends shows that $XRP searches hit a three-month low in late September and are now below 25 points.

$XRP Search Trends. Source: Google Trends.">

$XRP Search Trends. Source: Google Trends.">

The combination of bearish sentiment data from Santiment and declining search interest could make Brandt’s downside condition more likely to be met.

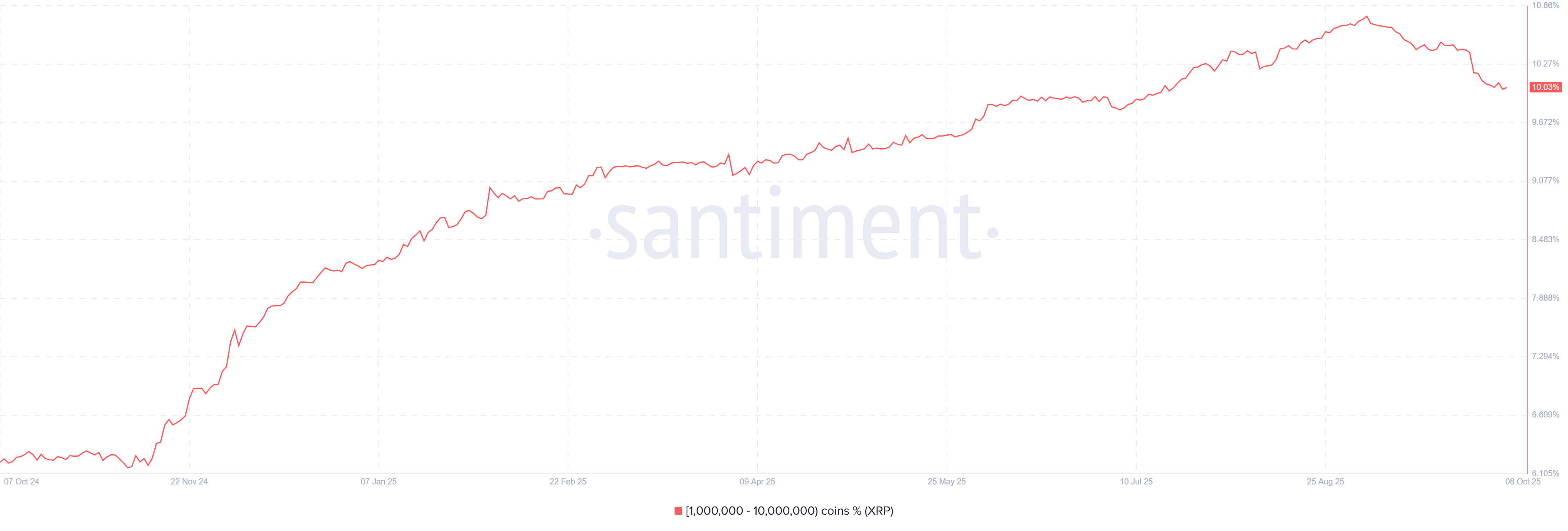

Mid-Level Holders Begin Selling After a Year of Accumulation

Another factor reinforcing the bearish outlook is the distribution of $XRP supply.

According to Santiment’s chart, wallets holding between 1 million and 10 million $XRP — typically mid-tier investors — have started selling for the first time in a year.

$XRP Supply Held by Wallets With a 1 Million—10 Million $XRP Balance. Source: Santiment.">

$XRP Supply Held by Wallets With a 1 Million—10 Million $XRP Balance. Source: Santiment.">

The percentage of supply held by this group rose from around 6% in October 2024 to a peak of 10.76% in September 2025, before dropping to 10% in early October 2025.

This sell-off could indicate profit-taking or declining confidence among mid-level holders, both of which are often precursors to increased selling pressure in the market. Because this group controls a significant portion of $XRP’s circulating supply, their actions can strongly influence price trends.

Overall, Peter Brandt’s forecast highlights the downside risks for $XRP in October, with the descending triangle pattern at the core of his analysis. With high FUD levels, low search interest, and mid-tier holder selling, $XRP may face heightened volatility in the coming weeks.

The post Peter Brandt Just Made a New $XRP Price Prediction — Here’s the Breakdown appeared first on BeInCrypto.

beincrypto.com

beincrypto.com