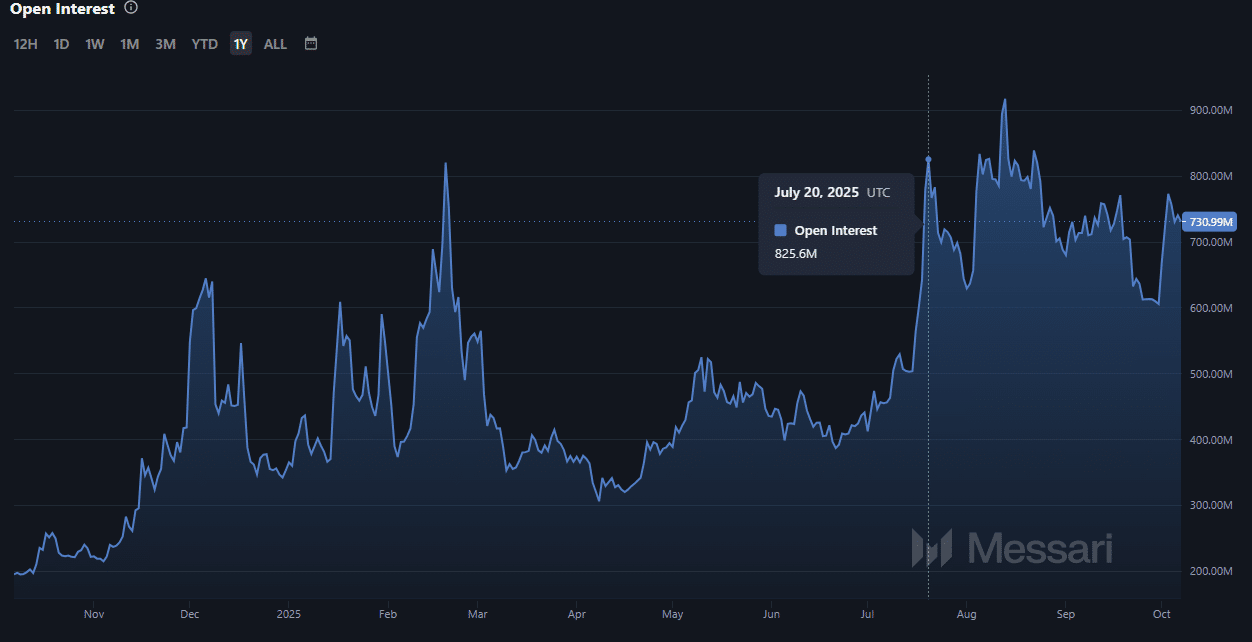

- Litecoin’s open interest rose to $730 million, indicating renewed institutional engagement.

- Despite the US government shutdown, sentiment around Litecoin ETF approval remains strong, with Polymarket data showing a 98% chance of approval and unprecedented investor interest.

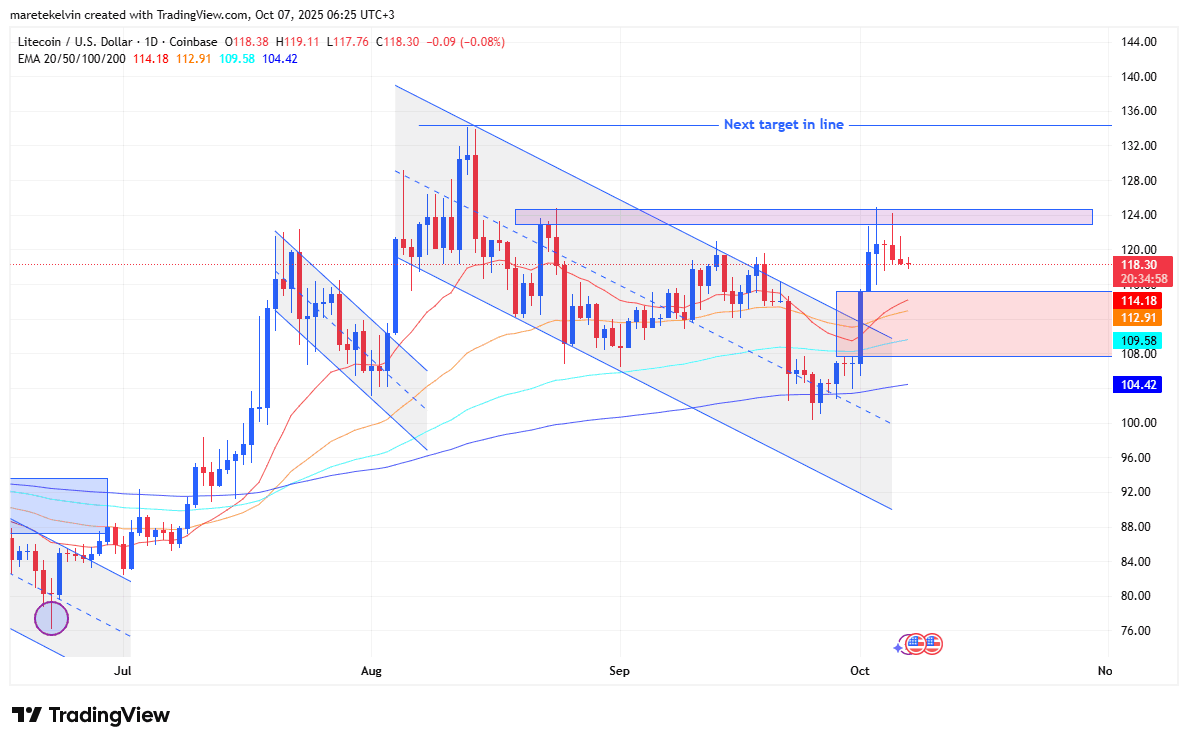

Litecoin ($LTC) price has bounced back once again from the $100 support, and is eyeing a breakout past $124 levels, for a sustained rally to the north. $LTC’s selling pressure appears to be easing as the price nears the market gap around $115. Despite minor pullbacks in recent sessions, $LTC has managed to hold above its 20-day Exponential Moving Average (EMA), which continues to act as short-term support.

This stability has strengthened investor confidence. As a result, traders are eyeing potential long positions near the $115 level amid a still-bullish long-term outlook. However, analysts caution that a breakdown below the 20-day EMA could shift momentum in favor of sellers and trigger renewed downside pressure.

Litecoin Attracts Institutions Amid Rising Open Interest

Litecoin’s on-chain metrics indicate renewed bullish sentiment, highlighted by a sharp rise in open interest (OI). At press time, $LTC’s OI reached $730 million, up from last month’s dip to $600 million, as per the Messari data.

Analysts say the steady increase suggests institutional traders are re-engaging with Litecoin, adding leveraged positions that could amplify any sustained upside move. Rising OI during periods of consolidation is often seen as a sign of accumulation, particularly when it coincides with key technical support levels.

Alongside rising institutional activity, Litecoin’s 90-day Sharpe Ratio has also surged, reaching 2.14 at the time of writing. This indicates stronger risk-adjusted returns for long-term investors. The trend reflects improved investor sentiment for $LTC, as reported by CNF. This marks a notable shift from previous months when returns lagged behind broader market benchmarks.

Litecoin ETF Approval on Radar

Investors are now pinning their hopes on the approval of Litecoin ETFs, which have been facing delays. Moreover, the US government shutdown has led to further uncertainty, as mentioned in our previous post.

Canary Capital’s proposed spot Litecoin ETF faces uncertainty after the U.S. SEC missed its October 2 decision deadline. The delay, coinciding with the ongoing government shutdown, leaves the fund’s future unclear. The ruling was originally expected under the 19b-4 framework.

Furthermore, the data from Polymarket shows that the odds of $LTC ETF approval have climbed to 98%. The Litecoin Foundation reported that interest in a Litecoin ETF is reaching unprecedented levels. The first ETF filing was submitted in January, and market sentiment around a potential approval has never been stronger.

Interest in a Litecoin ETF has never been higher. The first filing was back in January. Sentiment around an approval has also never been higher. $LTC 💯 pic.twitter.com/qyewwbwG80

— Litecoin Foundation ⚡️ (@LTCFoundation) October 6, 2025