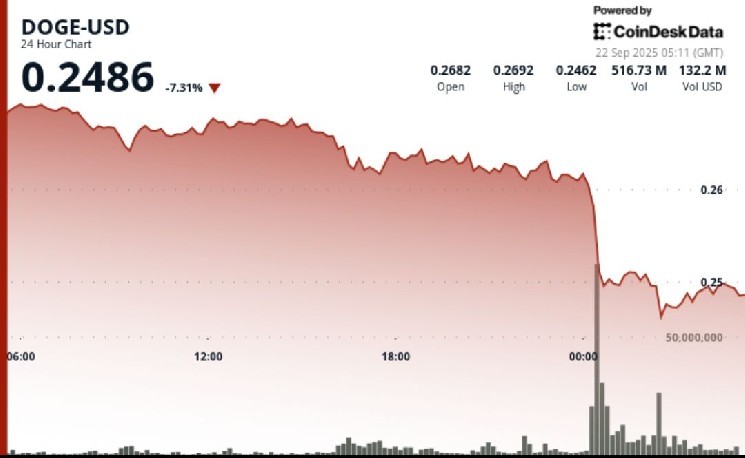

Dogecoin endured a sharp overnight selloff, sliding from $0.27 to $0.25 during the September 21–22 session, as institutional traders offloaded positions on record volumes exceeding 2.15 billion tokens.

The midnight rout carved through support levels and established fresh resistance zones, leaving $DOGE consolidating around $0.25 as traders monitor for recovery or continuation lower.

News Background

• $DOGE fell 7% over the 24-hour period ending September 22 at 02:00, retreating from $0.27 to $0.25.

• Midnight trading saw a collapse from $0.26 to $0.25 on record 2.15 billion volume, dwarfing the 24-hour average of 344.8 million.

• Analysts flagged a “1-2 pattern” formation that has historically preceded $DOGE breakouts above $0.28–$0.30.

Price Action Summary

• $DOGE’s range spanned $0.02 (≈8%) between a $0.27 high and $0.25 low.

• Resistance solidified near $0.27 following repeated rejections.

• Institutional support emerged around $0.25, with recovery attempts keeping $DOGE anchored above this level.

• In the final hour (01:14–02:13), $DOGE bounced within a narrow $0.25–$0.25 channel, showing accumulation patterns with spikes at 01:25 and 02:03.

Technical Analysis

• Record 2.15B tokens traded during the midnight dump confirms heavy institutional activity.

• Support confirmed at $0.25; failure here risks extending decline toward $0.23.

• Key resistance sits at $0.27, with next upside tests at $0.28–$0.30 should buying resume.

• Volume spikes during recovery attempts highlight potential bottoming interest.

• Pattern recognition: technicians identify a recurring “1-2 setup” consistent with prior rally structures.

What Traders Are Watching

• Whether $0.25 can hold as durable support after record liquidation flows.

• Institutional positioning around the $0.28–$0.30 resistance band if recovery gains traction.

• Follow-through volumes in upcoming sessions to confirm whether accumulation or further distribution dominates.

• Broader sentiment impact from ETF delays and ongoing regulatory uncertainty.

coindesk.com

coindesk.com