With just hours left until the highly anticipated FOMC meeting scheduled for later today, bitcoin’s price jumped to a new multi-week peak of just over $117,200.

Most altcoins have failed to produce any big moves over the past day, while $BNB charted a new all-time high, and $HYPE has neared its own.

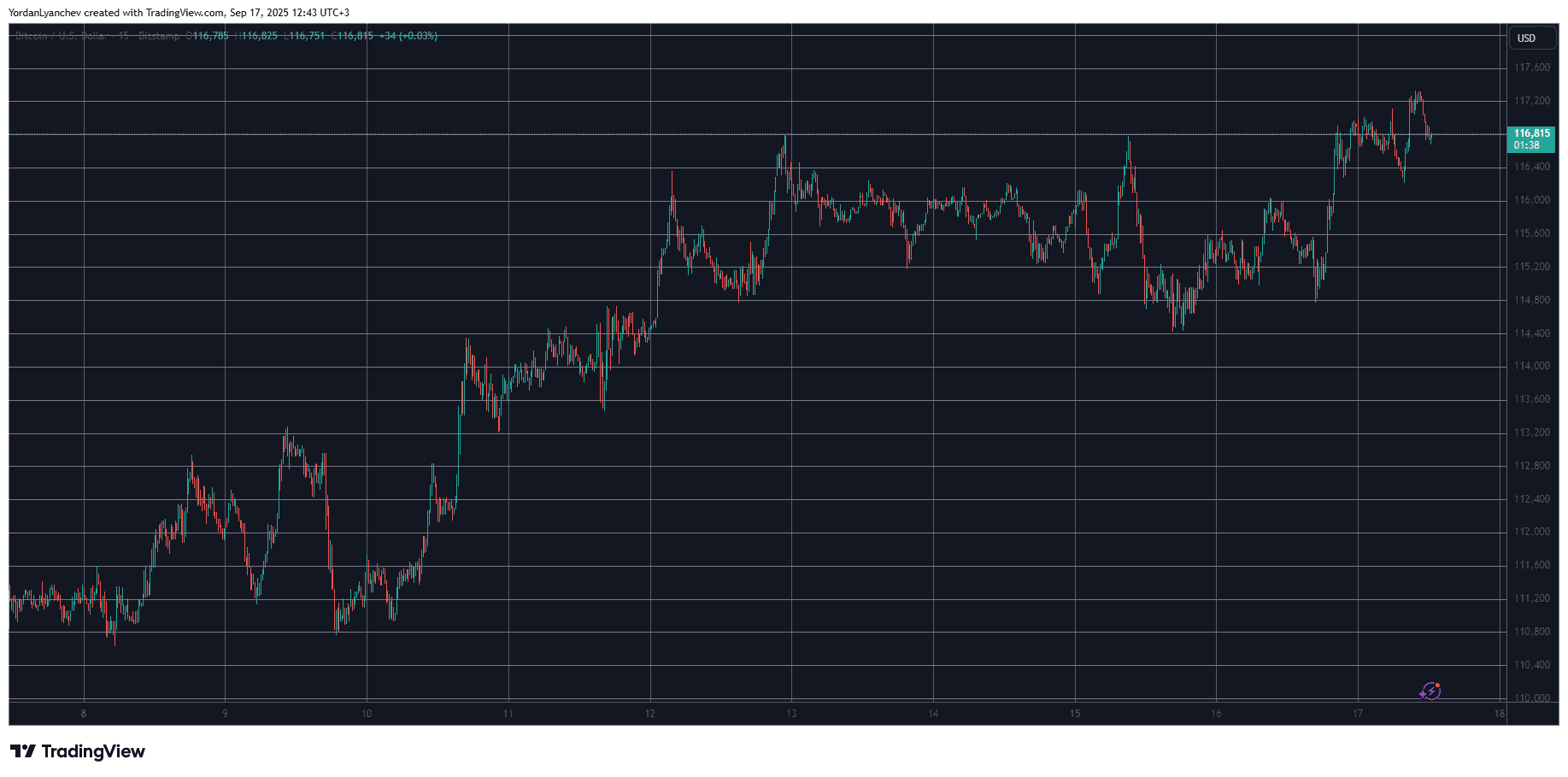

$BTC Stopped at $117K

The primary cryptocurrency has been on an evident uptrend for the past week or so, after bouncing off the $111,000 support last Tuesday. The asset started to recover some of the recently lost ground almost immediately and had risen to over $116,000 by Friday.

It failed there at first and remained sideways for most of the weekend, at least after it jumped to $116,800 on Saturday morning, where it was quickly stopped. The bulls went on the offensive on Monday, but the subsequent rejection at the same level pushed $BTC south to $114,400.

However, bitcoin recovered again and headed north to just over $117,200 earlier today, which became a four-week peak. Although it has slipped slightly since then, it’s still in the green on a daily scale.

More volatility is expected later today when the US Federal Reserve will announce whether it will indeed lower the interest rates as many anticipate. For now, though, $BTC’s market cap sits at just over $2.325 trillion on CG, while its dominance over the alts is up to 56.2%.

$BNB New Peak

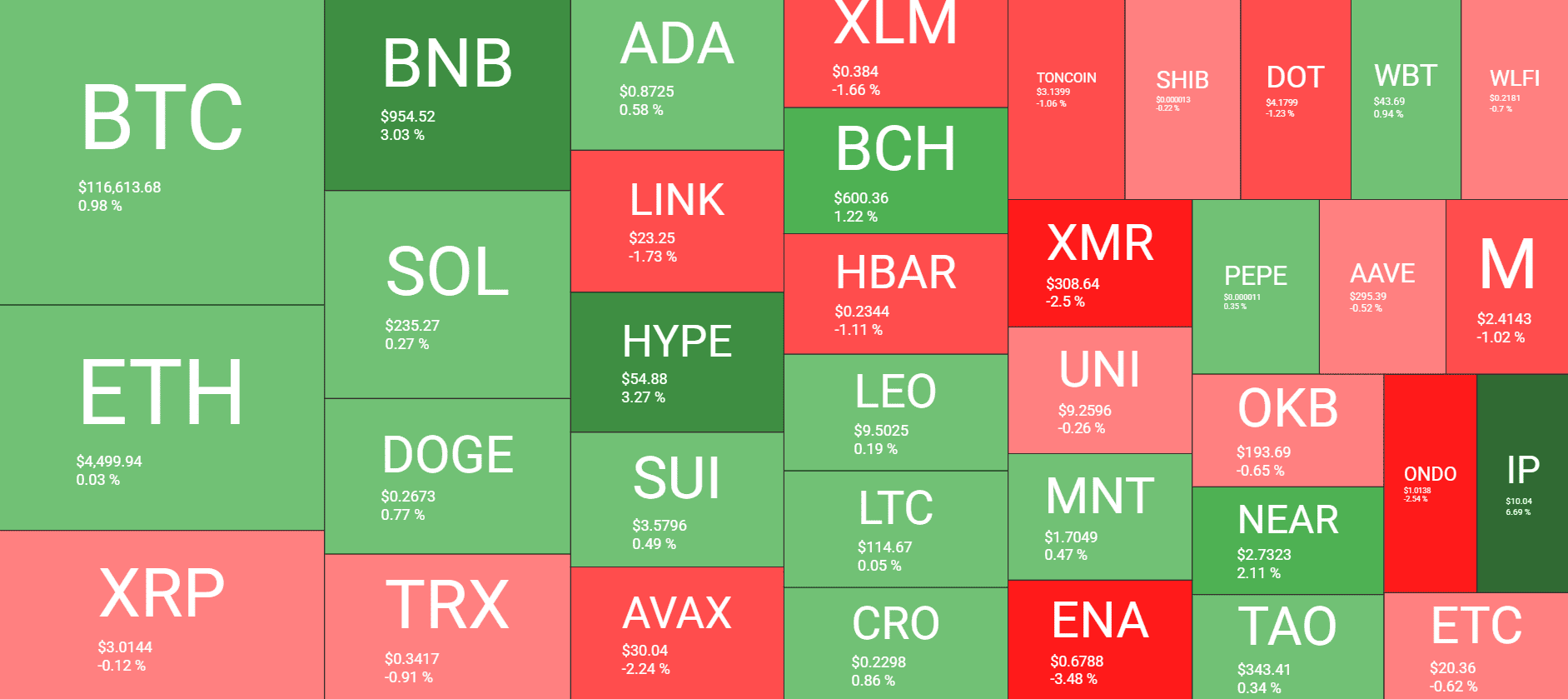

Most larger-cap alts have remained at essentially the same price levels as yesterday, including ETH, XRP, SOL, ADA, DOGE, TRX, and SUI.

In contrast, $BNB topped $960 earlier today to mark a new all-time high. $HYPE also neared its own record but now trades at $55. LINK, AVAX, XLM, and HBAR are slightly in the red on a daily scale.

MYX has skyrocketed the most from the larger-cap alts, gaining over 50% in a day to trade above $16. IP and SKY are far behind with 6% and 5%, respectively.

The total crypto market cap has risen to $4.140 trillion on CG, gaining more than $140 billion in the past several days.

cryptopotato.com

cryptopotato.com