Dogecoin's ($DOGE) dour price action this week has activated bargain hunters.

The largest meme token by market value, Dogecoin, has dropped nearly 5% to 26 cents, according to data from CoinDesk. However, institutional investors are seizing the opportunity, snapping up 680 million $DOGE tokens amid the price dip.

This flurry of accumulation comes as regulatory clarity improves ahead of the anticipated approval of the first U.S.-listed spot Dogecoin ETF, according to CD Analytics.

On Tuesday, CleanCore Solutions announced the purchase of an additional 100 million $DOGE, bringing its treasury holdings to over 600 million $DOGE.

The Rex Shares-Osprey Dogecoin ETF (DOJE) is expected to go live this week, allowing investors to gain exposure to the cryptocurrency without needing to own and store it.

Key AI insights

- Corporate interest in dogecoin intensified during the September 16-17 period as institutional accumulation and regulatory developments surrounding exchange-traded fund proposals created new investment parameters.

- Corporate trading desks monitored $DOGE's $0.01 range, representing 5% volatility between $0.27 resistance and $0.26 support levels.

- Institutional selling targeting $0.26, driven by an exceptional volume of 945.89 million, established corporate support parameters. Evening institutional buying created resistance around $0.27 on a volume of 629.60 million, indicating corporate accumulation strategies.

- Volume-based support confirmation at the $0.26 level, following an immediate institutional recovery, validated the corporate adoption thesis.

- Critical support zone resilience during 60-minute selling pressure demonstrates institutional commitment to current price levels.

- A technical breakout from a multi-month consolidation pattern attracts corporate treasury attention, with a $0.50 price objective.

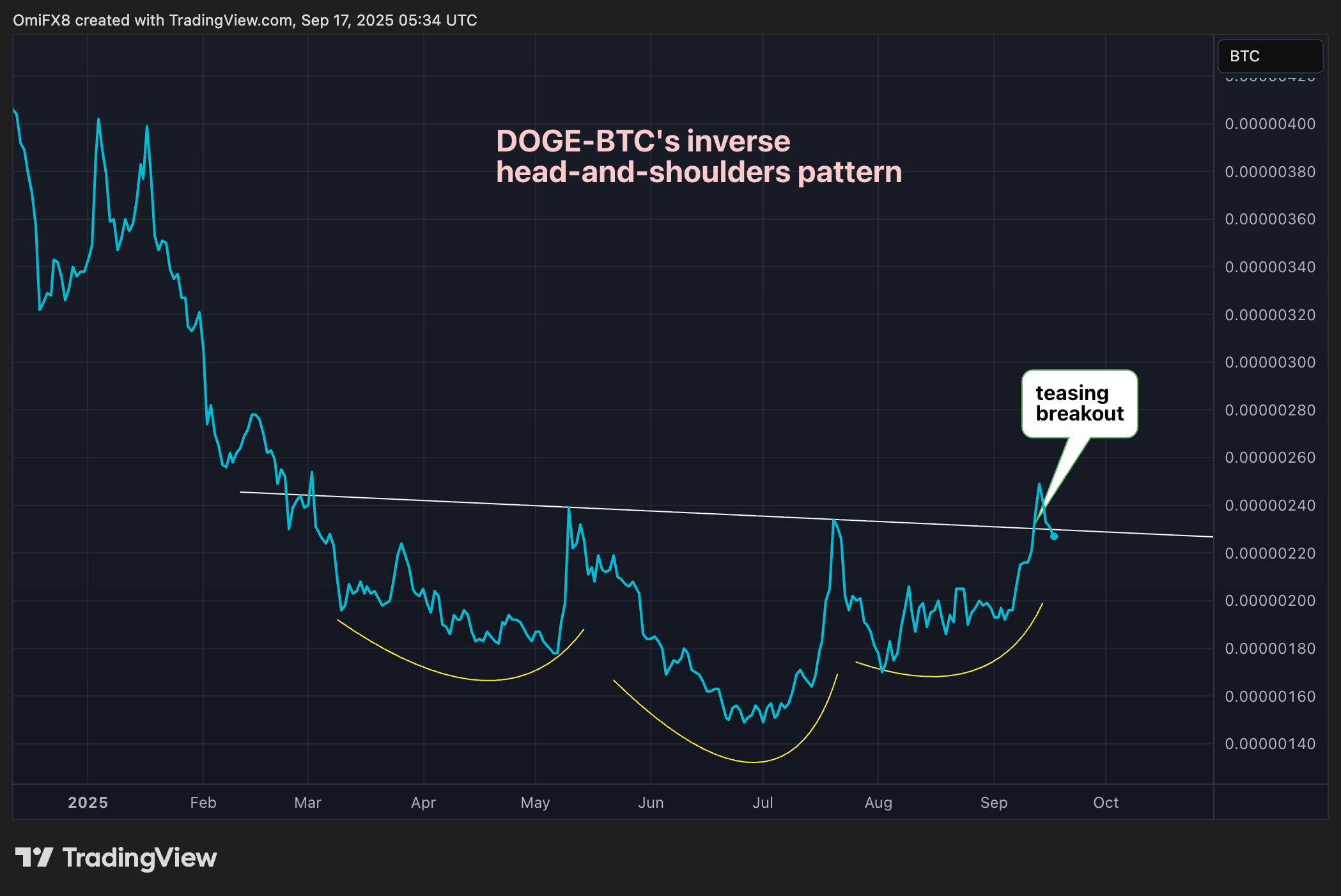

Focus on $DOGE/$BTC

The Binance-listed dogecoin-bitcoin ratio (DOBE/$BTC) could see sharp gains, assuming the Fed cuts rates as expected on Wednesday, while laying the groundwork for aggressive easing over the coming months.

That's because the $DOGE-$BTC ratio has carved out a bullish inverse head-and-shoulders pattern. In other words, the stage is set for an outsized $DOGE rally relative to $BTC.

The Federal Reserve is widely expected to cut interest rates by 25 basis points to 4% later on Wednesday. With traders pricing in a 99% chance of this move, it’s essentially baked into the market.

That means the focus now shifts to what the Fed signals about future cuts. $DOGE bulls will be hoping for the Fed to downplay inflation concerns, hinting faster, more aggressive rate reductions in the months ahead.

coindesk.com

coindesk.com