Leading meme coin Dogecoin ($DOGE) has surged 21% over the past week, riding on improvements in broader market sentiment and renewed investor confidence.

On-chain data reveals a consistent pattern of hodling among long-term investors. This behavior signals conviction and hints at the likelihood of a sustained uptrend.

Dogecoin Holders Lock In

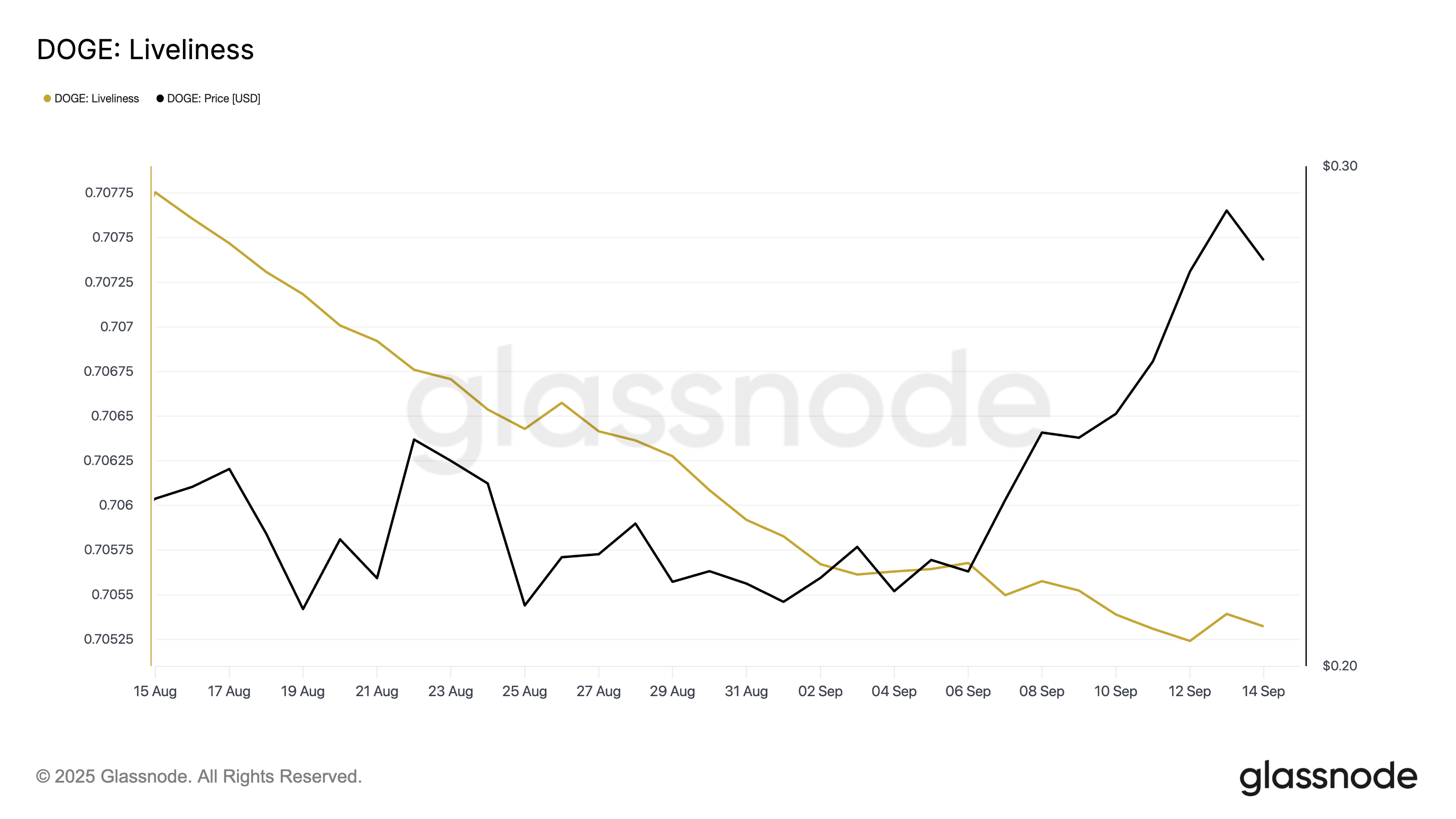

One key metric highlighting this renewed optimism is the coin’s liveliness, which measures the extent to which long-term holders (LTHs) are spending their coins.

According to Glassnode, $DOGE’s liveliness has plunged steadily over the past month. The move points to a sharp slowdown in selloffs among these investors. As of this writing, the metric is 0.705, suggesting that many long-held $DOGE have become dormant.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This supports the narrative of a conviction-led holding, which could help $DOGE record more gains in the short term.

Moreover, $DOGE’s Hodler Net Position Change has recorded a steady uptick since September 7. Thus, confirming that more coins are being moved into long-term storage.

According to Glassnode, this metric tracks the net position of long-term holders over a given period, measuring whether investors are increasing or reducing their exposure. A positive reading indicates that more coins are being transferred into hodler wallets.

For $DOGE, this is a bullish trend, as it reduces the available supply in circulation and reflects a vote of confidence from committed investors.

Can Holders Push Past $0.29 Before a Pullback?

This wave of accumulation strengthens the case for continued upside momentum. If the trend persists, it could propel $DOGE past the resistance at $0.29 and toward $0.33, a high it last reached in January.

However, daily chart readings from $DOGE’s Money Flow Index (MFI) show the momentum indicator hovering around the overbought zone. This signals a potential pullback. As of this writing, the indicator, which measures buying and selling pressure by combining price and trading volume, is at 80.29.

Typically, the MFI ranges between 0 and 100, with values above 80 considered overbought and readings below 20 signaling oversold conditions.

When the indicator pushes into the overbought zone, as $DOGE currently has, it suggests that buying pressure may be peaking and a short-term correction or price consolidation could follow.

If this plays out, $DOGE risks plummeting below $0.2583.

The post $DOGE Holders Refuse to Sell as Rally Heats Up— Is a 2025 High in Sight? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com