The second week of September saw the Altcoin Season Index reach its highest level in five years. Positive sentiment pushed several altcoins to all-time highs and attracted massive open interest. However, this also came with the risk of large-scale liquidations.

The following altcoins show signs of extreme FOMO and face potential liquidation risks in the third week of September.

1. Ethereum ($ETH)

By mid-September, Ethereum reserves reached a new peak of 4.9 million $ETH worth $22.2 billion. This figure excludes the 6.7 million $ETH held in Ethereum ETFs, valued at $46.3 billion.

A recent BeInCrypto report highlighted on-chain data suggesting Ethereum’s price could reach $5,000 or higher. Derivatives traders appear to share that belief, increasing leverage and long positions. This means their losses will be greater if $ETH moves against expectations.

$ETH Exchange Liquidation Map. Source: Coinglass">

$ETH Exchange Liquidation Map. Source: Coinglass">

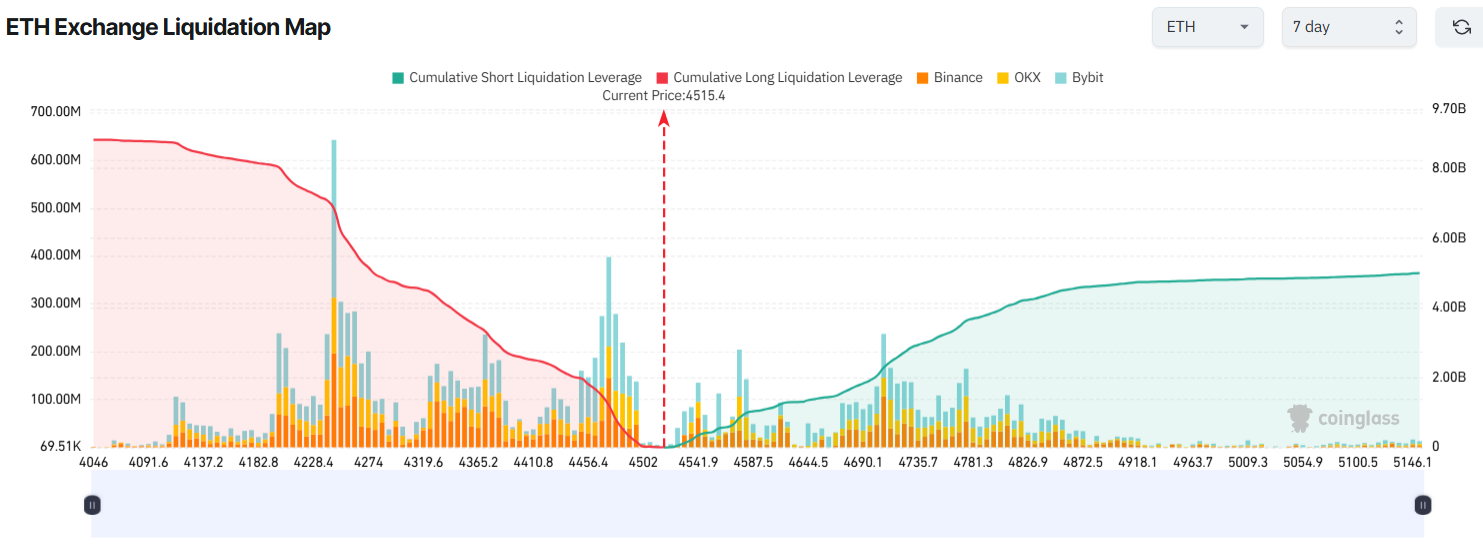

The liquidation map shows that if $ETH drops to $4,046 this week, more than $8.8 billion in long positions will be liquidated. Conversely, if $ETH rises to $5,000 as many analysts predict, about $4.8 billion in short positions will be liquidated.

Are there reasons to expect $ETH to decline? BeInCrypto’s latest analysis noted that Ethereum’s profitable supply recently hit 99.68%, a sign of potential profit-taking.

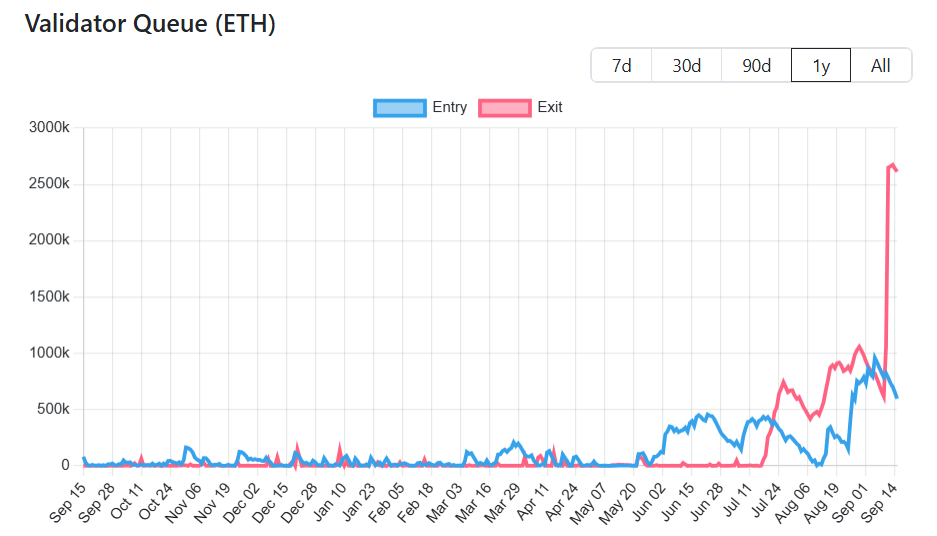

In addition, over 2.6 million $ETH are now queued for unstaking. The initial trigger came from Kiln Finance, which unstaked to manage risks after issues tied to SwissBorg.

$ETH). Source: Validatorqueue">

$ETH). Source: Validatorqueue">

However, the unstaking queue has continued to grow as $ETH’s price climbed, reflecting stronger demand for profit-taking.

2. Binance Coin ($BNB)

Binance Coin ($BNB) reached an all-time high of $944 in September.

The rally followed news that Binance and Franklin Templeton announced a new partnership to develop blockchain and crypto solutions for institutional adoption.

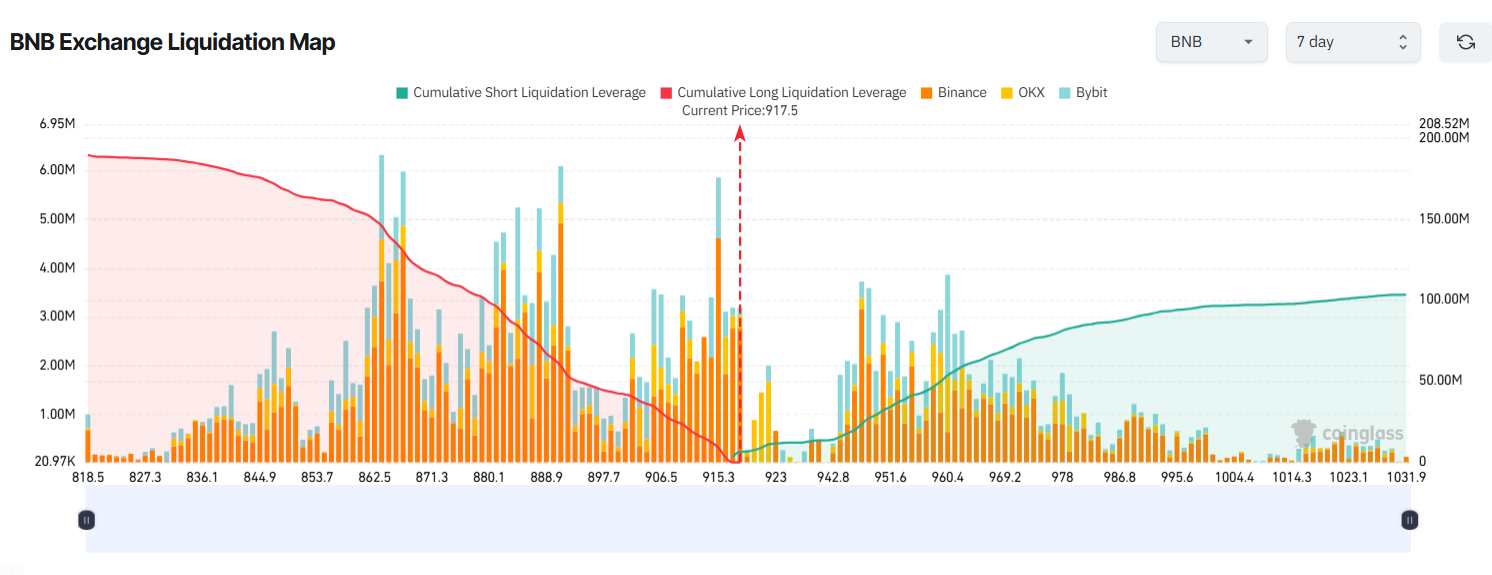

Like $ETH, $BNB’s 7-day liquidation map shows an imbalance between long and short positions. Long liquidations dominate, signaling that many traders are betting on continued gains.

$BNB Exchange Liquidation Map. Source: Coinglass">

$BNB Exchange Liquidation Map. Source: Coinglass">

If $BNB falls to $818 this week, more than $189 million in long positions will be liquidated. On the other hand, if $BNB climbs to $1,031, about $103 million in short positions will be wiped out.

What risks should traders consider for $BNB longs? One warning sign comes from total open interest (OI).

$BNB Futures Open Interest. Source: Coinglass">

$BNB Futures Open Interest. Source: Coinglass">

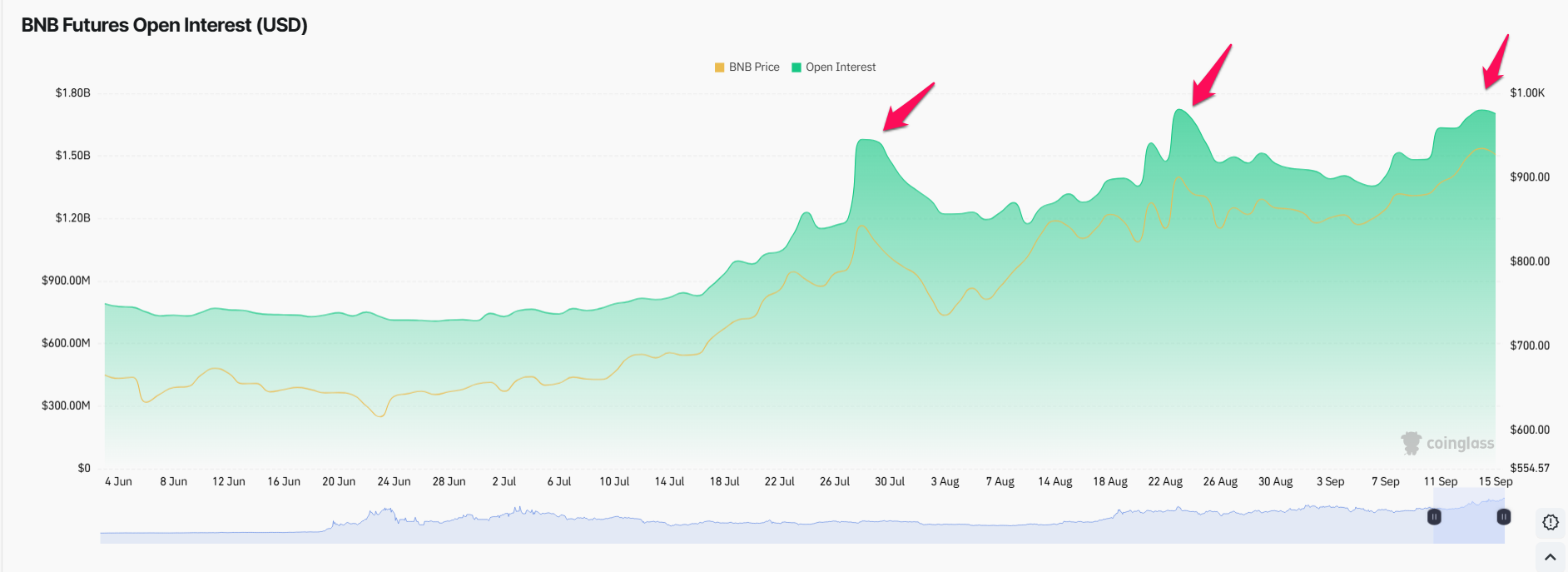

Data from Coinglass shows that as of September 14, $BNB’s total OI hit $1.72 billion. In the current quarter, OI crossed $1.5 billion three times. Both the previous two instances triggered corrections of 7% to 15%.

If history repeats, the third surge could lead to losses for traders holding $BNB longs.

3. $MYX Finance ($MYX)

$MYX Finance ($MYX) delivered one of the most controversial rallies of September. BeInCrypto’s data shows the token surged 450% in the past month.

However, $MYX has faced skepticism, including accusations of Sybil attacks in its airdrops and fears of a collapse similar to Mantra (OM).

The token has already dropped from its ATH of $18.9 to $10.9, a more than 40% decline. This pullback suggests that FOMO-driven sentiment has cooled.

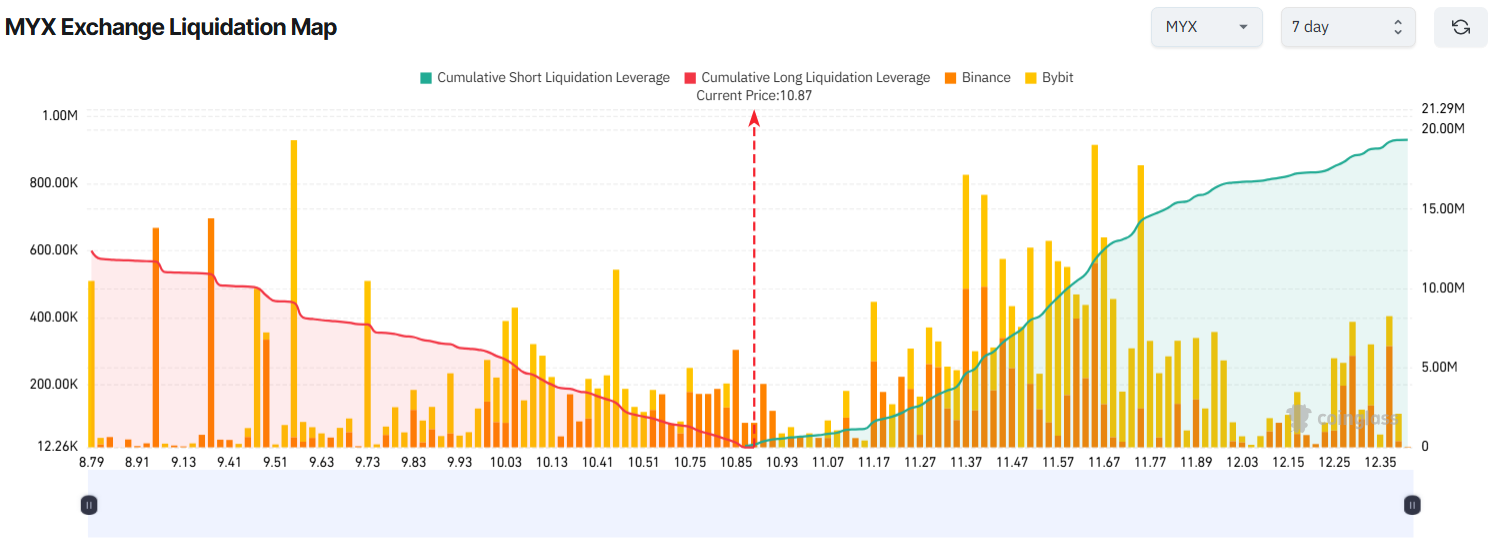

As a result, derivatives traders are leaning toward short positions. The 7-day liquidation map shows shorts will face heavier losses if they are wrong.

$MYX Exchange Liquidation Map. Source: Coinglass">

$MYX Exchange Liquidation Map. Source: Coinglass">

If $MYX recovers to $12.35, more than $19 million in short positions will be liquidated. If $MYX falls to $8.79, over $12 million in long positions will be liquidated.

Some technical analysts expect a rebound, arguing that the $10–$11 range is a strong support zone where investors are likely to buy.

“Beautiful breakout by $MYX & strong bounce from crucial support area. High chance of a nice bounce. Targets 12, 13, 14, 15, 16,” trader BitcoinHabebe predicted.

BeInCrypto’s latest analysis also suggested that the current pullback is not a trend reversal but a temporary correction.

The post 3 Altcoins at Risk of Major Liquidations in the Third Week of September appeared first on BeInCrypto.

beincrypto.com

beincrypto.com