- Litecoin prepares to launch a privacy-focused wallet in September with MWEB and stronger security features.

- On-chain activity rises with transactions hitting the highest levels since June 2023, and the hash rate nearing records.

Litecoin ($LTC) is trading around $111.90 on Tuesday after breaking above a falling wedge pattern that signals a bullish pattern. The momentum comes as the Litecoin Foundation, in partnership with AmericanFortress, announced plans for a Litecoin-native wallet, which has been slated for release in September.

The new wallet will include MimbleWimble Extension Blocks (MWEB), FortressNames, and c-filtering. These features aim to provide seamless usability while ensuring privacy becomes a default feature with Litecoin transactions. Privacy has been one of the major issues among cryptocurrency users, and the inclusion of MWEB in a native wallet is a major development in the evolution of Litecoin.

Announcing: The American Fortress Litecoin Wallet

The first Litecoin-native wallet designed to handle the vast spectrum of the network’s capabilities while making privacy the default. Launching soon!! $LTC ⚡️ @Americanfort_io https://t.co/W04aJA33mC

— Litecoin Foundation ⚡️ (@LTCFoundation) September 8, 2025

The Foundation stressed that the wallet will focus on intuitive design and robust privacy mechanisms, making Litecoin match growing global interest in secure, user-friendly digital payment solutions. The rollout is expected to position Litecoin as one of the few major networks where privacy protection is embedded on the protocol level.

Network Transactions and Miner Confidence on the Rise

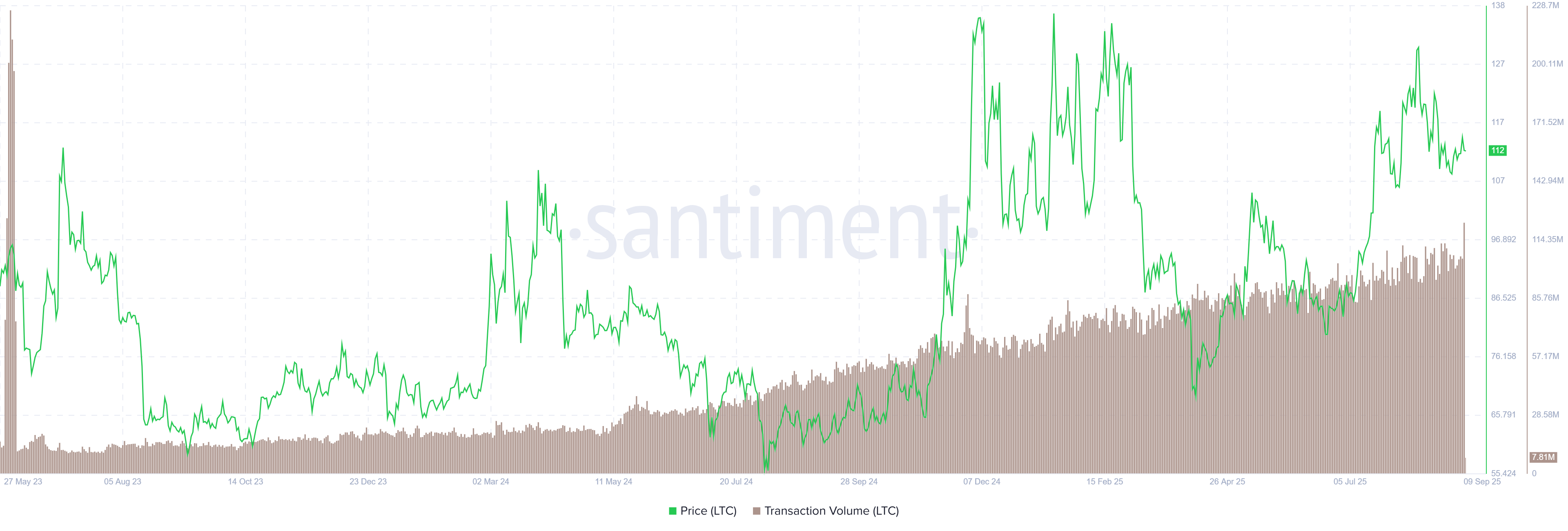

On-chain metrics add further credence to the bullish case for Litecoin. Santiment data reveals daily transactions rose from 105.12 million on Sunday to 122.67 million on Monday. The figure is the highest year to date and the strongest activity since June 2023.

The transaction spike indicates renewed network participation and increasing adoption of Litecoin for peer-to-peer transfers. Elevated usage often indicates both increasing investor interest and broader ecosystem involvement, cementing Litecoin’s position as one of the oldest assets in the market.

Alongside rising transactions, the network hash rate of Litecoin is nearing 3.5 petahash per second. Reaching new record highs in hash rate enhances network security, minimizes the danger of 51% attacks, and represents a rising confidence among miners. Strong miner participation can often signal long-term viability and ecosystem stability.

Price Action Highlights Short- and Long-Term Setups

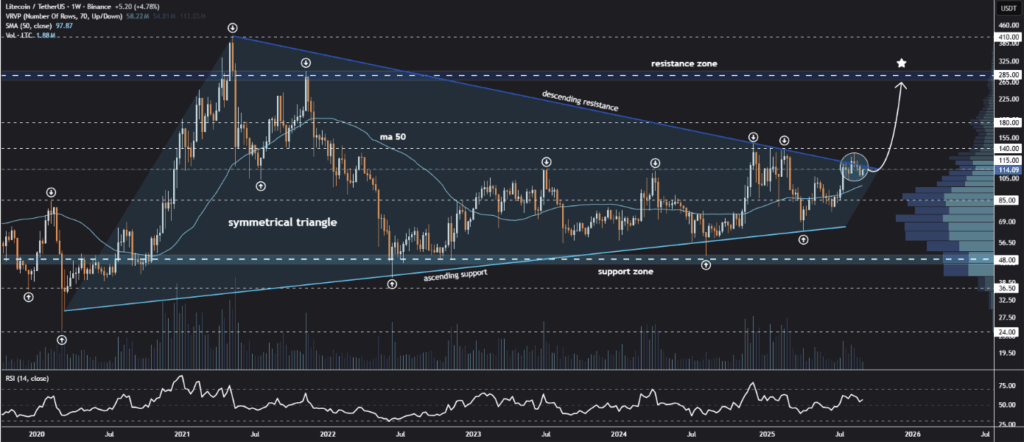

On the 4-hour chart, Litecoin is trading at just below a key resistance zone between $109 and $114. Recent higher lows indicate building demand, with analysts targeting the $128-134 range as the next possible supply barrier. If the momentum pushes the price above this level, it could cause a broader bullish breakout.

Support remains nearby, at $106.60, now serving as a strong base after playing the role of prior resistance. Traders closely monitor candlestick formations and divergences to determine if Litecoin can continue its current trajectory or if it could face a short-term pullback.

From a bigger picture standpoint, the weekly chart paints a more compelling picture. Litecoin has been tracing a symmetrical triangle since mid-2021, and currently tests the upper boundary of this structure at $114-115. Analysts suggest that a close above this range and the 50-week moving average could open the door to targets at $140-$155, and possibly $265-$285 if the momentum picks up. $LTC could see a retest of the 2021 high near $410 in a more extended bullish scenario.

Relative Strength Index (RSI) readings are still neutral with room for further gains, without immediate risk of overbought conditions. Combined with the wedge breakout and positive on-chain trends, Litecoin looks well-placed to continue its rally should near-term resistance levels give way.