$CRO has emerged as the market’s top gainer, surging nearly 50% in the past 24 hours. The rally is fueled by renewed strength in the broader crypto market and news of Trump Media Group (TMTG) acquiring $CRO tokens.

While the surge has drawn bullish attention, on-chain signals point to a market that may already be overheated, raising the likelihood of a near-term pullback.

$CRO Rockets on $6.42 Billion Trump Media Buzz

$CRO has surged nearly 50% in the past 24 hours, with much of the rally tied to reports linking Trump Media to a large-scale $CRO acquisition.

BeInCrypto reported that earlier news suggested Trump Media was preparing to purchase $6.42 billion worth of $CRO tokens, which fueled market speculation and spurred bullish sentiment.

However, new disclosures now indicate that the plan is more measured. Rather than an immediate $6.42 billion buyout, the company will begin with approximately $200 million in cash and a token position equal to around 19% of $CRO’s market cap.

Traders Pile Into Longs, Raising Liquidation Risks

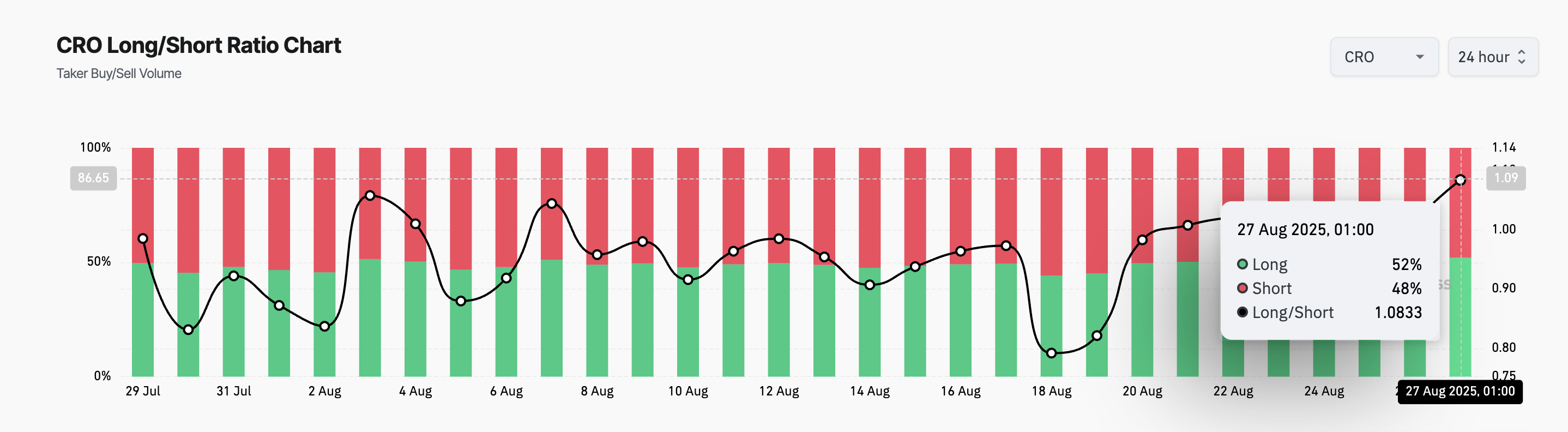

As $CRO surged, its futures traders have rushed into long positions, pushing the token’s long/short ratio to a 30-day high. As of this writing, this stands at $1.08, per Coinglass.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The long/short ratio measures the balance between traders betting on price increases versus those anticipating declines. A reading above 1 indicates that more traders are taking long positions, signaling strong bullish conviction, while values below one indicate a high demand for shorts.

While $CRO’s long/short ratio suggests confidence in its upward momentum, it also exposes the market to greater liquidation risks. If its price faces a reversal, the heavy concentration of longs could trigger many forced sell-offs, worsening market volatility.

$CRO Enters Overbought Zone

Readings from $CRO’s Relative Strength Index (RSI) on the daily chart show that the altcoin has entered overbought territory, a classic indicator that it may be due for a dip. At press time, this indicator stands at 80.77.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 80.15, $CRO’s RSI suggests the likelihood of a correction in the near term, with buyer exhaustion worsening. Any reversal in $CRO’s current trend could trigger a drop to $0.195, its next major support floor.

On the other hand, if buyers continue accumulating $CRO, it could reclaim $0.23 and rally to $0.27, a high last seen in May 2022.

The post Cronos ($CRO) Price Surges on Trump Media Hype, But Liquidation Risks Mount appeared first on BeInCrypto.

beincrypto.com

beincrypto.com