- $XRP ETF filings spark major hype with approval odds soaring near 85 percent already.

- Analysts eye breakout zones above $3.6 as bullish patterns hint upside.

Ripple’s legal victory over the U.S. Securities and Exchange Commission (SEC) continues to reshape market expectations for $XRP. With a stronger ledger ecosystem, bullish technical setups, and the push for new ETFs, analysts see a fast climb toward double-digit prices.

CNF previously reported that major financial firms including Franklin Templeton, Grayscale, 21Shares, CoinShares, WisdomTree, Bitwise, and Canary quickly updated their $XRP ETF registration documents. ETF specialist Nate Geraci described this as a “very good sign” for the sector, noting the strong interest now visible in regulatory filings.

Market sentiment has also turned more positive with approval odds for a spot ETF now reaching 85%. Two $XRP-focused ETFs, Teucrium and ProShares, have already collected hundreds of millions in assets, showing demand is expanding well before final regulatory decisions.

Meanwhile, the $XRP Ledger is recording higher activity. RLUSD is a stablecoin tied to the network that currently has assets near $700 million. Ledger transactions grew 15% in the past 30 days to achieve a volume of $2.7 billion.

Technical Patterns Point to Higher Levels

Analyst Altcoin Gordon emphasized on August 23 that $XRP/BTC is on the brink of breaking an 8-year downtrend. Behind this prediction he cited many reasons such as ETF momentum, agreements with Japan’s SBI Holdings, and upgrades to the ledger.

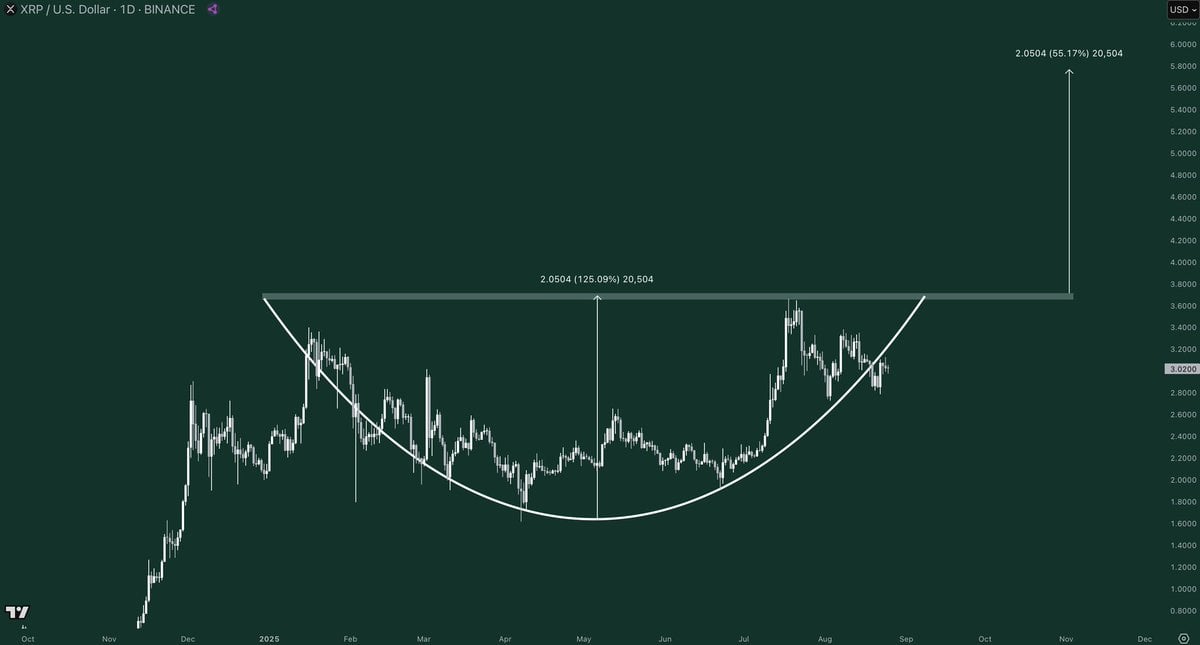

In the latest chart analysis, he noted a cup formation where $XRP had already surged 125% within the chart. Should the token breach the level of $3.6, the breakout may continue towards $5.6 with an additional 55% rise.

Defender offered the same upbeat opinion, positing that $XRP could register a Bull Flag like the November 2024 one, where the token went from $1.13 to $2.40. He noted support near $3 to $2.85, potential areas of interest in the short term ranging from $4.39 to $5.85.

Another analyst, Zach Rector, drew the comparison of the possibility of $XRP to the response of Bitcoin and Ethereum’s ETF. A rapid run-up comes before U.S. spot ETF launches but noted that specific pullback is due once the approvals take shape. SEC will come to a decision by late October 2025, allowing speculative trading to gather steam.

Analyst Predicts $XRP Reaching $10-$15 $ATH

Analyst BarriC provided the most aggressive prediction. He said:

$XRP will see explosive price movement over the next few months and again in early 2026. $XRP will skyrocket past $4 and finally hit a double digit $ATH $10-$15.

Early 2026 would bring another rally,” he said, “If we get announcements of banks adopting and utilising $XRP… prices won’t be $10-$50… we will see $1,000 minimally.”

This forecast, though more lofty than others, represents the increasing conviction that institutional adoption and ETF approvals would overhaul the long-term value of the token. If banks officially announce usage, the growth may surpass estimates.

Today, $XRP is changing hands at $2.95, falling 3.28% over the past day. Technical indicators remain balanced, the Relative Strength Index sitting at 50 and the converging MACD lines pointing to the market players are waiting for a clear trigger.