- ONDO now holds 33% of all tokenized assets with $1.3 billion AUM as the project strengthened its position through strategic partnerships.

- Technical indicators show a bullish structure with analysts projecting potential targets of $2 and $3.10 if ONDO breaks the $1 resistance.

ONDO, the native cryptocurrency of Ondo DAO, has rallied by 8%, attempting a breakout past $1.0, amid a sharp surge in the tokenization growth. The tokenization of real-world assets (RWAs) has surged significantly since the beginning of Trump’s second term, with momentum accelerating following the White House Bitcoin report that highlighted ONDO as a leading player in this sector.

ONDO Leads the 7000% Growth in RWA Tokenization

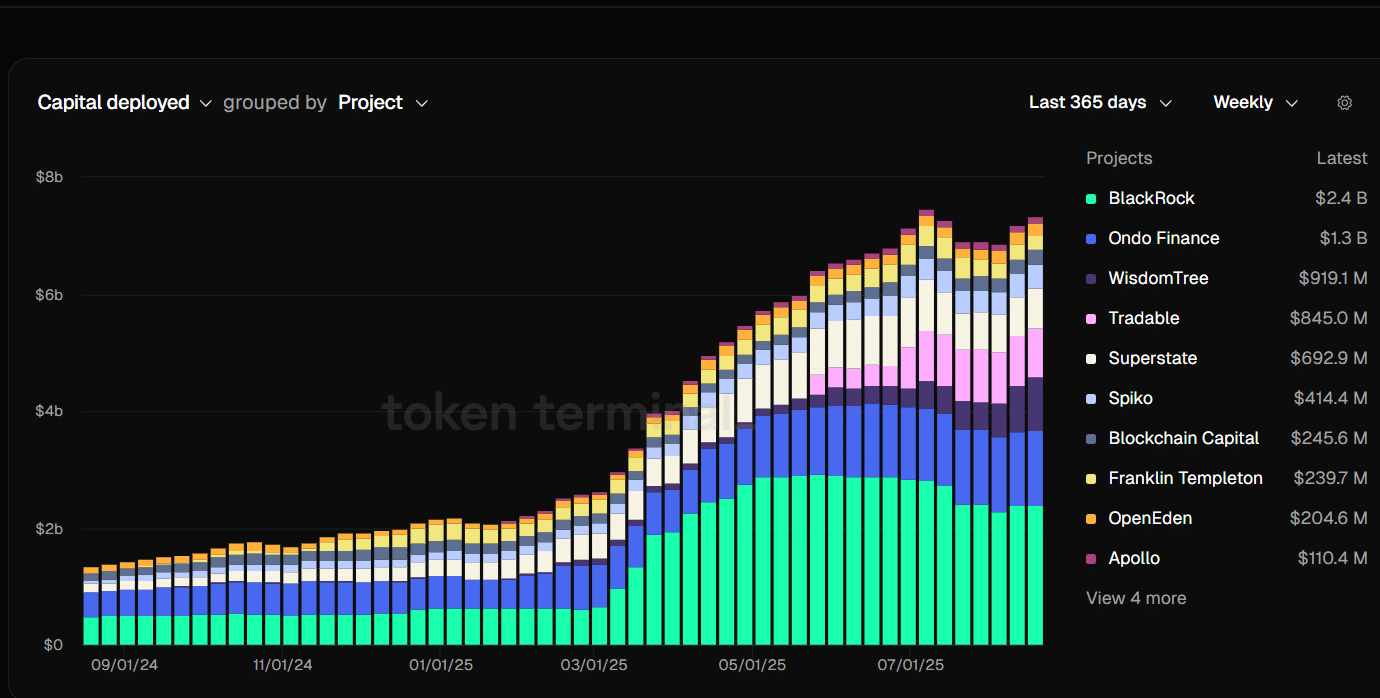

As per the latest details shared by Dami DeFi, tokenized U.S. Treasuries on blockchain have increased by approximately 7,000% in just two years. BlackRock leads the category, followed by ONDO, which has surged 120% since the beginning of 2025.

Other big market players like Ethereum (ETH), Chainlink (LINK), and Solana (SOL) are among the primary layers supporting tokenization. Blockchain analytics platform Messari also reported that ONDO’s assets under management (AUM) have reached over $1.3 billion, representing roughly 33% of all tokenized assets. As reported by CNF, Ondo Finance acquired Strangelove in order to expand its footprint in the RWA tokenization market.

Additionally, ONDO’s stablecoins issued on the Solana blockchain have grown to $250 million, accounting for about 64% of the segment. This underscores ONDO’s dominance in real-world asset deployment, a market projected by Standard Chartered to reach $30 trillion by 2034.

On the other hand, on-chain data from Arkham Intelligence revealed that a whale has been actively accumulating the altcoin while its price remains below $1. The wallet currently holds approximately 1.35 million ONDO, valued at around $1.26 million at the time of reporting.

Will the ONDO Price Rally Continue to $2?

The ONDO price has been subject to strong volatility and has been facing heavy rejection at $1.0, during mid-August. Before today’s pump to $0.99, ONOD took support at $0.90. If the altcoin manages to break past $1 resistance, the bulls could gear up for a rally to $2 and beyond.

ONDO is currently trading within a wedge formation, indicating a bullish market structure. The token has consistently posted higher macro highs, reflecting strong upward momentum in previous cycles. Historical returns include the first wave, 1, at +240%, and the second wave, 2, at +270%.

If the pattern holds, analysts suggest Wave 3 could deliver gains of around 350%, with the next major upside target projected at $3.10 per ONDO.

While Ondo Finance has seen substantial organic growth, its rapid surge in popularity has largely been driven by strategic partnerships. The firm has established agreements with leading institutions across both traditional finance and the Web3 ecosystem.

In July, Ondo Finance confirmed its collaboration with Alchemy Pay, a crypto on-ramp platform aimed at offering access to dollar yields through the USDY stablecoin.