This Friday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

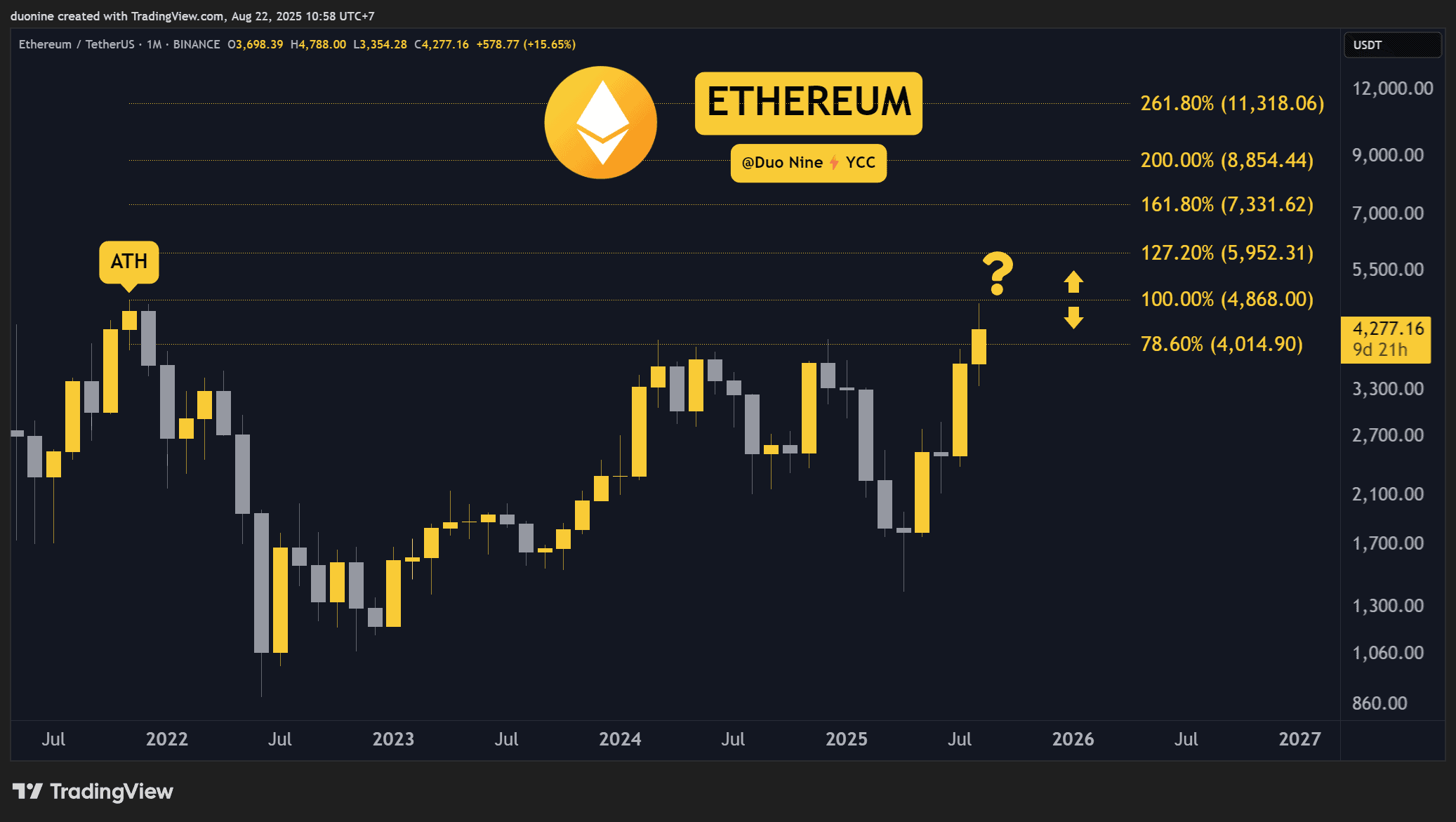

Ethereum ($ETH)

After being rejected at $4,800, Ethereum entered a significant pullback in the past two weeks. This is why the price closed this week in red with a 7% loss. Nevertheless, this is an expected pullback after the breakout at $4,000.

At the time of this post, the price holds well above the $4,000 support, and this re-test of the breakout point could be the catalyst for $ETH to finally challenge and surpass its all-time high at $4,868.

Looking ahead, Ethereum buyers appear determined to have another go at breaking the ATH resistance. This could happen towards the end of August or in early September. If successful, then $ETH will enter price discovery and aim for 6k and 7k next.

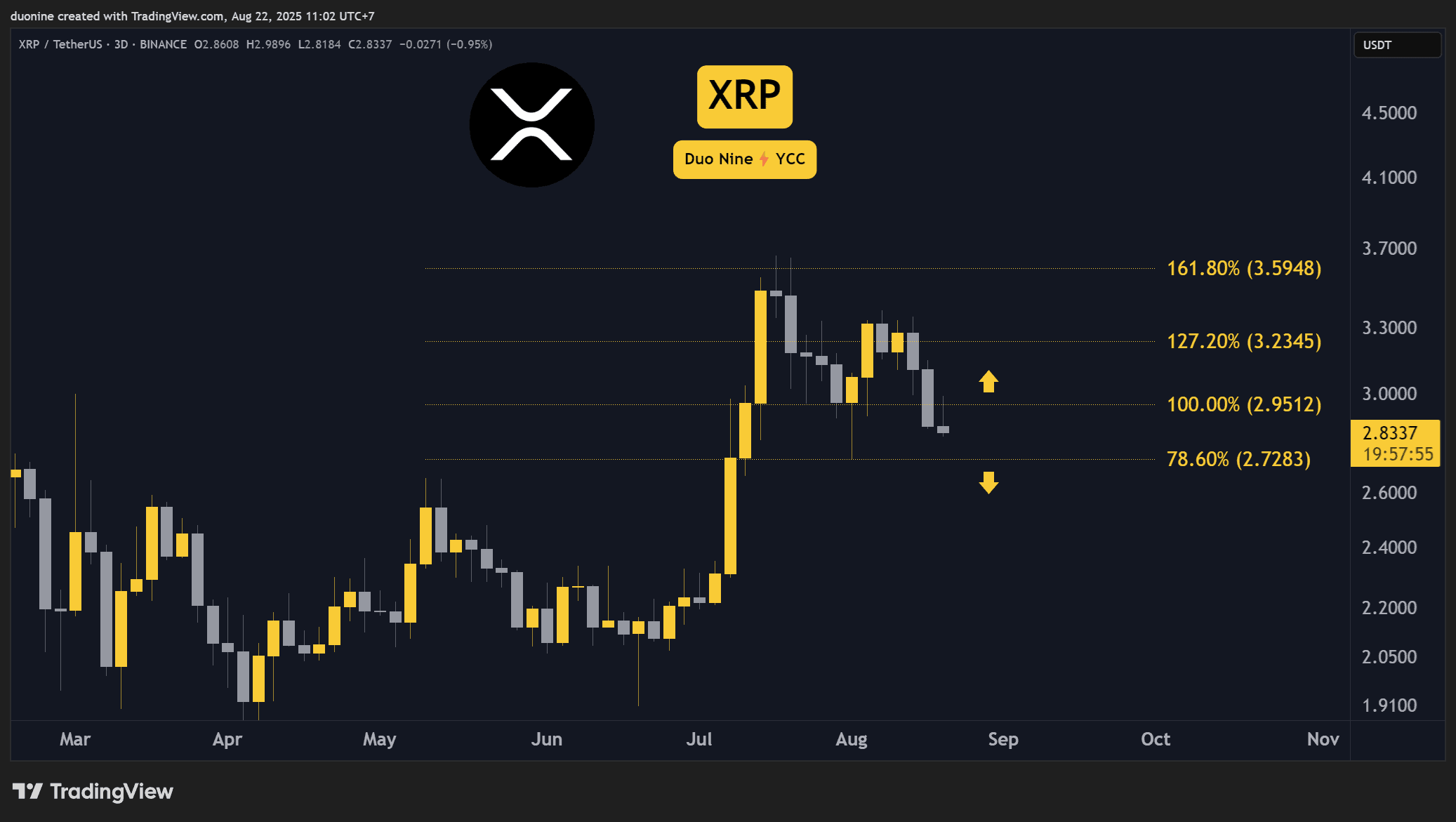

Ripple ($XRP)

$XRP lost its support at $3. This is bearish and led this cryptocurrency to close this week with a 9% loss. Buyers also appear to have retreated to the $2.7 support level.

With the sell pressure building up, a test of the $2.7 support could follow in the days to come. It is critical for $XRP to hold here, as losing this support would open the way for sellers to take the price much lower and towards $2.5.

Looking ahead, the downtrend appears to be accelerating based on the 3-day MACD, which did a bearish cross this past week. This makes lower price levels likely in the days and weeks to come. Hopefully, buyers will return to stop the downtrend soon.

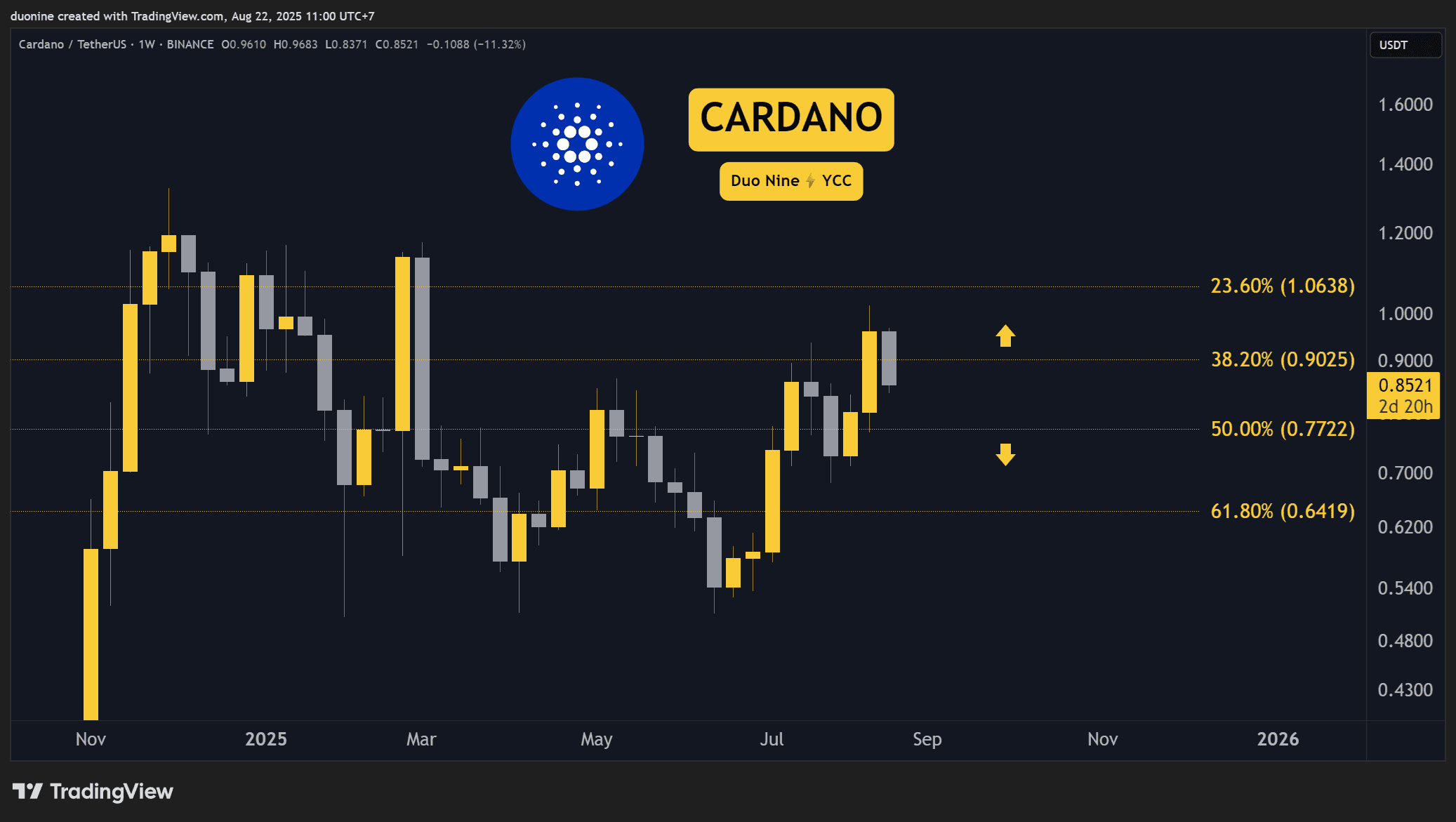

Cardano ($ADA)

Cardano had a good shot at reclaiming a price above $1, but sellers only allowed it to stay there for less than a day. Since then, $ADA has been correcting and is under $0.90 at the time of this post.

While this pullback is normal, it will be challenging for $ADA to return above $1 if the overall market remains bearish. The current support is found at $0.77, and buyers still have an advantage with clearly higher highs and lows on the chart.

Looking ahead, this cryptocurrency is much better positioned to return on an uptrend compared to $XRP. For example, its 3-day MACD is still bullish, and buy volume is making higher highs. Ideally, this will allow $ADA to secure $1 as support later on, which will open the way for higher price levels like $1.3.

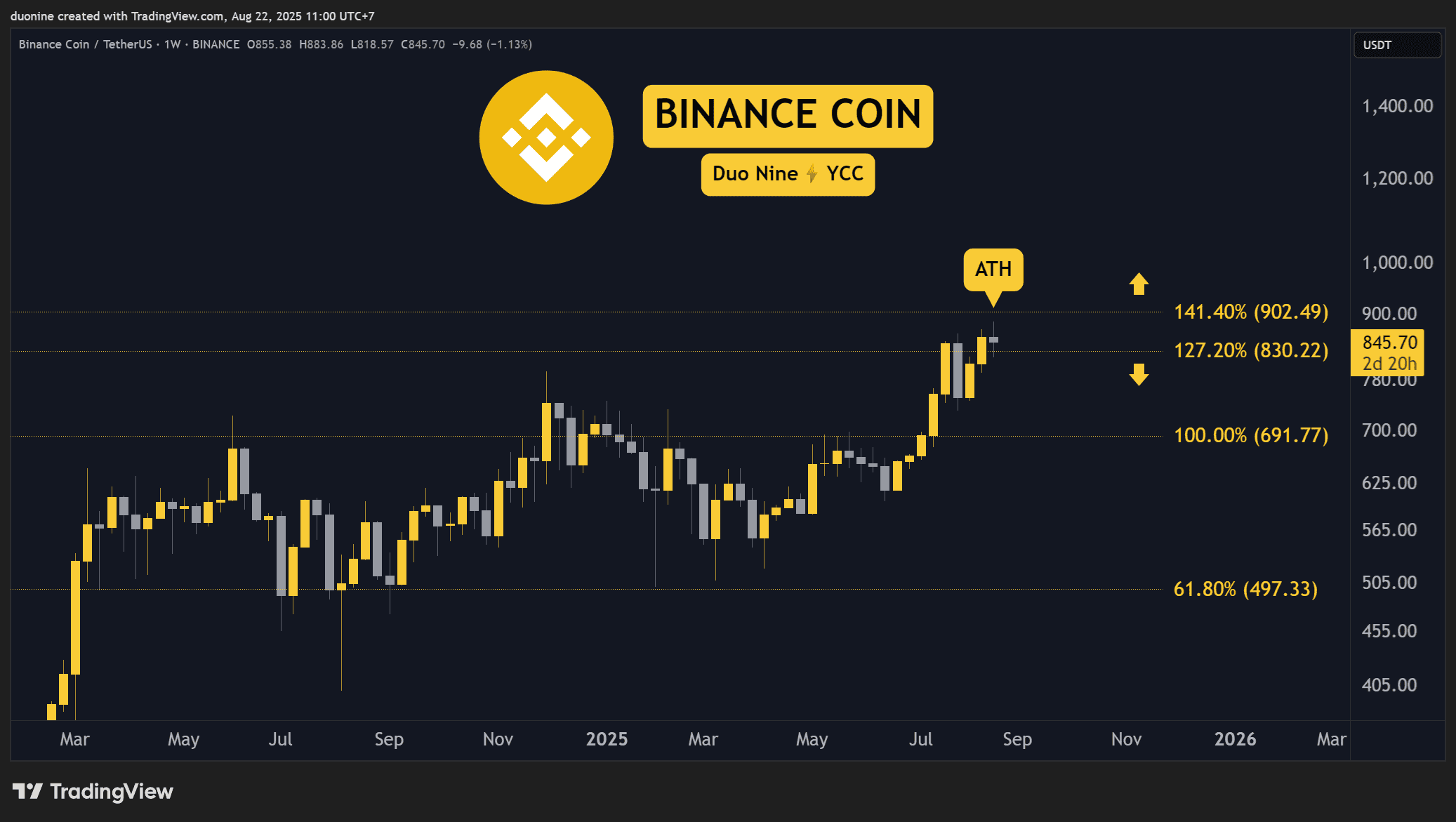

Binance Coin ($BNB)

Binance Coin is the undisputed champion of this week after it managed to make a new all-time high at $883 yesterday. Since then, the asset has entered a pullback, which has brought it to similar levels to last week.

The current support is found at $830, and this level was already tested and confirmed several times to date. Nevertheless, if this support is put under pressure again, that could be a sign of weakness as sellers are becoming more insistent.

Looking ahead, $BNB has to hold here if it wants to capitalize on this recent rally. Otherwise, bears will take advantage and push it into a more significant correction. Even so, the chart remains bullish as long as the price is above $800.

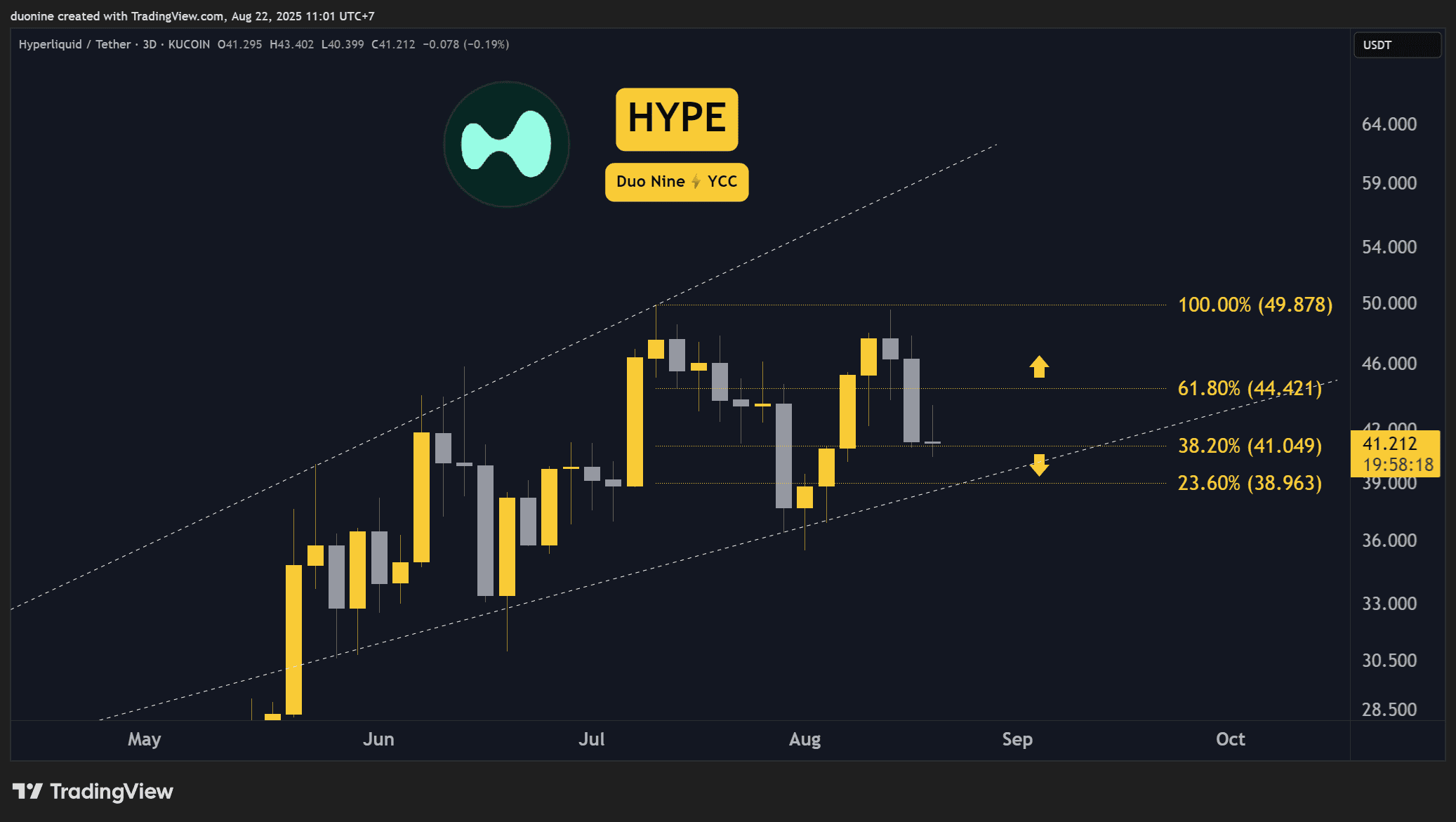

Hype ($HYPE)

$HYPE has been struggling since early July when it failed to move above $50. Most recently, buyers tried again to break this key psychological level in mid-August, but were rejected a second time by sellers. This is bearish, and the price closed the week with a 17% loss.

At the time of this post, the price is close to $41, and the current formation on the chart looks similar to a double top. If sellers put more pressure, the asset has good support at $39 and $37.

Looking ahead, if $HYPE loses its support at $37, then the price will likely fall towards $30. This would end its uptrend and push buyers to find a new support base to recover from. The most likely candidates for that are the $30 and $27 levels.

cryptopotato.com

cryptopotato.com