H

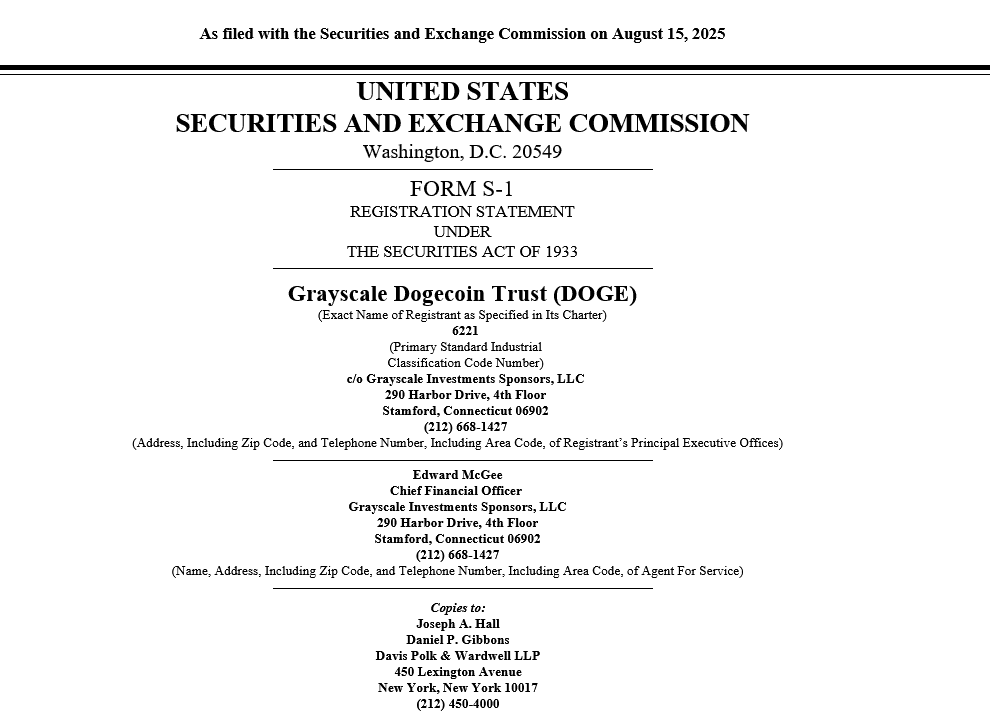

Dogecoin is back in the headlines, but not for the reason traders were hoping. The U.S. SEC has delayed its decision on a batch of spot crypto ETFs, including Grayscale’s proposed Dogecoin fund. While this move keeps $DOGE from an immediate institutional boost, it also highlights that the meme-turned-blue-chip asset is now being considered alongside Bitcoin and Ethereum for mainstream investment products. The daily chart shows $DOGE struggling near $0.22, caught between fading momentum and the promise of long-term legitimacy.

Dogecoin Price Prediction: Why is Dogecoin in the Spotlight?

The U.S. Securities and Exchange Commission has once again postponed its decision on multiple crypto-related ETFs, including Grayscale’s proposed spot Dogecoin ETF. Alongside Bitcoin, Ethereum, XRP, and Litecoin filings, $DOGE is now caught in the same regulatory limbo. The new deadline is set for October, leaving the market uncertain. This delay is a double-edged sword for Dogecoin: it signals growing institutional interest, but also extends the wait for mainstream adoption catalysts.

How Did the Dogecoin Price React?

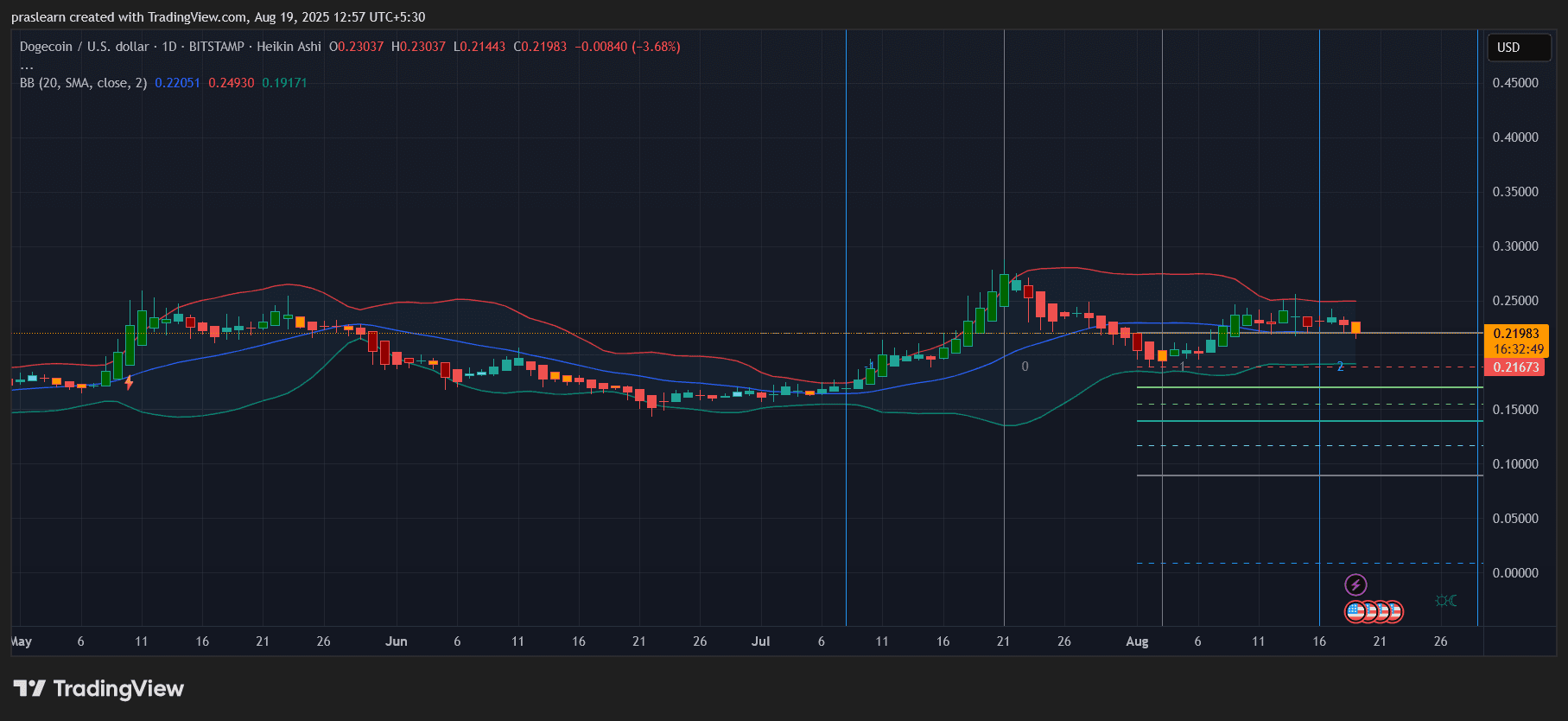

Looking at the daily $DOGE/USD chart, price is hovering around $0.219, down almost 4% today. The Heikin Ashi candles show consecutive red prints after a failed attempt to sustain above $0.25. The Bollinger Bands indicate narrowing volatility, suggesting the market is bracing for a breakout. Importantly, price has slipped below the 20-day moving average (~$0.24), shifting near-term bias bearish.

The ETF delay was the trigger behind this rejection, as traders were positioned for a regulatory green light that never came. With the news out, weak hands are exiting, leaving the chart at a key inflection zone.

Key Support and Resistance Levels

- Immediate Support: $0.216 (just above lower Bollinger Band). If broken, $DOGE could retest $0.19.

- Major Support Zone: $0.15–$0.16, where accumulation was heavy in June-July.

- Resistance: $0.25 remains the ceiling. A breakout above $0.25 could open the door to $0.30+.

At the moment, bears are in control unless $DOGE can reclaim $0.23–$0.24 quickly.

ETF Delay: Short-Term Pain or Long-Term Catalyst?

From a sentiment perspective, Dogecoin ETF delays usually create near-term downside pressure. Traders had priced in bullish speculation, and now those positions are unwinding. But the fact that a spot Dogecoin ETF is even on the SEC’s table is historic. It signals $DOGE is no longer just a meme coin—it is being positioned alongside Bitcoin and Ethereum for institutional-grade investment vehicles.

That’s a long-term bullish narrative, and when approvals eventually come, $DOGE could see sharp institutional inflows.

Dogecoin Price Prediction: What’s Next for $DOGE?

In the short term, expect $Dogecoin to remain under pressure, consolidating between $0.19 and $0.23. A decisive break below $0.19 could accelerate losses to the mid-$0.15 range. On the flip side, if broader crypto sentiment turns positive and $DOGE reclaims $0.25, it could rally toward $0.30 in anticipation of ETF approvals later this year.

What this really means is that the ETF delay has shifted $DOGE from bullish breakout mode into cautious consolidation. Traders should watch volume closely—any spike in buying near $0.19 could mark the bottom before the next leg up.

cryptoticker.io

cryptoticker.io