What to Know

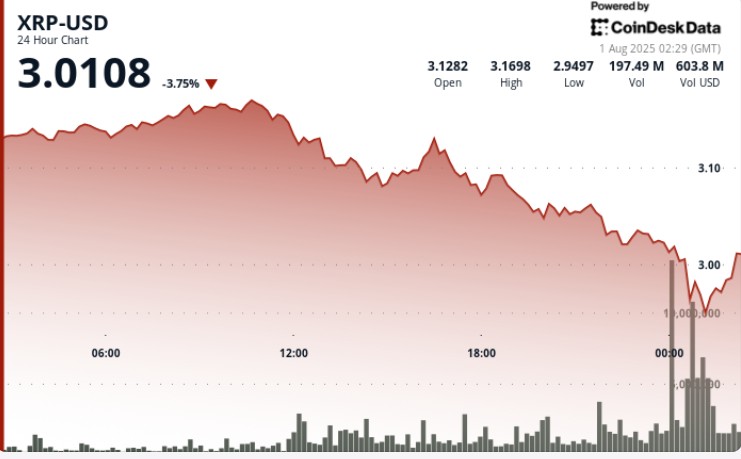

$XRP declined 8% over the past 24 hours, falling from a session high of $3.17 to a low of $2.94, as intense sell pressure overwhelmed initial strength. The sharpest drop occurred during the midnight trading window on August 1, when $XRP fell 2.7% in a single hour, accompanied by 259.21 million units in volume—nearly 4x its 24-hour average.

Despite the downtrend, accumulation signals surfaced during the recovery phase, as $XRP rebounded to $2.98. Volume diminished after the initial volatility, suggesting that institutional buyers stepped in to absorb excess supply near key support zones.

News Background

Whale activity surrounding $XRP continues to deliver mixed signals. On one hand, large holders have liquidated roughly $28 million worth of $XRP daily over a trailing 90-day period, according to on-chain data. This trend highlights persistent distribution among institutional and early holders.

At the same time, over 310 million $XRP tokens—valued at nearly $1 billion—have been accumulated during the recent correction phase, as exchange balances fell sharply, signaling sustained capital inflow.

Adding to the cross-currents, Maxwell Stein, Director of Digital Assets at BlackRock, confirmed participation at Ripple’s Swell 2025 conference, hinting at growing institutional alignment despite recent price pressure.

Price Action Summary

• High: $3.17 (10:00 UTC, July 31)

• Low: $2.94 (00:00 UTC, August 1)

• 24h Change: -8%

• Hourly Low Point: $3.02 → $2.94 (Midnight drop)

• Volume Surge: 259.21M units during correction vs. 64.89M average

• Closing Price: $2.98 (marginal recovery into session close)

$XRP’s closing price near $2.98 represents a minor recovery off session lows, but still signals broader structural weakness. Short-term sentiment remains fragile amid liquidation flows and technical breakdowns below the $3.00 threshold.

Technical Analysis

The $2.94 support zone held firm during multiple intraday tests, reinforced by aggressive dip-buying that allowed prices to reclaim $2.98 by session end. Resistance remains overhead at $3.02–$3.05, with continued rejection likely unless spot inflows pick up.

Momentum indicators remain skewed bearish, though recovering volume profiles suggest some exhaustion in the sell-off.

What Traders Are Watching

• Whether $2.94–$2.95 holds as structural support in the near term

• Signs of renewed whale accumulation or a pause in distribution trends

• BlackRock’s positioning ahead of Ripple Swell 2025 and its implications for future $XRP ETF-related narratives

• Reaction at the $3.00–$3.05 resistance band, which previously marked key distribution levels

coindesk.com

coindesk.com