The White House has officially released a major report on cryptocurrency regulation, a move that could be a game-changer for the digital asset world. Developed with key agencies like the U.S. Treasury and the SEC, the report is the first serious step towards full crypto regulation in the U.S.

The President’s Working Group on Digital Asset Markets released a report that provides a roadmap to USHER IN THE GOLDEN AGE OF CRYPTO 🇺🇸

— The White House (@WhiteHouse) July 30, 2025

"Together, we will make the U.S. the crypto capital of the world!" 🌎 pic.twitter.com/YwE5KRrjnA

This opens the door for certain altcoins to shine in a more regulated and secure environment. Here are three that are particularly well-positioned.

Related: Altcoins on Whale Radar: $ADA, LINK, ONDO, and HBAR

Cardano Could Gain a Regulatory Edge

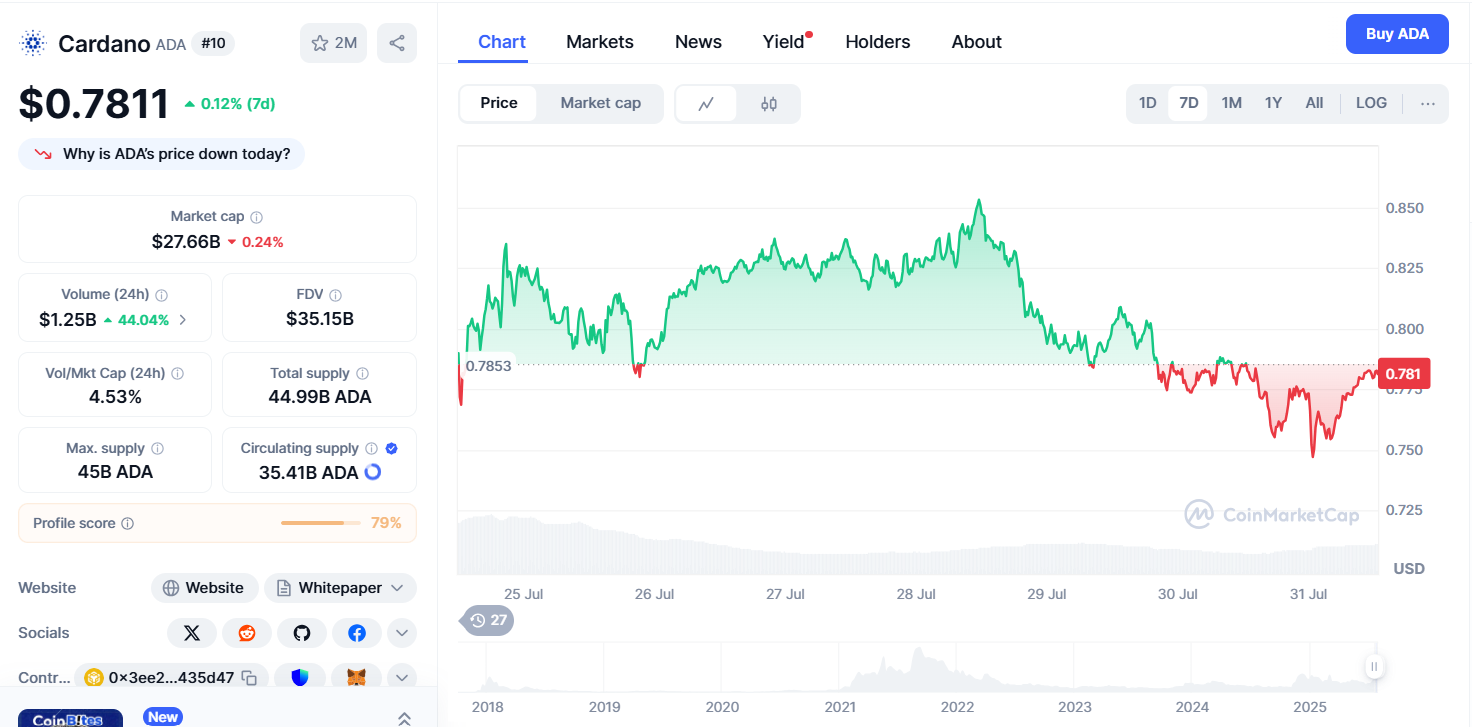

One of the most talked-about altcoins is Cardano ($ADA). Reports suggest that Cardano might be officially recognized as a digital commodity under the new U.S. framework. This classification would be a big win, as it would mean Cardano is seen as decentralized and driven by real-world utility.

BREAKING NEWS:

— Mintern (@MinswapIntern) July 23, 2025

CARDANO TO BE OFFICIALLY RECOGNIZED AS A DIGITAL COMMODITY UNDER U.S. FRAMEWORK🤯🤯🤯

Cardano could be classified as a digital commodity under the new U.S. regulatory framework because it meets the key criteria:

• Decentralized in function

• Lacks centralized… pic.twitter.com/BmI8dmwpkq

Despite all this, Cardano’s price remains under pressure. $ADA is currently trying to hold support around $0.74. If this level fails, prices could dip to $0.66.

Related: Cardano’s EMURGO-Led Global Branding Strategy Heads to Final Treasury Vote

Still, with regulatory clarity and institutional interest possibly growing, $ADA price might soon reflect its strong fundamentals.

$SUI Rising as a Treasury-Backed Altcoin

$SUI is another altcoin that could benefit from growing institutional interest. Mill City Ventures recently announced a $450 million investment into a $SUI treasury strategy. This would allow institutions to gain exposure to $SUI through traditional stock markets.

Sui's growth rate has been alarming recently, with its TVL surpassing $2.2 billion, and $2.7B in Bridge TVL, marking an all-time high due to increased DeFi activities.@SuiNetwork’s Defi is taking off, ranking 8th among all chains. 30-day Dex volume on Sui is over $8.52B,… pic.twitter.com/OkTl6oKx9S

— BMS (@bloomstarbms) July 29, 2025

On-chain activity is booming too. $SUI’s DeFi ecosystem has over $2.2 billion in total value locked (TVL) and ranks among the top 10 blockchains in terms of DEX volume. Its stablecoin market cap jumped 180% in July alone. With over 1,300 developers and dozens of new dApps launching, the analyst said that the $SUI ecosystem is all set for growth.

Plume: A Quiet Giant in RWA Tokenization

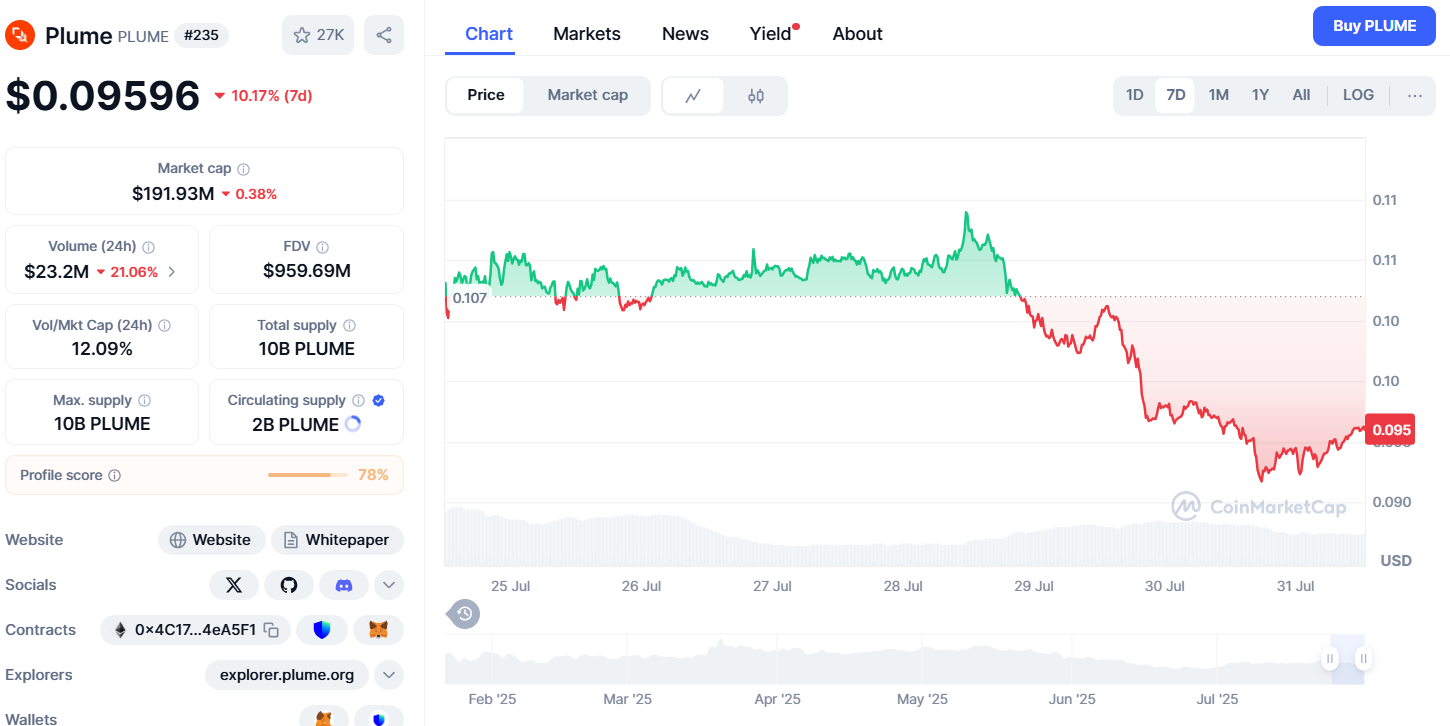

Another altcoin flying under the radar is Plume, a Real-World Asset (RWA) tokenization project. Despite being in a consolidation phase price-wise, Plume is making serious moves behind the scenes.

Plume’s total locked value has reached $325 million, and it’s actively working with U.S. regulators. Big partnerships like World Liberty Finance and new tools like Skylink are pushing the project forward.

The project has also delayed its token unlock until 2026 to comply with regulations and build long-term trust. While the fundamentals are bullish, technicals hint that Plume’s price may still dip further, possibly to the $0.07 range, before any major move. The analyst said that Plume may soon hit $0.12.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com