The adoption curve of crypto is believed to be in its early stages, and Wells Fargo data shows its close similarities with the early stages of internet adoption back in 1990, giving a glimpse of how crypto could become a part of everyone’s lives as it reaches the mainstream.

In a Brief History of The Internet, internetsociety.org notes that “The Internet has revolutionized the computer and communications world like nothing before.”

If crypto is the next revolution and many industries are already jumping in (finance, music, fashion, gaming, social media, etc), what will our world and portfolios look like once mass adoption happens?

90’s Internet Vs. Crypto Technology

A Wells Fargo Investment Institute report has compared how users started to embrace the internet in 1990 with the current cryptocurrency adoption rates.

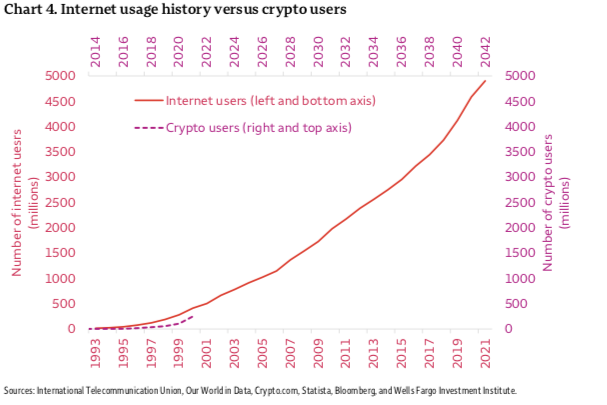

The investment adviser suggests that both internet and crypto adoption started at a slow pace, but as the former “hit an inflection point, and then steeply accelerated”, the following years could show a similar spike for the crypto industry.

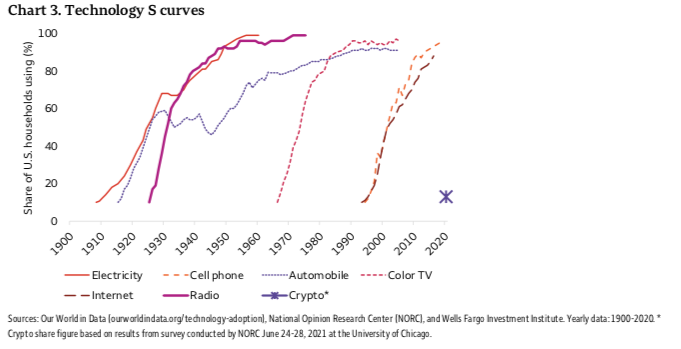

The report notes that in the cases of several technologies, “decades passed between the actual inventions and surging adoption rates.”

Only 1% of the world population and 14% of Americans were using the internet by 1995 even though it was invented in 1983. The experts think these numbers look familiar to the current rates of cryptocurrencies adoption.

Citing Crypto.com, collected data reveals that by 2021 almost 3% of the world’s population had become crypto users (221 million in June 2021). The most impressive part is how fast the industry got to that percentage, given that only four months before that time the number of users was half in size, around 100 million.

A common factor among how users approach new technologies in their early stages is the period of time many need to “figure out what the technology is, what it can do, and how it can benefit them.” In this matter, data shows that in 2021 crypto newcomers believed the space is still in its early adoption stage, “as they find the technology daunting and use cases unclear.”

Data represented in the following charts hints that the cryptocurrency adoption rates could be taking a similar road to “other earlier advanced technologies, particularly the internet.” Meaning that crypto could soon enter “an inflection point of hyper-adoption” like these other technologies, in which cases the rising path has not looked back.

“For the internet, that point was the mid-to-late 1990s. After a slow start in the early 1990s, internet use surged from 77 million in 1996 to 412 million in 2000. By 2010, worldwide internet use had grown to 1.98 billion, and today it sits at 4.9 billion.”

The following chart closely compares the growth of internet adoption from 1993 to nowadays and the rise in crypto users since 2014. Experts believe that “cryptocurrency use today may even be a little ahead of the mid-to-late 1990s internet,” showing no doubt of the rising adoption that could “soon hit a hyper-inflection point.”

“It often takes many years for consumers to widely adopt new advanced technologies.”

Experts at Wells Fargo foresee that “cryptocurrencies eventually will follow an accelerated adoption path similar to recent digital inventions,” meaning wifi, smartphones, and so forth. All innovations that are now part of most people’s daily lives.

Moving Into Early Majority

NewsBTC had previously explained that an adoption curve portrays the cumulative rate at which people adopt and react to a product and technology over time.

Its original model, Everett Rogers’s diffusion of innovations, shows five segments of an adoption curve’s life cycle: Innovators, Early Adopters, Early Majority, Later Majority, and Laggards.

As the adoption of this new technology moves into the early majority –and mass adoption–, more investors are likely to lose the fear of the crypto industry, and with increasing demand value is believed to spike.

Moreover, an important factor that may slow down the path toward adoption is the lack of a clear regulatory framework for the industry, which drives investors and consumers away. But as governments cannot look away for much longer, clarity is expected to come soon enough and also drive an increase in adoption.

newsbtc.com

newsbtc.com