A Surprising Start for Crypto Prices in July 2025

The first week of July 2025 has delivered some unexpected crypto winners. While large-cap tokens like Bitcoin and Ethereum saw minor corrections, smaller and mid-cap tokens like $HYPE, $SUI, and $PEPE surged ahead. Based on TradingView’s performance screener (Top 50 by market cap), we break down the Top 5 Weekly Performers, what’s behind their price action, and where they might head next.

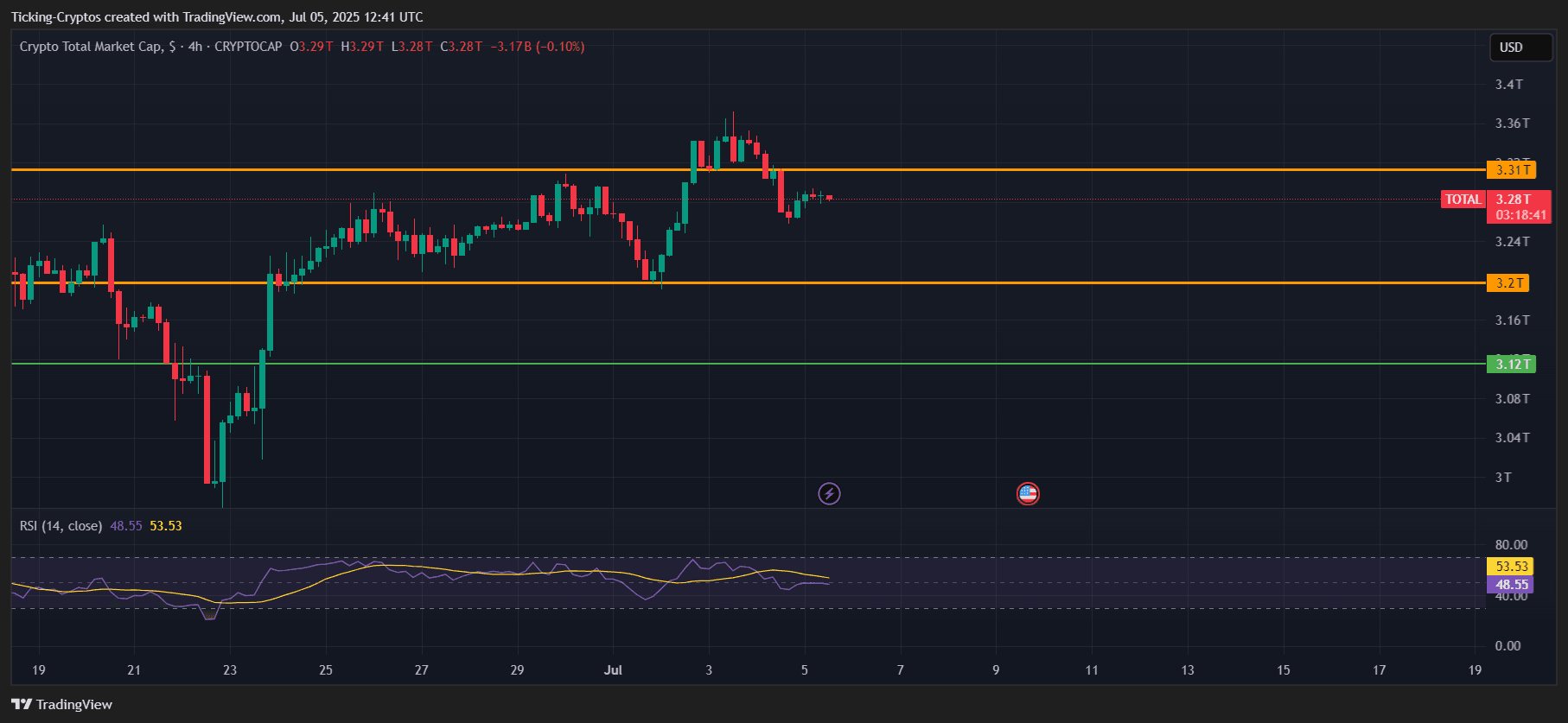

Total market cap in USD - TradingView

1. Hyperliquid ($HYPE) — 🥇 +7.78% This Week

What’s Driving $HYPE’s Momentum?

Hyperliquid, the native token for the rising decentralized perpetuals exchange, saw a sharp rise of +7.78% this week. Its recent announcement of expanding cross-margin and permissionless market features has caught traders’ attention. Hyperliquid’s reputation for low-latency, high-performance DEX infrastructure is gaining traction among pro traders seeking alternatives to dYdX and GMX.

Forecast:

With +227.94% gains in 3 months and growing user base, $HYPE could test new local highs above its June peak. As long as trading volumes stay healthy, $HYPE remains bullish short-term.

2. Sui ($SUI) — 🥈 +7.42% This Week

Why Is $SUI Pumping?

Sui Network has quietly posted a solid +7.42% weekly gain, likely driven by the recent launch of Sui Kiosk $NFT protocols and growing TVL in DeFi. The blockchain continues to attract GameFi and $NFT developers thanks to its scalable Move-based architecture.

Forecast:

Despite a -7.61% dip in the past month, the 3-month trend is still +31.97%. If bullish sentiment continues and ecosystem growth accelerates, $SUI could revisit its April highs.

3. Pepe ($PEPE) — 🥉 +7.34% This Week

Meme Resurgence?

The frog-themed memecoin is back in the spotlight, posting a +7.34% weekly gain. Whales appear to be rotating back into meme tokens, with $PEPE outperforming DOGE and SHIB this week. Social media chatter and high speculation levels on Binance and OKX also helped boost its visibility.

Forecast:

The RSI and chart show early reversal signals. If $PEPE breaks the 0.000013 mark, a 50% short-term rally could be in play—though volatility remains high.

4. Arbitrum ($ARB) — 🏅 +7.04% This Week

What’s Behind $ARB’s Strength?

Despite broader L2 fatigue, Arbitrum gained +7.04% as investor attention turned to its upcoming Orbit Chain integrations and renewed community incentives via the Arbitrum DAO. Transaction activity is up, and gas usage remains strong, confirming user growth.

Forecast:

Although its YTD performance remains weak (-54.58%), a breakout above $1.00 could trigger momentum traders. Cautious optimism is warranted.

5. Hedera ($HBAR) — 🎖 +6.70% This Week

$HBAR’s Steady Climb

Hedera gained +6.70% on the week, likely buoyed by enterprise developments and strategic partnerships, including talk of new CBDC pilots on the Hedera network. Its unique Hashgraph consensus and council-based governance structure continue to appeal to institutional players.

Forecast:

$HBAR’s price action suggests consolidation with upside potential. If it clears the $0.10 psychological barrier, a mid-term rally toward $0.13–$0.15 could be realistic.

cryptoticker.io

cryptoticker.io